U.S. Jobless Claims Report: Will the Data Shake Crypto Market?

Another jobs report drops—crypto traders brace for impact.

The Fed's Crystal Ball

Wall Street treats every unemployment figure like a sacred text, parsing it for hints about the Federal Reserve's next move. Lower claims? That screams 'strong economy' and whispers 'higher rates for longer'—a classic buzzkill for risk assets. Higher numbers? Suddenly, rate cuts are back on the menu, and digital gold starts to glitter.

Crypto's Delicate Dance with Macro

Forget 'decentralized and detached.' Today's crypto markets move in lockstep with traditional finance's mood swings. A hot jobs number can send Bitcoin into a tailspin as capital flees to safer yields. A cold one? Watch the altcoins rally on fresh liquidity hopes. It's a fragile tango between innovation and interest rates.

Trader Psychology & The Narrative Shift

The data itself is almost secondary. The real trigger is the story it creates. A surprise beat or miss doesn't just adjust models—it flips the entire market narrative overnight. Fear of inflation? Back to 'store of value.' Fear of recession? Hello, 'hedge against systemic risk.' Crypto's identity is whatever macro needs it to be that week.

Looking past the immediate knee-jerk, the long-term signal matters more. Persistent labor market strength could cement crypto as a cyclical asset, swayed by every Fed whisper. Sustained weakness might finally test its 'uncorrelated' thesis. Either way, it's another reminder that in finance, the 'future of money' still waits patiently for the old money to decide what happens next.

Last week’s 191,000 claims marked a three-year low, but economists expect today’s number to rise around 220,000, with 223,000 as the key threshold that may determine whether markets interpret the report as cooling or resilient for the week ending December 6.

But exactly how the U.S. jobless claims report binds volatility, directly or indirectly, in digital assets marketplace

A lower-than-expected U.S. jobless claims report would signal a still-tight labor market, reducing the chances of aggressive rate cuts and creating short-term volatility for Bitcoin and equities.

A higher reading, however, suggests hiring is slowing, giving the Fed more room to ease monetary policy, which can create a more favorable environment for crypto and other risk markets.

Either way, the broader trend is becoming clearer: the Fed is slowly shifting from fighting inflation to maintaining economic stability. One data point won’t change the long-term direction, but it can definitely set off intraday volatility.

U.S. Jobless Claims Report: Sparking Points and Reaction

This comes at a delicate moment for markets following the Federal Reserve’s recent 25-bps rate cut, its third of 2025. Despite expectations being met, the Fed’s message was mixed. Internal disagreement, with some officials wanting no cut and others pushing for 50 bps, left investors uncertain about the January meeting.

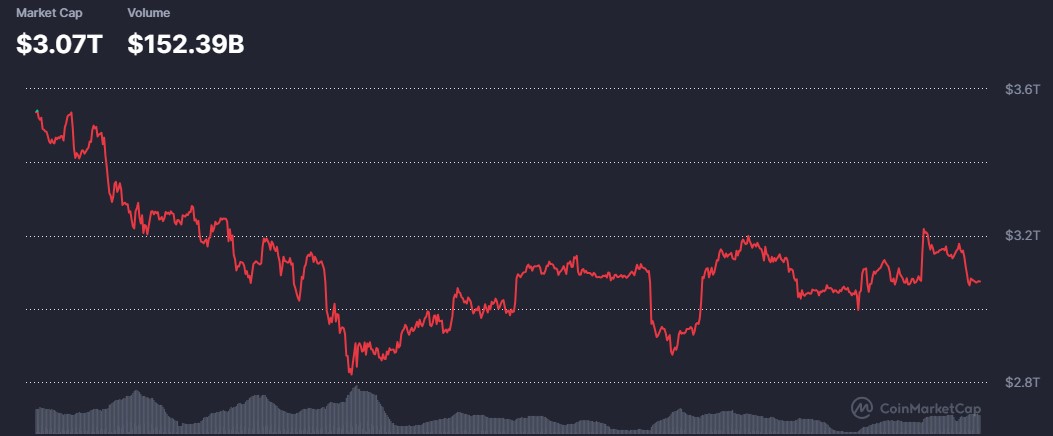

As a usual reaction, the broader crypto market reacted immediately. The global market cap fell 2.57% in 24 hours, extending a 7-day drop of 3.46%. Bitcoin also dropped 1.88% to $90,258, while Ethereum –3.5% to $3,195.

Along with this the key points that matters:

Leverage Unwind: $169M in BTC liquidations (+327% long squeeze).

Weak Technical Structure: Market cap fell below its 7-day SMA (simple moving average) to around $3.09T.

Macro Mismatch: The Fed injecting liquidity through $40B in Treasury purchases, still risk assets did not rally.

This environment makes today’s U.S. jobless claims report even more critical. A surprising print could accelerate volatility already fueled by leverage flushes and cautious Fed rate cut signals.

Risks, Supports, and What to Watch Next

Today’s U.S. jobless claims report is a direct signal for markets, Fed expectations, and crypto volatility. With leverage still high and macro uncertainty growing, even a small surprise in this data could define the broader reactions in both traditional and crypto markets.

Despite today’s uncertainty, oversold technicals, RSI (Relative Strength Index) is nearing 40, and solid ETF inflows suggest that long-term fundamentals remain intact.

The real question is whether bitcoin can stabilize enough to prevent further liquidation cascades — and whether altcoins can decouple if Bitcoin dominance continues to rise.

Crypto traders should stay alert. At 8:30 AM ET (7:00 PM IST), the jobless claims report will set the mood for the entire trading day.

This article is for informational purposes only and should not be considered financial advice. Crypto markets involve risk; always conduct your own research before making investment decisions.