FOMC Fallout: Why the Crypto Market Is Bleeding Today

Crypto markets are in the red, and all eyes are on the Fed. The latest FOMC meeting results have sent a chill through digital asset prices, proving once again that even the most decentralized markets can't escape the gravitational pull of traditional monetary policy.

The Hawkish Signal That Spooked Traders

The Federal Reserve didn't just hold the line—it drew a new one in the sand. While the decision itself was widely anticipated, the accompanying language and economic projections painted a picture of prolonged higher interest rates. For a sector built on cheap capital and high-risk appetite, that's a direct hit to the fundamentals. Liquidity gets tighter, leverage becomes more expensive, and the 'risk-on' trade loses its shine.

Risk Assets Take the First Punch

Crypto, sitting at the far end of the risk spectrum, always feels the impact first and hardest. It's the canary in the coal mine for global liquidity. When the cost of money rises, speculative capital is the first to retreat. Today's sell-off isn't about a flaw in blockchain technology; it's a classic, almost cynical, recalibration of risk versus return in a shifting macro landscape. The 'digital gold' narrative gets tested when old-school treasury yields start looking attractive.

Looking Beyond the Immediate Reaction

Volatility is the price of admission. Short-term price action, driven by Fed announcements and trader sentiment, often obscures the longer-term trajectory. The underlying adoption curves for blockchain infrastructure and decentralized applications haven't changed overnight. This dip, while painful for portfolios today, may simply be resetting the stage—washing out weak leverage and providing a clearer entry point for conviction holders who see past the quarterly Fed machinations.

The market is down, but it's not out. It's just remembering who, for now, still controls the money printer.

Why Crypto Market is Down: Fed Rate Cut Sparks Volatility?

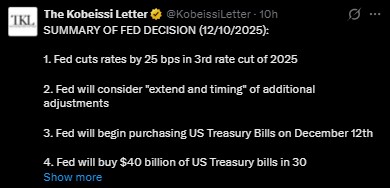

Instead of lifting the market, the Fed news created doubt. It was expected to have a strong bullish reaction, but the result of the FOMC meeting was signaled with a cautious tone. Fed Chairman Jerome Powell indicated that the Fed might hold back again on rate cuts, and two members, Schmid and Goolsbee, also voted against the rate cut, preferring no change. In addition, the Fed also announced that they will start buying $40 billion worth of US Treasury bills starting December 12. These mixed signals caused a loss of market confidence and served as the first trigger in answering why is crypto crashing today.

Bitcoin Price Crash After FOMC Meeting: History Repeats Again

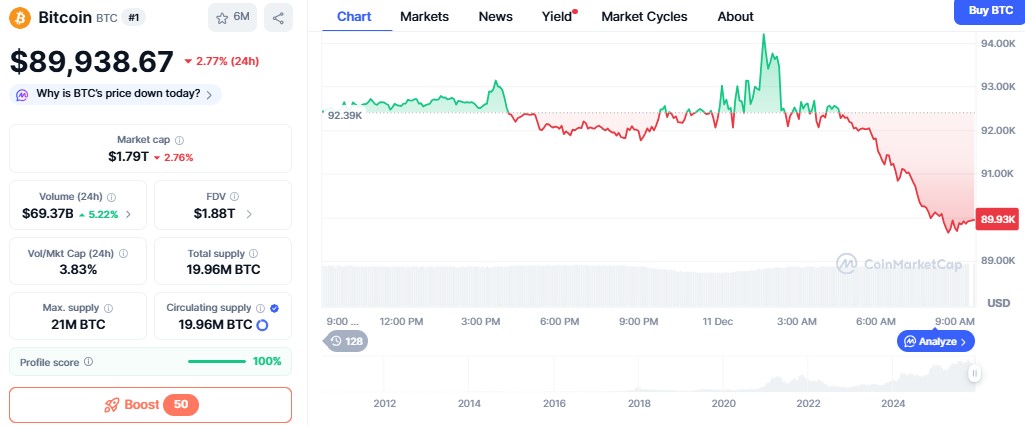

The Bitcoin price crash started almost immediately after the result of the FOMC meeting. The BTC price fell below the $90,000 mark within hours. More than $250 million worth of levered long positions were liquidated in just four hours as volatility intensified. This pattern is not new. Bitcoin has crashed after every major FOMC announcement throughout the year, and this time again the trend held perfectly. Within a single day, Bitcoin slipped another 2.70%, reaching $89,998.63 with a market cap of $1.79 trillion.

Analyst Ali highlighted that Bitcoin’s open interest has dropped drastically from $47.5 billion to $27.5 billion over the past two months, nearly cutting in half. This sharp decline shows that traders are reducing leverage and taking a more cautious approach, adding another LAYER of pressure to the ongoing price cycle. As expected, Ethereum, XRP and most altcoins followed Bitcoin’s downward trend, deepening the overall red sentiment.

Liquidations Surge, Fear Rises: The Core Reason Why Crypto Is Crashing

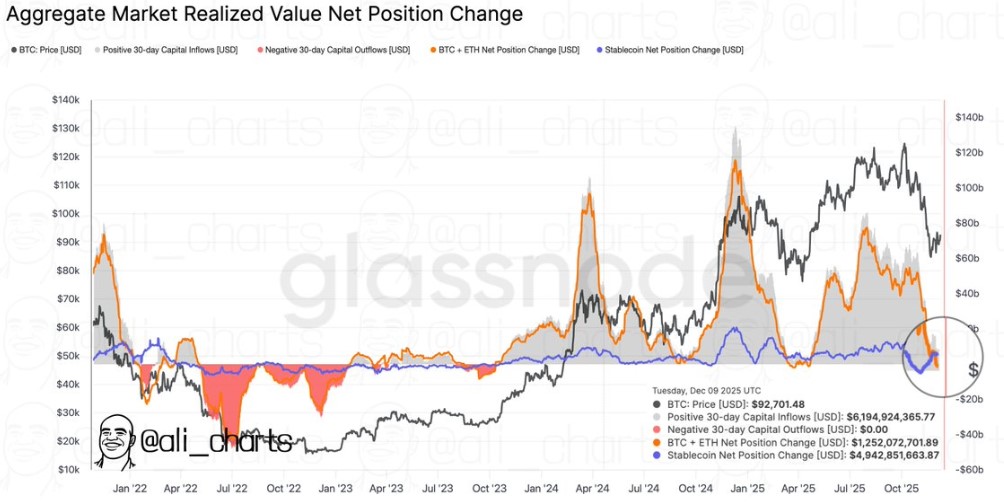

The liquidation data paints a clearer picture of why crypto market is down today. Glassnode reported that 154,228 traders were liquidated in the past 24 hours, wiping out a total of $512.53 million. The single largest liquidation was recorded on Hyperliquid, where a BTC-USD position worth $23.18 million was forcefully closed. Meanwhile, total crypto inflows have fallen to just $6.2 billion — the lowest level since April, as per Ali.

The Fear and Greed Index also remains in DEEP fear territory at 29, marking yet another week of suppressed sentiment. This combination of aggressive long liquidations, falling inflows and rising fear has created the perfect storm for a broad correction.

Will the Market Bounce Back? Signals Suggest a Reversal Later

Despite the widespread panic, several strong signals show that the downturn may not last long. Analyst Ali noted that some of the best historical buying opportunities appear when Bitcoin’s on-chain realized losses fall below –37%. At present, this metric is at –18%, meaning deeper dips may still come, but the road to a powerful rebound is being prepared. Large players are also quietly accumulating.

Tom Lee’s Bitmine purchased 33,504 ETH worth $112 million in just six hours, increasing its total position to 120,094 ETH valued at $392.5 million. Similarly, Machi Big Brother added more USDC on Hyperliquid to expand his 11,100 ETH long position. Such whale behaviour often hints that it may soon turn green.

Conclusion

The crypto market is down due to the Fed’s cautious messaging, heavy Bitcoin liquidations, falling open interest and weak inflows. Yet whale accumulation and improving on-chain trends suggest that the dip may transform into the next major buying opportunity. For now, the message remains simple: stay calm, understand the reasons, and HODL through the fear.

This is for educational purposes only. Always do your own research before any crypto investment.