Fed Rate Cut News Sparks Crypto Crash as Fed Signals Pause Ahead

Markets just got a brutal reminder: crypto still dances to the Fed's tune. The central bank's latest signal—a rate cut followed by a clear 'pause'—sent digital assets tumbling, proving that for all the talk of decentralization, traditional finance still holds the whip hand.

The Domino Effect

It wasn't a gentle nudge. The announcement triggered a cascade of sell-offs across major exchanges. Bitcoin, the so-called digital gold, proved just as malleable as any other risk asset when monetary policy shifts. Altcoins, predictably, fared worse—their higher volatility magnifying the downside. The speed of the drop left algorithmic traders scrambling and leveraged positions vaporizing in a flash.

Reading Between the Lines

The real story wasn't the cut itself; markets had priced that in. The shock came from the 'pause ahead' language. It signaled the Fed isn't embarking on a long easing cycle but is hitting the brakes for a reassessment. That uncertainty is kryptonite for speculative assets. Suddenly, the 'higher for longer' narrative on rates got a second wind, and crypto's yield-generating narratives faced immediate pressure. It's the old finance playbook: don't fight the Fed, even if you're using a blockchain.

A Reality Check for the Faithful

This volatility isn't a bug; it's a feature of an asset class still finding its macroeconomic footing. Each cycle promises decoupling, and each major Fed move delivers a stark lesson in correlation. For institutional players, it's another data point for risk models. For the average investor? A harsh lesson that when the cost of money changes, everything from meme coins to DeFi yields gets repriced—often violently. It turns out digital scarcity is no match for the world's most powerful interest rate setters.

So, the 'pause' is on. The market's reaction was a punctuation mark—a loud, definitive exclamation point. Crypto's long-term thesis remains, but its short-term sensitivity to central bank whispers is now undeniable. After all, what's a distributed ledger against a centralized bank with a printing press? Some traditions, it seems, are harder to disrupt than others.

Fed Cuts Rates but Warns Future Easing May Slow

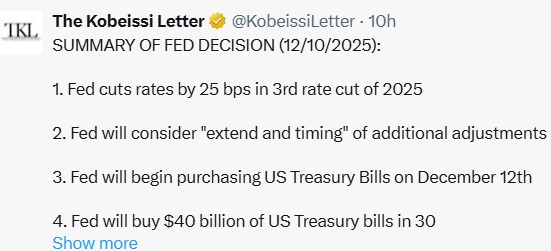

The latest FOMC meeting ended with a 25 bps cut, the third of the year, but the message was far from dovish. The Kobeissi letter reported that two officials Schmid and Goolsbee opposed the decision entirely, while another wanted a bigger 50-bps reduction. New projections show only one cut in 2026, leaving markets wondering if the Central Bank is stepping back again.

Source: X (formerly Twitter)

The news only added more tension around the FOMC meeting, with real-time interest in the FOMC meeting live updates building even further.

During the press briefing, Jerome Powell indeed said that the central bank is "well-positioned to wait," hinting that January may bring no action.He also said it WOULD begin buying $40 billion in Treasury bills over the next month, in an effort to stabilize liquidity in the financial system.US Dollar Falls after Powell Rules out Rate Hike Possibility

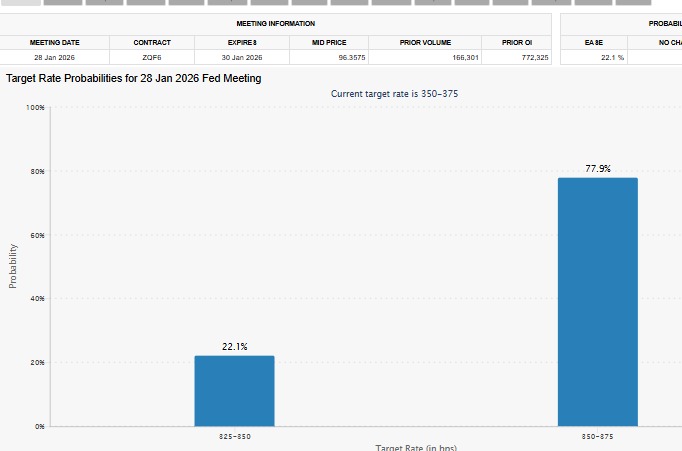

Right after the announcement, the US dollar weakened against the euro, yen, and Swiss franc. Powell also underscored that a hike isn't the base case for 2026. Futures traders now see a 78% chance of no change in January. However, despite the central bank projecting just one, markets still price in two cuts next year.

Source: FedWatch Tool

Crypto Market Crash by 3%

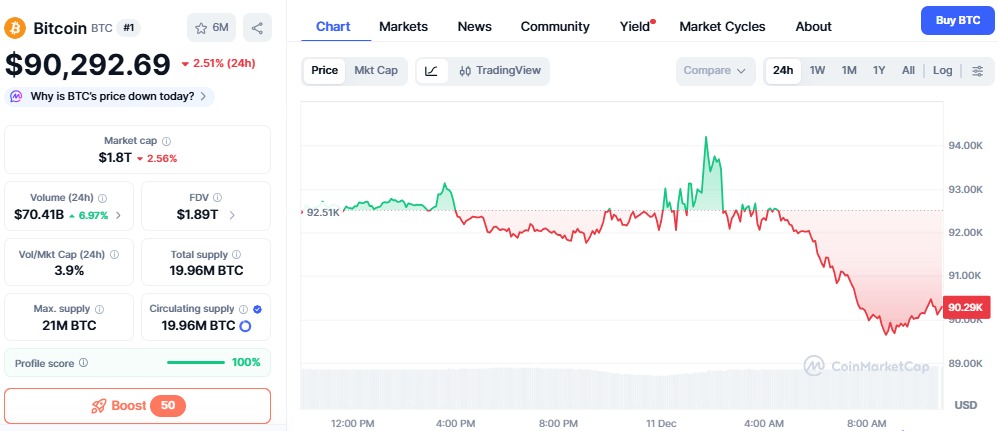

The crypto market instantly reacted to the Fed Rate Cut news. In 24 hours, the global digital currency market fell 3%, further extending its sharp plunge throughout the month.

As per the Coinmarketcap, this update sent Bitcoin tumbling 2.5%, while its dominance climbed to 58.6%, indicating a very clear risk-off shift.

Source: CMC

Altcoins suffered more, with ETH and XRP lagging. The Altcoin Season Index slipping to 17 shows how investors are avoiding high-risk tokens.

Technically speaking, the total crypto market cap broke below the 200-day EMA, $3.49 trillion, suggesting weakened momentum. Traders believe the market needs to reclaim $3.16 trillion to avoid further downside.

What to Watch Next by Traders

Attention for the markets turns to Friday's PCE inflation report. A hotter number would result in delaying the next Fed rate cut and adding more pressure to crypto. Still, ETF inflows and whale activity-including plans for a $500M bitcoin buy-offer some support. The big question now: Can Bitcoin hold $89K as macro pressure builds?

This article is for informational purposes only, kindly do your own research before investing.