Major Dashboards Double-Count Polymarket Trading Volume - What It Means for Crypto Data Integrity

Your favorite crypto data dashboard might be lying to you—or at least, telling the same story twice.

Polymarket's trading volume is getting counted twice across major tracking platforms, inflating the perceived activity on the prediction market giant. It's a classic case of data double-dipping that makes the ecosystem look busier—and maybe healthier—than it actually is.

The Double-Count Conundrum

Here's how it works: one trade flows through the system, but two different data aggregators pick it up and report it as unique volume. The result? A statistical hall of mirrors where every reflection gets added to the total. It's the financial equivalent of counting both the chicken and the egg.

Why This Matters for Traders

Inflated volume metrics distort everything—from liquidity assessments to trend analysis. Traders make decisions based on these numbers, and platforms build reputations on them. When the foundation's shaky, the whole structure wobbles. Just another day in crypto, where sometimes the most accurate prediction is that the data itself will be wrong.

Transparency Takes a Hit

The incident exposes the fragile infrastructure of crypto data reporting. With no universal standard for volume calculation, each dashboard becomes its own truth—and sometimes, that truth gets multiplied. It's enough to make you nostalgic for traditional finance's boring, audited spreadsheets.

The industry keeps building skyscrapers on quicksand, then acts surprised when the windows crack. Clean data shouldn't be a speculative asset—it should be the bedrock.

Paradigm Research Exposes Data Flaw

The root issue is how the platform processes the `OrderFilled` events. Polymarket's architecture emits one event for the maker of the order, and another for the taker. These two events describe the same economic transaction from the perspective of the two parties. However, they represent the same cash flow and movement of the contract. Summing them creates a fundamental accounting error. A simple token swap valued at $4.13 WOULD be recorded as $8.26.

Slivkoff's analysis dissects the unique trade anatomy of the platform. All transactions follow a specific template with one maker and one taker. Around fifty externally-owned accounts under Polymarket submit these transactions. The redundant events serve internal tracking purposes but confuse public dashboards. Thereby, raw data from blockchain explorers is most misleading to analysts. Trading volume should only count one side of the transaction, the research explains.

Implications for Market Perception and Valuation Accuracy

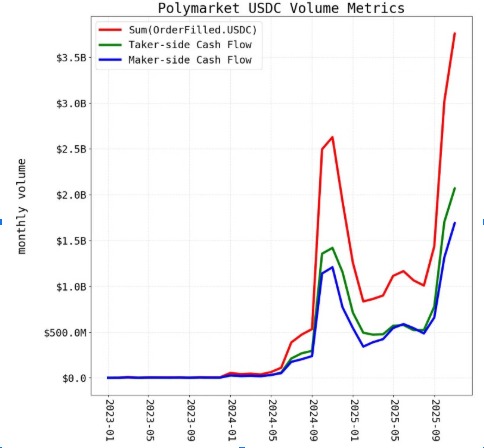

This discovery raises some questions about the perceived success and growth of the platform. The Paradigm finding suggests that the actual figure could be close to half of $3.7 billion. This data flaw touches on the platform's multi-billion dollar valuation assessments. Accurate metrics go hand-in-hand with investor confidence and market integrity. Paradigm created a public simulator to demonstrate proper ways of calculating.

This simulator models eight different trade types on the prediction market. It shows how splits, merges, and swaps affect open interest and volume. The team believes consistent and transparent reporting standards across the industry are necessary. As prediction markets continue to mature, quality data is crucial for all participants in the market. This episode features the increased importance of sophisticated on-chain analytics in the future of decentralized finance. Proper reporting of trading volume is integral to a trustworthy financial system.