Binance Co-CEO Yi He Declares India a Crypto Powerhouse: The Next Frontier for Digital Assets

Binance's leadership is placing a massive bet on India's crypto future. Co-CEO Yi He's recent statements signal a strategic pivot towards one of the world's most dynamic—and complex—financial markets.

Why India Can't Be Ignored

Forget the regulatory whiplash. The underlying fundamentals are screaming for attention. A massive, tech-savvy population, skyrocketing internet penetration, and a historic appetite for alternative asset classes create a perfect storm for crypto adoption. It's a demographic goldmine that exchanges are scrambling to claim.

The Regulatory Tightrope

Navigating India's policy landscape requires more finesse than a bull run. The government's stance has oscillated between outright hostility and cautious curiosity. Success here means playing a long game—building relationships, advocating for clear frameworks, and demonstrating tangible economic benefits. It's a chess match, not a sprint.

Beyond Trading: Building an Ecosystem

The real play isn't just onboarding new users. It's about embedding crypto into the fabric of India's digital economy. Think decentralized finance (DeFi) solutions for the underbanked, blockchain-based supply chains for its massive export sector, and digital asset innovation that leapfrogs legacy systems. The potential extends far beyond speculative trading.

The Bottom Line

When a giant like Binance makes a public declaration, it's not just an observation—it's a market signal. It draws a line in the sand for competitors and tells institutional money where to look next. Of course, traditional finance veterans might scoff, calling it another overhyped tech narrative—right up until the capital starts flowing and they're left holding bags of outdated financial instruments.

The race for India is on. The winners won't just be those with the best trading engine, but those who understand the local terrain and build for the long haul.

Source: X (formerly Twitter)

Despite some regulatory setbacks, the nation already boasts more than 100 million users, ranking it among the largest digital asset communities in the world.

Binance Co-CEO News Signals a Global Shift

The comment of Yi He that stock-market players are entering this industry reflects a major change in how traditional finance now looks at digital assets.

The digital asset market for years was highly driven by retail traders. Today, institutional investors from the equity markets are rotating into crypto with long-term strategies.

This shift is expected to bring stronger liquidity, better risk controls, and a more mature market structure.

The Statement Builds on Richard Teng's Support

Yi He's latest statement closely aligns with recent Richard Teng India news when he described the country as one of the most important growth markets for global crypto adoption.

During Binance Blockchain Week in Dubai, Teng confirmed a leadership shift where Yi He became the Binance New Co-CEO while he continues guiding the regulatory strategy.

Teng has time and again said the country has the right mix of a young digital population, strong fintech rails like UPI and Aadhaar, and fast-growing blockchain adoption. With Binance Co CEO news now repeating the same message, Binance's long-term commitment to the nation indeed seems firmly established.

Rapid Market Acceleration

Many believe across the industry that India's crypto growth is now moving at a faster pace than expected. Participation is rising not only among retail investors but also among professional traders and institutions.

Recent India crypto news, latest trends have shown higher trading volumes, growth in new digital asset investment accounts, and stronger participation across every major Indian exchange. The market is also expanding beyond metro cities, with Tier-2 and Tier-3 regions seeing rapid user growth.

This surge supports the view that the country is becoming one of the most important global hubs for digital assets adoption.

India Crypto Regulation Remains the Biggest Challenge

Despite strong momentum, India crypto regulation remains the biggest hurdle. Current rules still include:

A 30% tax onprofits

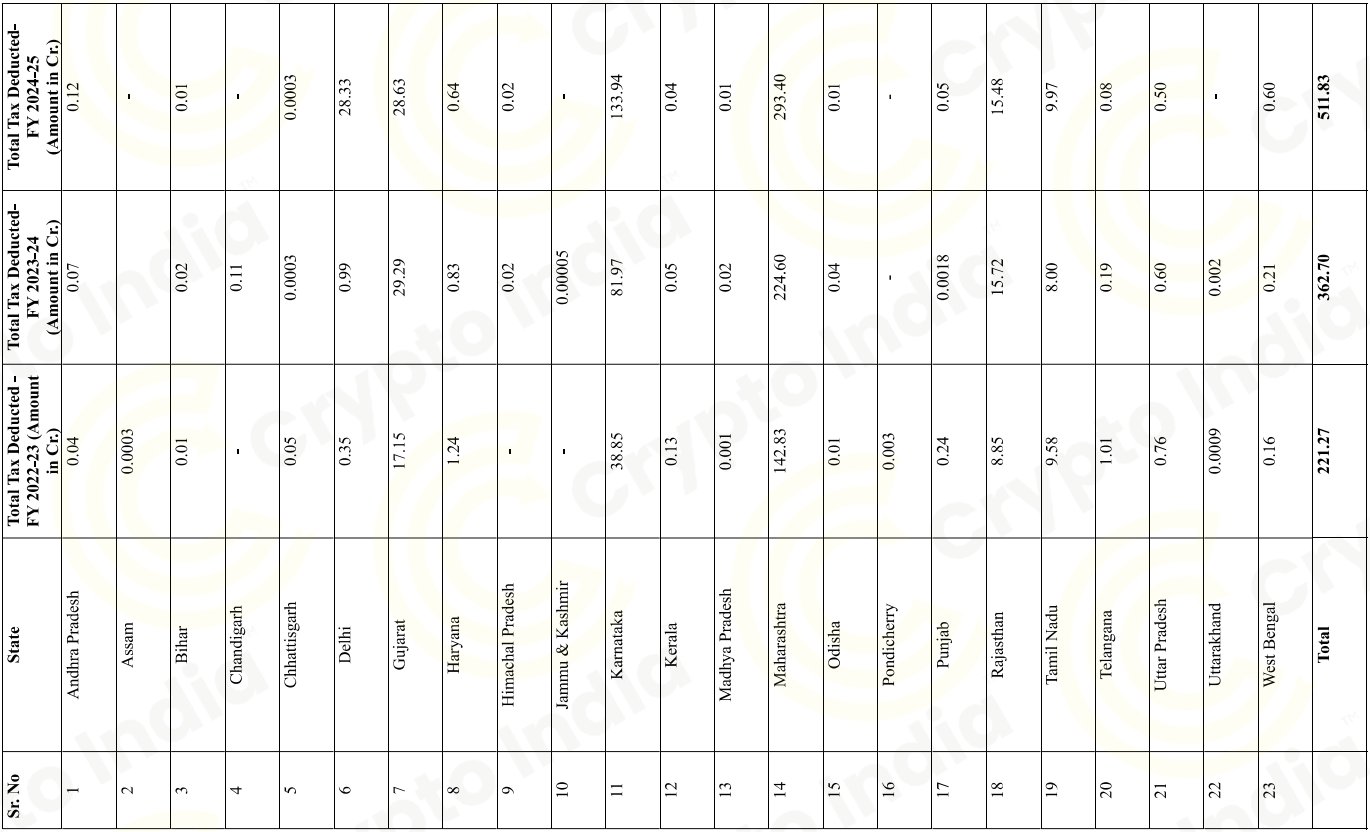

1% TDS on every transaction

Many traders say it limits active participation. However, positive regulatory signals are already emerging.

Total TDS Collected by the Exchanges- FY 2024-25: ₹511.83 Cr

- FY 2023-24: ₹362.70 Cr

- FY 2022-23: ₹221.27 Cr

Source: X (formerly Twitter)

Binance recently signed up with FIU-IND under the Prevention of Money Laundering Act and thus could operate legally in the country again. This may also pave a clear compliance road map for other platforms.

The exchange has expanded education through regional-language programs to strengthen India blockchain growth and reduce user risks.

What Comes Next

With both Binance Co CEO Yi He and Richard Teng India crypto openly backing the country, The exchange's roadmap now rests on compliance, regulatory cooperation, and protection for its users.

Global platforms such as Coinbase and Binance have continued to show great confidence in the long-term potential of the country despite strict India crypto tax rules.

This article is for informational purposes only and not a financial advice, kindly do your own research before investing.