Crypto Market Plunge: Unpacking the Crash & Tom Lee’s Bold 2025 Forecast

Digital asset markets are reeling. Major cryptocurrencies have sliced through key support levels, leaving investors scrambling and analysts dissecting the wreckage. The sell-off isn't random—it's a perfect storm of familiar pressures hitting with renewed force.

The Usual Suspects, Amplified

Regulatory uncertainty remains the ghost in the machine. Global watchdogs are moving, but not in unison, creating a patchwork of compliance nightmares. Meanwhile, whispers of macroeconomic shifts—potential rate hikes, inflation data—are spooking the institutional money that recently flooded in. It turns out, Wall Street's 'risk-on' appetite has a very quick off-switch. Then there's leverage. The crypto ecosystem's love affair with borrowed money means corrections aren't just dips; they're cascading margin calls that liquidate positions en masse, accelerating the fall.

Tom Lee's Contrarian Compass

Amid the panic, Fundstrat's Tom Lee is mapping a path through the noise. His analysis often cuts against the grain, and his current prediction is no exception. Lee points to historical patterns where severe capitulation has preceded major rallies. He's watching on-chain metrics—like exchange outflows and long-term holder behavior—that suggest accumulation is happening beneath the market's fearful surface. His forecast hinges on a belief that the fundamental drivers of crypto adoption haven't disappeared; they've just been overshadowed by short-term fear.

The Road Ahead: Volatility as a Feature, Not a Bug

Forget hoping for calm. This is crypto. The volatility is the point—it's the price of admission for an asset class rewriting the rules. The current crash is a brutal stress test, separating resilient protocols from hollow hype. While traditional finance pundits cluck about the 'irrational' market from their glass towers (funded by generous banking fees, of course), builders keep building. The narrative will flip, it always does. The only question is whether your conviction survives the ride.

Major Reasons Behind the Fall: Why Is Crypto Crashing Today?

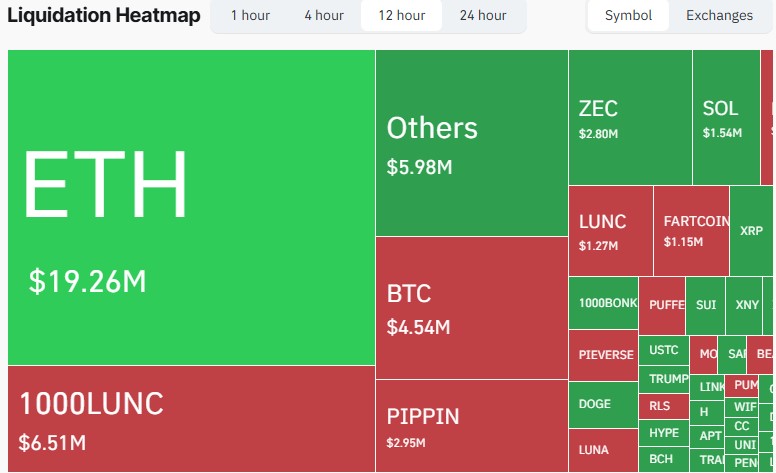

The crash began with aggressive liquidations that pulled Bitcoin back under the $90,000 mark. Over $200 million worth of Leveraged positions vanished within four hours, triggering a chain reaction across exchanges. According to CoinGlass, in the last 24 hours alone, 131,764 traders were wiped out, taking total liquidations to an enormous $413.35 million. The largest single liquidation order came from Hyperliquid, where a BTC-USD position worth $8.50 million disappeared instantly. This cascade forced both Bitcoin and altcoins to slide deeper.

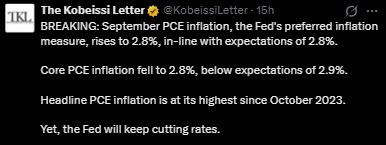

Fresh PCE news today added more pressure. September PCE inflation stood at 2.8%, perfectly matching expectations. According to The Kobeissi Letter, Core PCE also came in at 2.8%, slightly below the forecast of 2.9%. However, headline PCE reached its highest point since October 2023.

Even though the Federal Reserve is expected to continue cutting rates, the stubborn inflation trend triggered fear across all risk assets. This is one of the major reasons analysts cite when answering Why Is crypto Crashing Today.

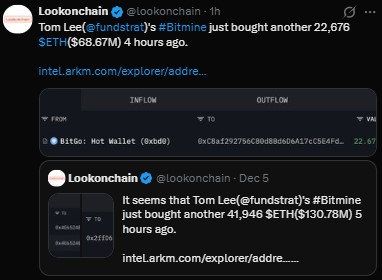

Large whale movements added to the nervousness. Tom Lee’s Bitmine bought 22,676 ETH, worth $68.67 million, only a few hours ago, as per Lookonchain data.

At the same time, a whale wallet that had been silent for 14 years suddenly transferred 1,000 BTC—worth $89 million—to a new address. This whale originally received those coins when Bitcoin was only $3.88. Sudden whale wakeups often trigger panic, as traders assume these funds may hit the market.

The SEC also played a role in today’s correction. Its major privacy meeting, which was previously delayed, has now been rescheduled to December 15. The discussion will run from 1:00 p.m. to 5:00 p.m. and will involve regulators, privacy experts and major industry participants. Since the topics include data collection, surveillance standards and user protections, uncertainty has risen again. Whenever regulatory pressure builds, traders start revisiting the same question: Why Is Crypto Crashing Today?

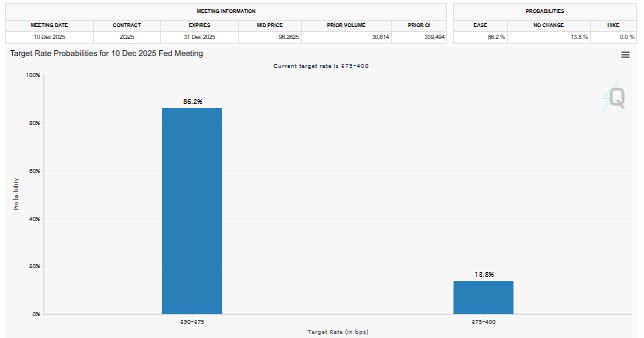

Only four days remain before the December Federal Reserve meeting, and the market is still unsure whether Jerome Powell will announce another rate cut. The probability of a 25-bps cut stands at 86.2%, while a 50-bps cut sits at 13.8%.

Current rates range between 372–400 bps. Whenever the market becomes uncertain about the Fed, volatility spikes—and crypto absorbs the first shock.

Will Crypto Recover and Will Tom Lee’s Prediction Come True?

According to Tom Lee, the market may already have bottomed. He believes the best years of growth are still ahead, with nearly 200x adoption expected. The Fear & Greed Index also shows extreme fear at 23, indicating that many traders are panic-selling at the bottom. Historically, this stage has often preceded strong market recoveries.

Conclusion

So, Why Is Crypto Crashing Today? The fall is a direct result of heavy liquidations, hot PCE data, unpredictable whale movements, SEC discussions and uncertainty before the Fed meeting. Despite the crash, analysts like Tom Lee maintain a bullish long-term outlook. For traders, the smartest strategy now is to stay calm, avoid panic and treat this moment as a disciplined dip-buying opportunity.

This is for educational purposes only. Always do your own research before any investment.