Crypto Market Shifts: Key Events Reshape the Last 24 Hours

Crypto markets are moving. Fast. The last day saw major catalysts trigger volatility, forcing traders to rethink positions and strategies.

Regulatory Whiplash Hits Exchanges

A surprise regulatory announcement from a major jurisdiction sent shockwaves through exchange tokens. The move—part crackdown, part framework—highlights the ongoing tug-of-war between innovation and oversight. One executive's carefully worded statement did little to calm nerves, proving that in crypto, the only constant is regulatory uncertainty. It's the financial equivalent of building a plane while flying it—and while someone else keeps changing the flight manual.

Institutional Moves Under the Microscope

Meanwhile, a flagship fund reported a significant adjustment to its digital asset holdings. The rebalancing act, interpreted by some as profit-taking and by others as strategic repositioning, provided a clear signal: the so-called 'smart money' is actively managing crypto exposure, not just HODLing. This isn't your cousin's diamond-handed meme coin portfolio.

Technical Breakdowns and Breakouts

On the charts, key technical levels shattered. A major altcoin broke decisively above a consolidation pattern it had been trapped in for weeks, while Bitcoin's dominance metric ticked down as capital rotated. The moves weren't uniform—some sectors bled while others led—painting a picture of a maturing market finding its footing through selective momentum.

The last 24 hours served as a potent reminder: crypto never sleeps, and neither does the news cycle that fuels it. For every bullish narrative, there's a skeptical regulator or a profit-taking whale. Navigating this requires less blind faith and more agile analysis—because in this market, the only thing you can truly predict is the next headline.

X

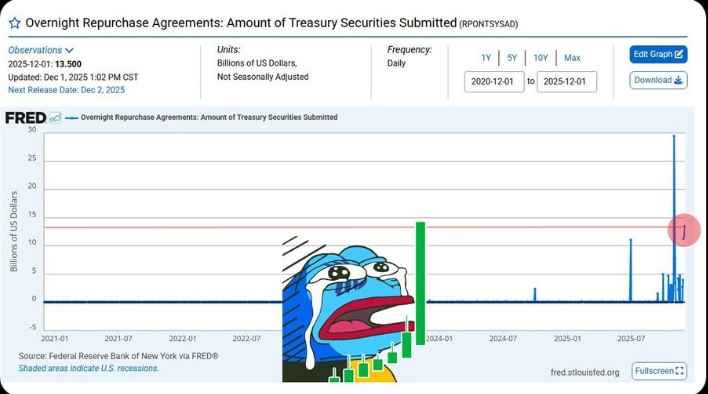

Fed injects $13.5 Billion into U.S banking system: Why it matters for crypto

According to FRED overnight repo data, the federal reserve injected $13.5 billion into the U.S banking system, marking the second largest liquidity boost since the covid era. This sudden MOVE signals tightening liquidity conditions in traditional finance, prompting the Fed to stabilize short term funding digital assets.

X

Why this affects the digital assets:

Liquidity injections often support risk assets, including crypto.

Market view repos as an early sign the Fed wants to calm volatility.

Traders interpret this as a near term bullish driver for bitcoin and altcoins

Coinbase Adds RLS and XPL- Expanding Retail Access

Coinbase announced new spot market listings for Rayls Labs (RLS) and Plasma (XPL)

RLS trading started from Dec 1

XPL trading begins from Dec 2

Trading will go live once the liquidity conditions are met in supported regions. The addition of these coins could expand retail exposure as coinbase continues to onboard emerging ecosystem tokens

ZAMA to hold sealed bid dutch auction on january 12

Zama revealed that 10% of its token supply will be offered through a sealed bid dutch auction on ethereum scheduled on january 12. The sale will leverage Zama protocol’s fully homomorphic encryption to keep bids confidential until settlement.

All tokens purchased will be fully unlocked at mainnet launch, allowing immediate use for encryption fees, delegation or staking, marking one of the most innovative token sale mechanisms surfacing in the market.

Strategy (MSTR) acquires 130 BTC: mNAV falls below 1

Strategy closely linked to microstrategy confirmed the purchase of 130 BTC worth approximately $11.7 million at an average cost of $89,960 per BTC

Michael saylor and the CEO stated that MSTR may consider selling BTC or its derivatives if mNAV falls under 1x

The company now holds 650,000 BTC valued at around $56.2B compared to its market cap of $55.4B, a development that is drawing heightened landscape attention.

FDIC signals first stablecoin rules under genius act

FDIC acting chairman Travis hill stated the agency is ready to propose the first stablecoin application rule under the genius act before month end

Why this matters for the virtual landscape

This could be the first federal level clarity on stablecoin issuance.

The genius act involves cooperation between multiple regulators.

Stablecoin regulation is one of the biggest catalysts for mainstream adoption.

Prediction Markets hits new highs as Kalshi tokens event contracts

Both major prediction posted record breaking volumes:

Kalshi: $5.8B(+32%)

Polymarket: $3.74B (+23%)

Kalshi also introduced tokenized event contracts on solana

Why the volume surge?

Election season, and macro uncertainty drive demand.

Chain markets offer faster settlement and transparency.

Tokenized contracts are the next step toward tradable real world information.

SEC’s Paul Atkins to deliver important speech– Market braces for policy signals

SEC Chairman Paul Atkins will deliver a high profile speech at 10:00 a.m ET tomorrow, describing it as a reflection on principles powering America's economy for 250 years.

Why Investors are watching

The speech may include early hints about future regulatory frameworks.

Policy tone from the SEC can shift crypto sentiment instantly.

participants want insights into how the SEC will approach digital assets in 2025.

How these major events will impact the crypto market

Overall cryptocurrency enters a high impact and high volatility phase

With liquidity injections, new listings, innovative token mechanisms, stronger regulatory signals, and a major SEC speech ahead, the VIRTUAL asset is poised for:

Short term volatility spikes

Bullish pressure on BTC and altcoins

Growing institutional interest via regulation

Narrative driven opportunities across privacy, and stablecoins

This is shaping up to be one of the most influential weeks for the crypto market in recent months.

Final outlook: A pivotal turning point for crypto market

The past 24 hours show the market is entering a pivotal phase, driven by liquidity movements, regulatory clarity, and rapid innovation. With the Fed injecting liquidity, coinbase broadening access, prediction markets hitting new high, and key regulatory speeches around the corner, investors are preparing for heightened volatility and potential trend shifts.

Tomorrow’s SEC announcement and the upcoming stablecoin rule may set the direction for December;s narrative , making this one of the most influential weeks for the cryptocurrency market in months.