Bitcoin Whales Showdown: Long vs Short High-Leverage Positions

Whale wars erupt as Bitcoin's price teeters—massive leveraged bets clash in a high-stakes battle for market direction.

The crypto trenches

Forget retail sentiment. The real action unfolds in the derivatives pits, where whales deploy staggering leverage to back their convictions. Long-position giants bet on a historic breakout, pouring capital into contracts that amplify every upward tick. Across the aisle, short-sellers dig in, wagering that gravity—or a nasty macro surprise—will finally bite.

A dangerous game

High leverage cuts both ways. It turbocharges gains and annihilates margins with equal fury. One sharp move triggers a cascade of liquidations, feeding volatility and creating the very price swings these players try to exploit. It's a self-fulfilling prophecy fueled by borrowed money—the kind of casino logic that would make a traditional finance regulator reach for the aspirin.

Who blinks first?

The standoff won't last. Market structure, a key news catalyst, or sheer exhaustion will force a resolution. When it breaks, the resulting liquidation wave will rock the spot market, offering a brutal reminder: in crypto's high-leverage arena, there are no bystanders, only targets.

Whale Wallets Enter High-Leverage Long and Short Positions

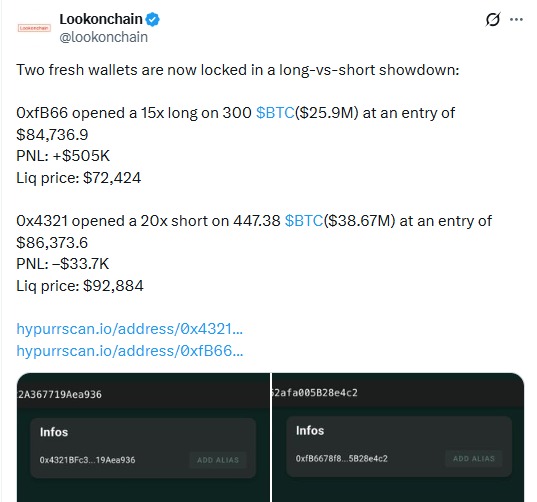

On-chain data from Lookonchain shows two new wallets taking aggressive positions within hours of each other:

Wallet 0xfB66 opened a 15x long on 300 BTC worth nearly $25.9 million at an entry of $84,736.9. The position is already showing a $505,000 profit, and with a liquidation level at $72,424, this whale sits comfortably as long as BTC stays NEAR current levels.

Source: X (formerly Twitter)

On the contrary, wallet 0x4321 opened a 20x short on 447.38 BTC valued at over $38.6 million with an entry of $86,373.6. That trade is currently down about $33,700 and its liquidation price sits higher at $92,884, leaving the short exposed if it extends its rebound.

This head-to-head setup has become the buzzing topic in the market. While a rising price favors the long whale and puts pressure on the short whale, any sharp pullback would turn the tables. Therefore, traders are closely following this bitcoin Whales Showdown, which is already up 125% month-over-month in derivatives open interest.

Bitcoin Tries a Bounce After Heavy Selling

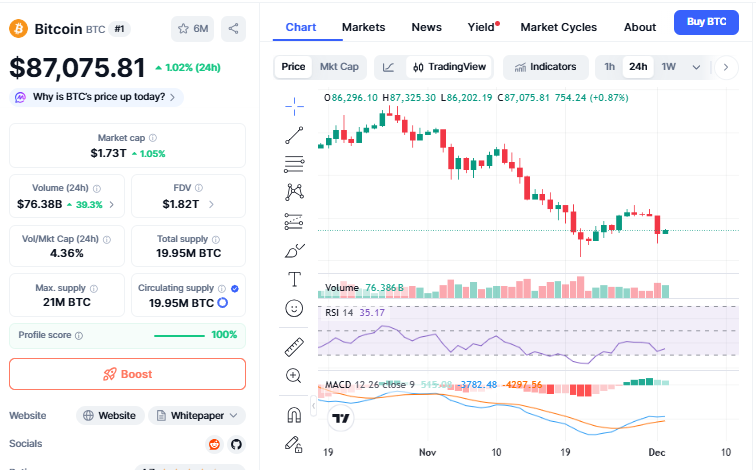

Following the action of whales, as per the CMC, Bitcoin price today moved to $87,075, up about 1.02% in the last 24 hours. Though the daily chart presents a mild recovery, the broader market still reflects notable weakness from 30-day and 90-day declines near 20.95% and 21.71%, respectively.

A contributing factor to today's rebound is the highly oversold state of BTC: The seven-day RSI fell to 35.17, opening a window for possible short-term recovery. Readings below 40 have very often triggered bounce attempts, and this time has proved no different.

Source: CMC

BTC also managed to stay above the 100-week SMA at $84,000, a support line that has cushioned deeper losses during previous market drawdowns.

Indicators of momentum further support the bullish case: The MACD histogram flipped positive into +754.24, which could suggest that sellers are losing momentum. Traders now view $88,000 as the next key area of interest, aligning with the 50% Fib level from the recent drop.

Macro Environment Adds Caution to Market Sentiment

Despite this short-term reprieve, global conditions remain uncertain. U.S. 10-year Treasury yields held above 4%, which caps Bitcoin's utility as a dollar hedge. Japan's rising bond yields and continuing BOJ tightening fears further pressured risk assets.

Meanwhile, the U.S. Bitcoin ETFs had $3.4 billion in outflows during November, reducing the effect of technical support levels.

Bitcoin Price Prediction:

If the bullish momentum continues, it might head toward $88,000-$89,200 as the long whale takes over. If macro pressure returns, it could retest the $85,000 zone. Much depends on how the Bitcoin Whales Showdown goes and whether the short whale can survive another push higher.

Disclaimer: This article is for informational purposes only and not a financial advice, kindly do your own research before investing in crypto.