RollBlock Presale Ends: Will $RBLK’s Exchange Listing Trigger a Massive Price Pump?

The wait is over. RollBlock's presale has officially closed its doors, locking in capital and setting the stage for its next major act: the public exchange listing. All eyes are now on the charts, with one burning question dominating trader chats—will this be the catalyst that sends $RBLK pumping?

The Listing Catalyst: More Than Just a Tickert

For any new token, the transition from presale to a public trading platform is a make-or-break moment. It's the first real stress test of market demand, free from the controlled environment of a staged sale. Liquidity floods in—or doesn't. Order books form, and the true price discovery battle begins. History is littered with projects that soared on listing day and others that flatlined, becoming just another forgotten line on a decentralized exchange's pair list.

Market Mechanics at Play

A successful pump post-listing isn't magic; it's mechanics. It hinges on a tight confluence of factors: pent-up demand from presale investors waiting for gains, fresh capital from new entrants drawn by the listing hype, and a tokenomics structure that doesn't immediately drown the market in sell pressure. Projects that navigate this gauntlet can see parabolic moves, as FOMO kicks in and trading volume explodes. It's the crypto equivalent of an IPO pop, just with less paperwork and more memes.

The Speculative Frenzy vs. Sustainable Growth

Let's be real—the immediate goal for most holders is a pump. A big, green, attention-grabbing candle that turns early support into profit. This speculative frenzy is the lifeblood of a new listing. But the smarter players are looking beyond the first few hours. They're gauging whether the initial surge has legs, supported by the project's fundamentals, roadmap updates, or ecosystem development. Otherwise, you're just left holding a bag after the traditional 'pump and dump'—a ritual as old as finance itself, now dressed in digital assets and fueled by anonymous Telegram groups.

The Verdict Awaits

RollBlock's team has built the runway. The presale is complete, the token is minted, and the exchange deal is presumably inked. Now, the market takes control. Will $RBLK ride the listing wave to new heights, or will it struggle to find its footing in the brutal arena of open trading? The order books are about to give their answer. Time to see if the hype was justified or just another expensive lesson in crypto economics.

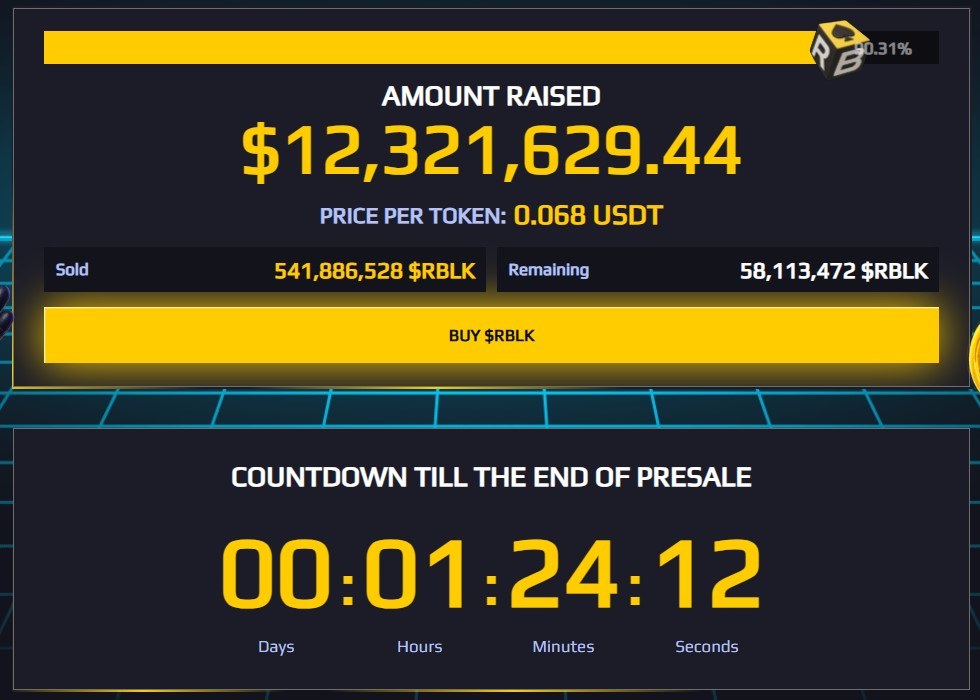

Countdown To Listing: RollBlock Presale End, Check Complete Numbers

The coin offering is almost sold out, and the official numbers show massive demand:

-

Total Raised: $12,321,629.44

-

Current Price per Token: $0.068

-

Total Tokens Sold: 541,886,528

-

Tokens Left: 58,113,472

-

Starting sale price: $0.01

-

Price Growth: Each round increased the price until this final stage

If anyone still wishes to enter, this is truly the last chance to “Buy RBLK tokens before the sale ends”.

What’s Next in $RBLK Coin News? Potential Listing Exchanges

Analysts tracking Rollblock listing date activity believe the token could debut on major platforms in late December 2025 or early January 2026. Based on similar asset’s marketing strategy, expected $RBLK listing exchanges include:

-

Uniswap (DEX)

-

PancakeSwap (DEX)

-

MEXC

-

BitMart

-

Gate.io

-

KuCoin

-

Binance (high potential depending on volume + liquidity)

The asset is supported by the ethereum chain, with a total supply of 1,000,000,000. As Rollblock presale nears end, such high supply and strong backing makes these potential launch exchanges more suitable.

Tokenomics + Real Revenue + Burn Model

The tokenomics are designed to help the token grow while supporting the ecosystem:

-

60% Presale: To build the base community

-

11% Rewards: For loyal holders

-

12% Marketing: For promotions and exchange partnerships

-

11% Exchange Listings: For CEX + DEX liquidity

-

6% Team Allocation: For developers

-

Price prediction target isn’t only based on market hype. The platform shares up to 30% of weekly casino revenue with the community.

How does the buyback and burn model work? 60% Buyback & Burn of revenue share with 40% staking rewards of revenue share. Investors who stake the coin can earn weekly rewards.

Combined with the fixed supply of 1 billion tokens, this model supports long-term price stability and growth aligned with a successful early sale.

Rollblock Price Prediction: Based on Celestia’s $TIA$ Model

Since this asset has a supply similar to Celestia (1B vs 1.1B) and aims to list on similar exchanges, top crypto watchers are using TIA’s launch pattern as reference.

But unlike Celestia, current asset has lower initial FDV, real revenue backing backing, zero tax, and buyback and burn mechanism.

$RBLK Coin Price Prediction:

-

Listing Price Target: $0.15 – $0.35

-

Short Term After $RBLK launch: $0.40 – $0.75

-

Mid Term: $1.20 – $2.50

-

Long Term 2026: $3 – $5+

These targets depend on volume, launch, and tokenomics, and they might vary depending on the market conditions at the time of debut.

Conclusion

With the RollBlock Presale ending in just 2 hours, the project is entering a major turning point. Strong demand, clear tokenomics, upcoming listings, and a powerful revenue system all make it a unique GambleFi opportunity for early investors.

Given the $12.32M early offering success, limited supply left, and expected exchange support, $RBLK coin price prediction for listing is positioned to gain strong market attention once trading begins.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. Always do your own research before investing.