Tom Lee’s Bold Ethereum Prediction: Why $63K ETH Isn’t Just Hopium

Fundstrat's Tom Lee just dropped a bombshell—Ethereum could hit $63,000. Here's why the math might not be insane.

The Case for a 20X ETH Rally

Lee's model factors in Ethereum's burn mechanism, institutional adoption, and its role as the 'digital oil' of Web3. The $63K target assumes ETH captures just 15% of Bitcoin's market dominance—conservative by crypto standards.

Wall Street's Worst Nightmare

While traditional finance still debates 'blockchain, not Bitcoin,' Ethereum's deflationary pivot and staking yields are quietly building a yield-bearing asset that outpaces Treasury bonds. Cue the institutional FOMO.

The Cynical Take

Of course, this assumes regulators won't try to 'protect' us from profits—again. But with BlackRock's ETH ETF filing and Visa settling stablecoins on-chain, even the suits are betting against bureaucracy this time.

One thing's clear: in a world where the S&P 500 yields less than crypto staking, $63K ETH isn't a moon shot—it's spreadsheet math.

Bitmine Immersion Tech Goes All-In: Reason Behind Bullish Setup

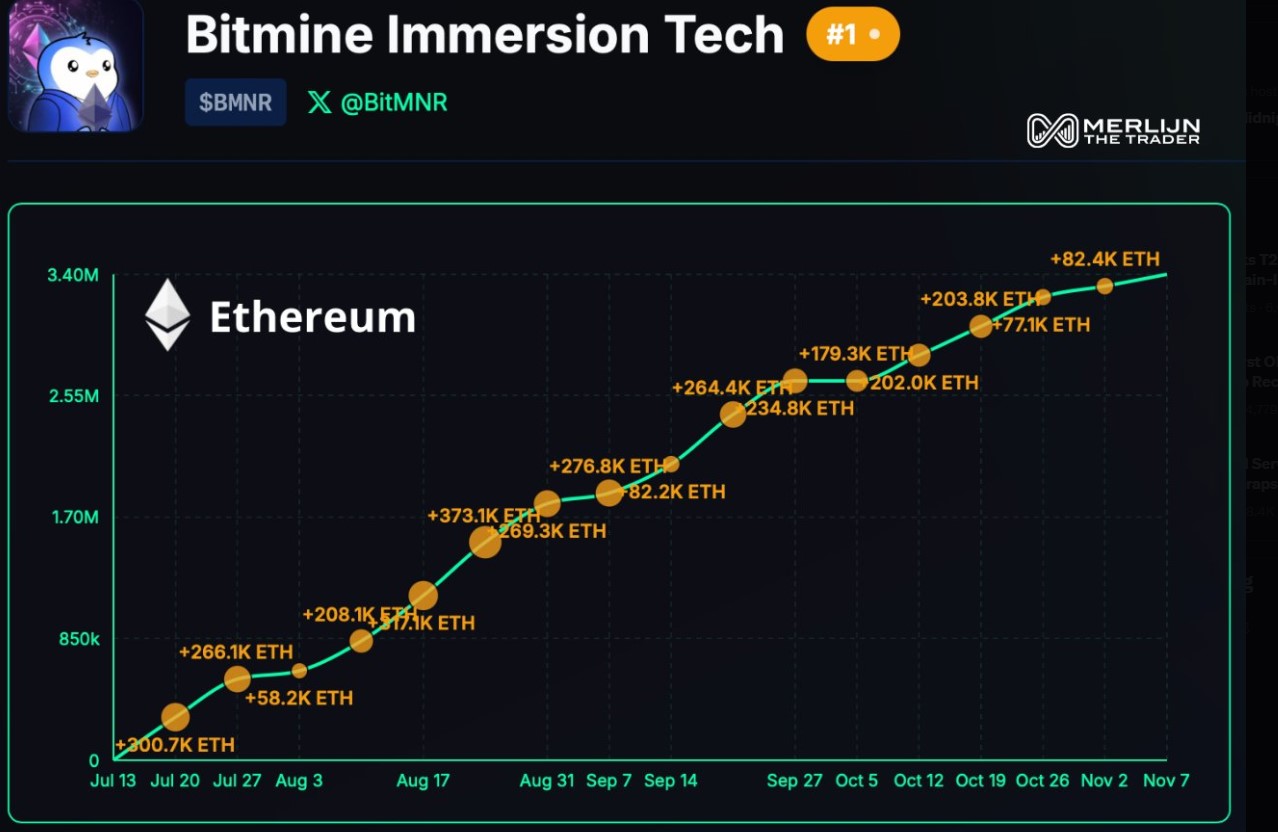

Adding huge support to this latest ethereum news is a big company named Bitmine Immersion Tech. As per Merlijin The Trader’s November 7 post, bitmine ethereum holdings are now massive, they hold 3.4 million tokens, which is 2.8% of all coins in existence.

As seen in the above chart, the company has been buying consistently since mid-July, growing its reserves from about 300K tokens. This isn’t just another whale play — it’s a strategic MOVE by a company doubling down on coin’s infrastructure, staking, and mining tech.

This huge, steady buying and long term vision shows why today’s Tom Lee Ethereum prediction is so bullish.

ETH Price Analysis: Resting Before The Big Climb

Right now, the token is trading at $3,367.06, having gone up about 2% in the last 24 hours. The trading volume, however, went down by 25.36% to $30.63B.

-

The price is resting after moving up from the $3,200 zone.

-

The RSI is neutral near 39–50, and MACD shows a small bearish crossover, suggesting short-term weakness.

-

Analyst View: Another analyst, Ali Martinez, has a clear plan: It will hit $2,000 first, then $10,000.

The technical side is mixed, but the fundamentals, like Tom Lee ETH price target and Bitmine's buying—are extremely bullish. As per my analysis being a crypto strategist, this might be one of the biggest signals for traders to enter because there won’t be next time, seeing the bullish price catalysts.

Inside Tom Lee Ethereum Prediction: The Road to $63,000 Price

This forecast is based on global finance completely changing, setting up the asset for a huge run. Let’s break it down as per the latest TradingView price chart.

-

Short Term (2025 Q1–Q2): It could test resistance near $3,800–$4,200. Small price drops might happen if Bitcoin's dominance falls.

-

Mid Term (2025–2026): If big buyers keep accumulating, then it can rally to $7,500–$10,000, matching Ali Martinez’s goal.

-

Long Term (2028–2030): If tokenization takes over the world, and this altcoin captures 1-2% of all the global assets, then Tom Lee Ethereum Prediction of $63,000+ can be reached by 2030.

The mix of the wall street's famous analyst ETH forecast, Bitmine holding 2.8% of the total supply, and the tokenization story is setting the stage for altcoin’s next huge price spike.

In conclusion, while traders chase short-term volatility, the deeper story is being written by institutions and infrastructure players preparing for a multi-trillion-dollar future.

Disclaimer: This article is for informational purposes only. Always DYOR before you buy or sell any asset because cryptocurrency is risky.