Crypto Bloodbath: Bitcoin Plummets, Ether Sinks With Zero Support in Sight

Digital assets hemorrhage value as market leaders Bitcoin and Ethereum spiral downward with no safety net in sight.

Freefall Accelerates

Bitcoin's dramatic plunge drags the entire crypto complex into the abyss. Ether follows suit, collapsing under relentless selling pressure that shows no signs of abating.

Support Levels Vanish

Traditional buy zones evaporate like mirages in the desert. The absence of meaningful support suggests institutional players have abandoned ship—or are waiting for total capitulation before stepping in.

Market Psychology Shattered

Fear dominates trading floors as retail investors panic-sell while whales remain ominously quiet. This eerie silence from major holders signals either strategic patience or preparation for further downside.

The silver lining? Wall Street's 'risk management' teams will probably blame millennials buying avocado toast instead of their own flawed models.

What to Watch

- Crypto

- Sept. 22: Coinbase introduces Mag7 + Crypto Equity Index Futures, a product combining major U.S. tech stocks with cryptocurrency ETFs in a single futures contract.

- Macro

- Sept. 22, 8:30 a.m.: Canada August PPI YoY Est. N/A (Prev. 2.6%), MoM Est. 0.9%.

- Sept. 22, 12 p.m.: Fed Governor Stephen Miran speech on "Non-Monetary Forces and Appropriate Monetary Policy."

- Earnings (Estimates based on FactSet data)

- None scheduled.

Token Events

- Governance votes & calls

- Delysium (AGI) to unveil its community governance plan.

- Gnosis DAO is voting on a $40,000 pilot growth fund using conviction voting on Gardens to empower GNO holders and support small, community-led ecosystem initiatives. Voting ends Sept. 23.

- Balancer DAO is voting on an ecosystem roadmap and funding plan through Q2 2026. It sets growth, revenue, innovation and governance targets and requests $2.87 million in USDC and 166,250 BAL to fund initiatives. Voting ends Sept. 23.

- Unlocks

- None.

- Token Launches

- Sept. 22: 0G (0G) to list on Kraken, LBank, Bitget and Bitrue.

Conferences

- Day 1 of 2: Canada Fintech Forum 2025 (Montréal)

- Day 1 of 2: Digital Assets Conference Brazil 2025 (São Paulo)

Token Talk

By Oliver Knight

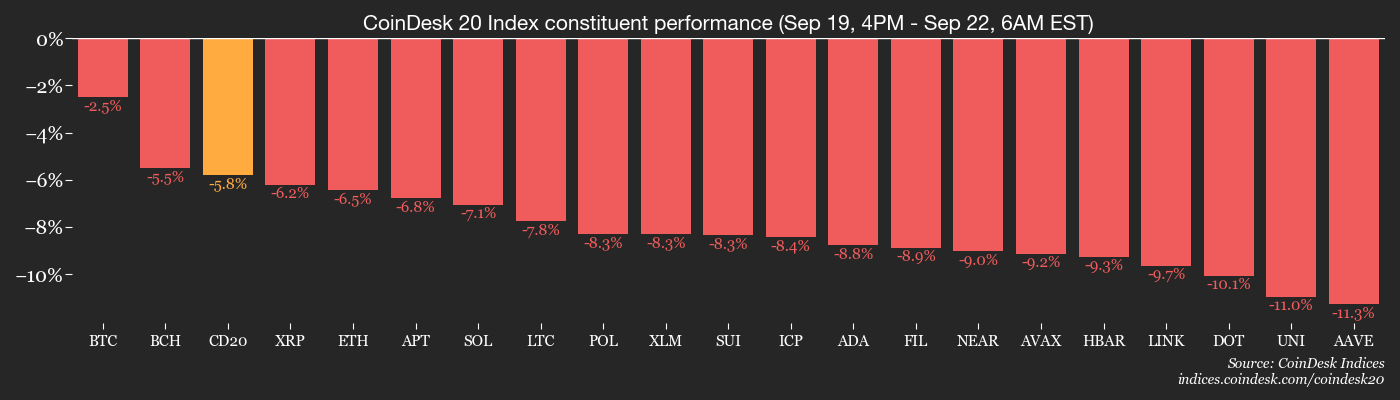

- A number of altcoins were dealt double-digit moves to the downside on Monday, with the likes of PUMP, RAY, CRV and TIA all sliding to their lowest in over a month.

- The sell-off was made worse by a $1.6 billion liquidation cascade, with $500 million occurring on ether (ETH) trading pairs, according to CoinGlass.

- Funding rates for ether flipped negative, which means short traders are paying to hold their position, demonstrating a shift in sentiment following ETH's rally from $2,400 at the start of July to $4,831 in late August.

- It's worth noting that crypto majors like BTC, ETH and SOL are now at respective levels of support and as sentiment has flipped bearish, a recovery could be staged to target traders being overly aggressive in short positions.

- The average crypto token relative strength index (RSI) is also at 28.4 out of 100, indicating heavily oversold conditions that will likely lead to a relief rally, unless ETH and BTC break their levels of support.

Derivatives Positioning

- The top 20 tokens, except for BTC and HYPE, have seen double-digit declines in futures open interest as the price drops shake out overleveraged bets.

- Shorts seem to be stepping in via Binance-listed USDT futures, as OI has increased to 276K BTC from 270K alongside near-zero funding rates in the past couple of hours.

- Funding rates in TRX, ADA, LINK, TON, UNI and Binance-listed 1000SHIB futures are notably negative, indicating a bias for bearish, short positions. Funding rates for other majors, including BTC, are flat to slightly positive.

- BTC front-month futures on the CME still trade at a roughly $100 premium to the spot price. Traders need to watch out for a potential shift into discount for signs of strengthening of selling pressure.

- On Deribit, put premiums relative to calls have spiked, as the price drops bolster demand for downside protection.

- Sentiment in the XRP and SOL options has flipped bearish too, aligning with BTC and ETH markets.

Market Movements

- BTC is down 2.6% from 4 p.m. ET Friday at $112,403.60 (24hrs: -2.61%)

- ETH is down 6.7% at $4,162.70 (24hrs: -6.7%)

- CoinDesk 20 is down 5.93% at 4,015.36 (24hrs: -5.93%)

- Ether CESR Composite Staking Rate is down 5 bps at 2.8%

- BTC funding rate is at 0.0002% (0.2606% annualized) on Binance

- DXY is down 0.12% at 97.53

- Gold futures are up 1.4% at $3,757.50

- Silver futures are up 2.32% at $43.95

- Nikkei 225 closed up 0.99% at 45,493.66

- Hang Seng closed down 0.76% at 26,344.14

- FTSE is unchanged at 9,208.44

- Euro Stoxx 50 is down 0.47% at 5,432.61

- DJIA closed on Friday up 0.37% at 46,315.27

- S&P 500 closed up 0.49% at 6,664.36

- Nasdaq Composite closed up 0.72% at 22,631.48

- S&P/TSX Composite closed up 1.07% at 29,768.36

- S&P 40 Latin America closed up 0.18% at 2,911.26

- U.S. 10-Year Treasury rate is down 1.2 bps at 4.127%

- E-mini S&P 500 futures are down 0.3% at 6,702.00

- E-mini Nasdaq-100 futures are down 0.36% at 24,776.25

- E-mini Dow Jones Industrial Average Index are down 0.33% at 46,496.00

Bitcoin Stats

- BTC Dominance: 58.61% (+1.11%)

- Ether-bitcoin ratio: 0.03699 (-4.1%)

- Hashrate (seven-day moving average): 1,079 EH/s

- Hashprice (spot): $50.10

- Total fees: 3 BTC / $347,276

- CME Futures Open Interest: 145,845 BTC

- BTC priced in gold: 30.1 oz.

- BTC vs gold market cap: 8.59%

Technical Analysis

- The ratio between the dollar prices of bitcoin and and gold has dropped to 30.25 on TradingView, the lowest since June 23.

- The decline pierced support at 30.57, the Sept. 9 low, and now looks set to test the June 24 low of 29.44.

- In other words, gold's outperformance looks set to continue.

Crypto Equities

- Coinbase Global (COIN): closed on Friday at $342.46 (-0.2%), -3.59% at $330.18

- Circle (CRCL): closed at $144.14 (+2.65%), -4.18% at $138.11

- Galaxy Digital (GLXY): closed at $32.87 (-0.63%), -5.45% at $31.08

- Bullish (BLSH): closed at $69.18 (+5.44%), -4.76% at $65.89

- MARA Holdings (MARA): closed at $18.29 (-1.14%), -4.21% at $17.52

- Riot Platforms (RIOT): closed at $17.46 (-0.29%), -3.21% at $16.90

- Core Scientific (CORZ): closed at $16.62 (-0.78%), -2.71% at $16.17

- CleanSpark (CLSK): closed at $13.62 (+1.19%), -4.99% at $12.94

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $41.56 (+1.12%)

- Exodus Movement (EXOD): closed at $29.18 (-0.27%)

- Strategy (MSTR): closed at $344.75 (-1.25%), -3.3% at $333.39

- Semler Scientific (SMLR): closed at $29.18 (-1.05%), -2.5% at $28.45

- SharpLink Gaming (SBET): closed at $17.33 (+0.64%), -6.58% at $16.19

- Upexi (UPXI): closed at $6.58 (-3.52%), -7.29% at $6.10

- Lite Strategy (LITS): closed at $2.80 (+3.32%), -3.57% at $2.70

ETF Flows

Spot BTC ETFs

- Daily net flows: $222.6 million

- Cumulative net flows: $57.68 billion

- Total BTC holdings ~1.32 million

Spot ETH ETFs

- Daily net flows: $47.8 million

- Cumulative net flows: $13.94 billion

- Total ETH holdings ~6.67 million

Source: Farside Investors

While You Were Sleeping

- Ether, Dogecoin Lead $1.5B Liquidation Wipeout as Bitcoin Slips Below $112K (CoinDesk): More than 407,000 traders were liquidated over a 24-hour period, Coinglass data show — the most in recent months — against a highly uncertain macro drop.

- Bitcoin Longs on Bitfinex Jump 20%, Prices Drop Below 100-Day Average (CoinDesk): Bitfinex longs climbed 20% to more than 52,000 positions, even as bitcoin slipped below its 100-day average of $113,283, a pattern that has often foreshadowed declines.

- UK Watchdog Speeds Up Crypto Approvals in Response to Critics (Financial Times): The FCA has shortened crypto approval times to just over five months and raised its acceptance rate to 45% as it prepares to launch a full regulatory framework in 2026.

- Gold Hits Fresh Record as Traders Wait for U.S. Rate-Path Clues (Bloomberg): Gold’s record run is being fueled by expectations of deeper Fed rate cuts, geopolitical tensions, tariff-driven inflation worries and continued central-bank buying.

- Metaplanet Becomes Fifth Largest Listed Bitcoin Holder With $632M BTC Buy (CoinDesk): The Japanese firm's latest purchase, at a cost of $116,724 per bitcoin, takes its total holdings to 25,555 BTC valued at approximately $2.70 billion.