Stablecoin Adoption Set to Explode After GENIUS Act, Projected to Hit $4T in Cross-Border Volume: EY Survey

Stablecoins are about to eat traditional finance's lunch—and regulators just handed them the utensils.

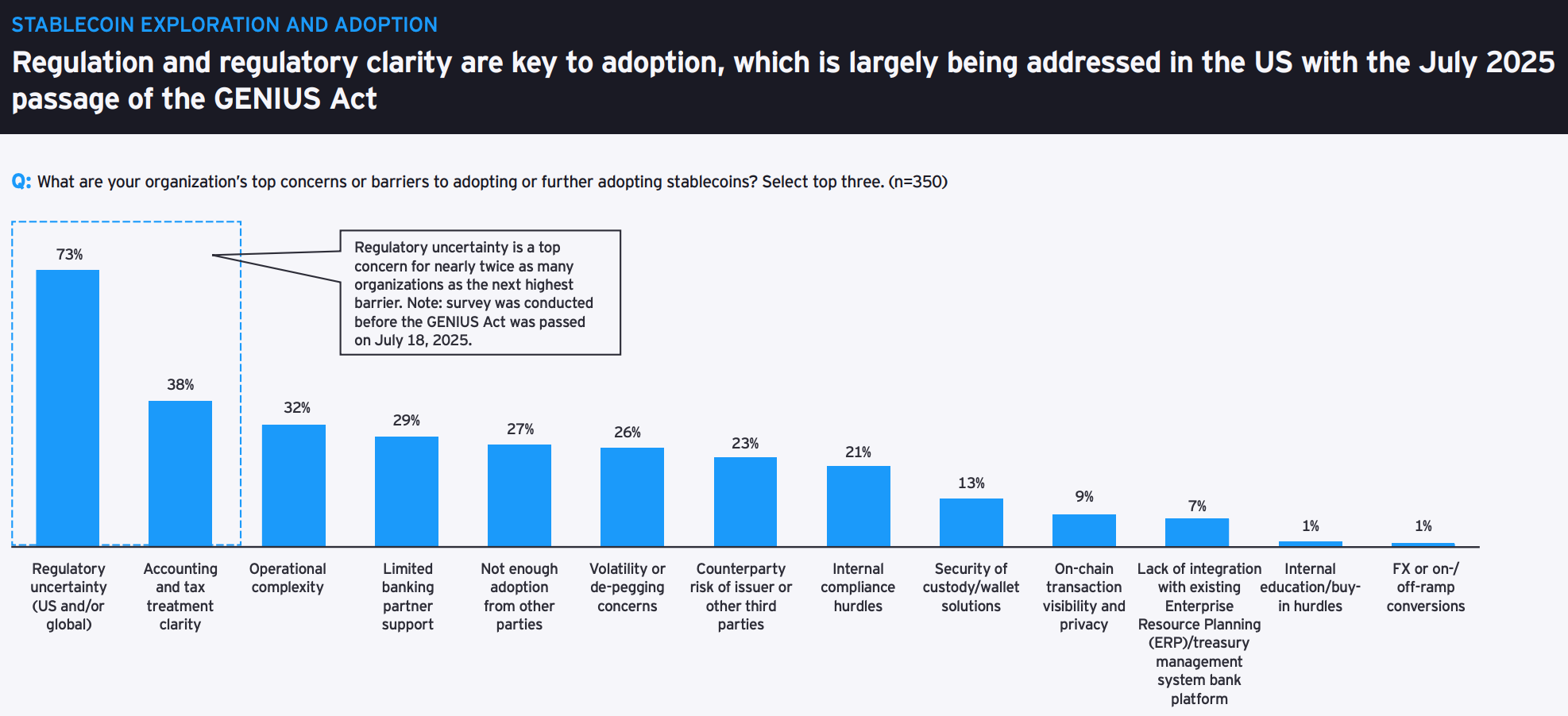

The GENIUS Act Effect

New legislation cracks open cross-border payments, sending stablecoin volume skyrocketing toward that $4 trillion mark. No more waiting three business days for settlements that cost more than the transaction itself.

Wall Street's Worst Nightmare

Digital assets bypass correspondent banking networks, slicing through red tape and middlemen fees. Suddenly, moving value across borders happens at internet speed—not banking speed.

EY's survey confirms what crypto natives knew years ago: traditional finance infrastructure is about as efficient as a fax machine in a Zoom meeting. The GENIUS Act doesn't just open doors—it demolishes walls.

Cost savings are also a key driver for adoption, with 41% of current users reporting at least a 10% reduction in expenses from using stablecoins in international transactions.

Respondents also saw stablecoins as a long-term fixture in global finance. By 2030, they estimate stablecoins could facilitate between 5% and 10% of all cross-border payments, representing $2.1 trillion to $4.2 trillion in value.

Still, infrastructure hurdles remain. Only 8% of businesses accepted payments in stablecoins, and many firms planned to lean on banking and fintech partners for integration.