Why We Need More Stablecoins: The Digital Economy’s Missing Anchor

Stablecoins aren't just crypto's safe harbor—they're becoming the backbone of global finance.

Forget volatility. These digital assets peg to real-world currencies, offering traders stability while traditional markets swing. They bridge crypto and fiat, letting users move value across borders faster than any bank wire.

More options mean better competition. New entrants push innovation in collateralization models and transparency—something the space desperately needs after last year's meltdowns.

They're not without risk. Regulatory scrutiny tightens daily, and poorly-backed stablecoins threaten entire ecosystems. But the alternative? Staying dependent on legacy systems that take three days to settle a transaction—and still charge you $30 for the privilege.

Love them or hate them, stablecoins are here to stay. The real question isn't whether we need more—it's whether traditional finance can keep up.

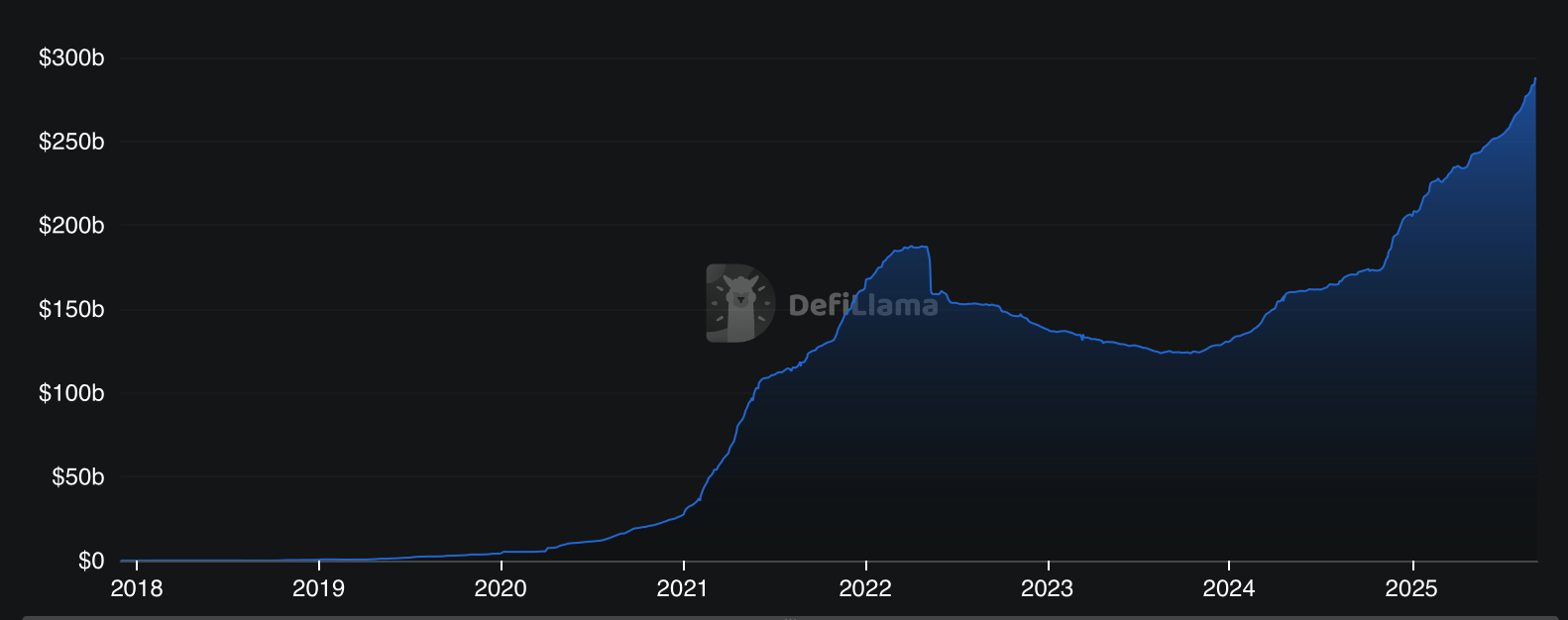

Total market cap of stablecoins is over $280 billion Source: Defillama

We’re seeing a rush of companies launching stablecoins in the U.S. because issuers finally gained clarity with the passing of the GENIUS Act in July 2025. For the first time, the U.S. government clearly defined who can issue stablecoins, what counts as a “payment stablecoin,” and what obligations issuers have to consumers.

Since the GENIUS Act passed, MetaMask rolled out mUSD, Stripe launched a payments-focused chain called Tempo, Circle announced their purpose-built stablecoin payments L1, Arc Network, and there’s been a spree of acquisitions. Stablecoin infrastructure companies like Iron are getting snapped up, and traditional finance firms like Stripe are spending heavily to buy crypto companies (Privy and Bridge) whose products they can fold into their existing offerings.

In addition, chains are launching their own stablecoins as a way to capture more revenue from the yield they generate. MegaETH has its native stablecoin, USDm. Hyperliquid launched USDH, which sparked a bidding war with Paxos, Agora, Sky, and Frax all vying to get involved.

At this rate, it’s easy to imagine a world where every serious company in crypto eventually issues its own stablecoin. Which raises the obvious question: do we need more?

: Even as the number of unbanked people falls, over 1.3 billion remain without access to banking, mostly in places with unstable currencies. Stablecoins provide 24/7 access to money online, without borders. If companies like PayPal push stablecoins directly to existing customers, they could onboard more people to use the global money rails of crypto.

: In the real world, we don’t have one currency. We have dollars, euros, yen. The same should be true onchain. If everything settles in dollars, the entire crypto economy becomes dependent on U.S. monetary policy. More stablecoins means less over-reliance on a single standard.

: Right now stablecoin markets are concentrated into the hands of a few big players. With more stablecoins, concentration risk decreases. If one issuer faces technical, regulatory, or solvency issues, users WOULD have alternatives to pivot to without destabilizing the broader ecosystem. More issuers mean more redundancy, making the system safer.

Stablecoins are quietly rewriting the rules of global finance. They give anyone, anywhere, access to money that moves instantly, across borders, with incentives aligned to users rather than banks. The more competition, the better. If crypto transforms the global economy, it won’t be because of speculation. It will be because of stablecoins.