Curve Finance Unveils Yield Basis: A Game-Changing $60M Strategy to Transform CRV into a High-Yield Income Powerhouse

DeFi's yield revolution just leveled up—Curve Finance drops its boldest play yet.

The $60M Blueprint

Forget speculative token pumps. Curve's Yield Basis initiative flips the script entirely—converting CRV from pure governance token into a legitimate income-generating asset. The mechanism leverages protocol fees and strategic treasury deployment to create sustainable yield streams.

How It Actually Works

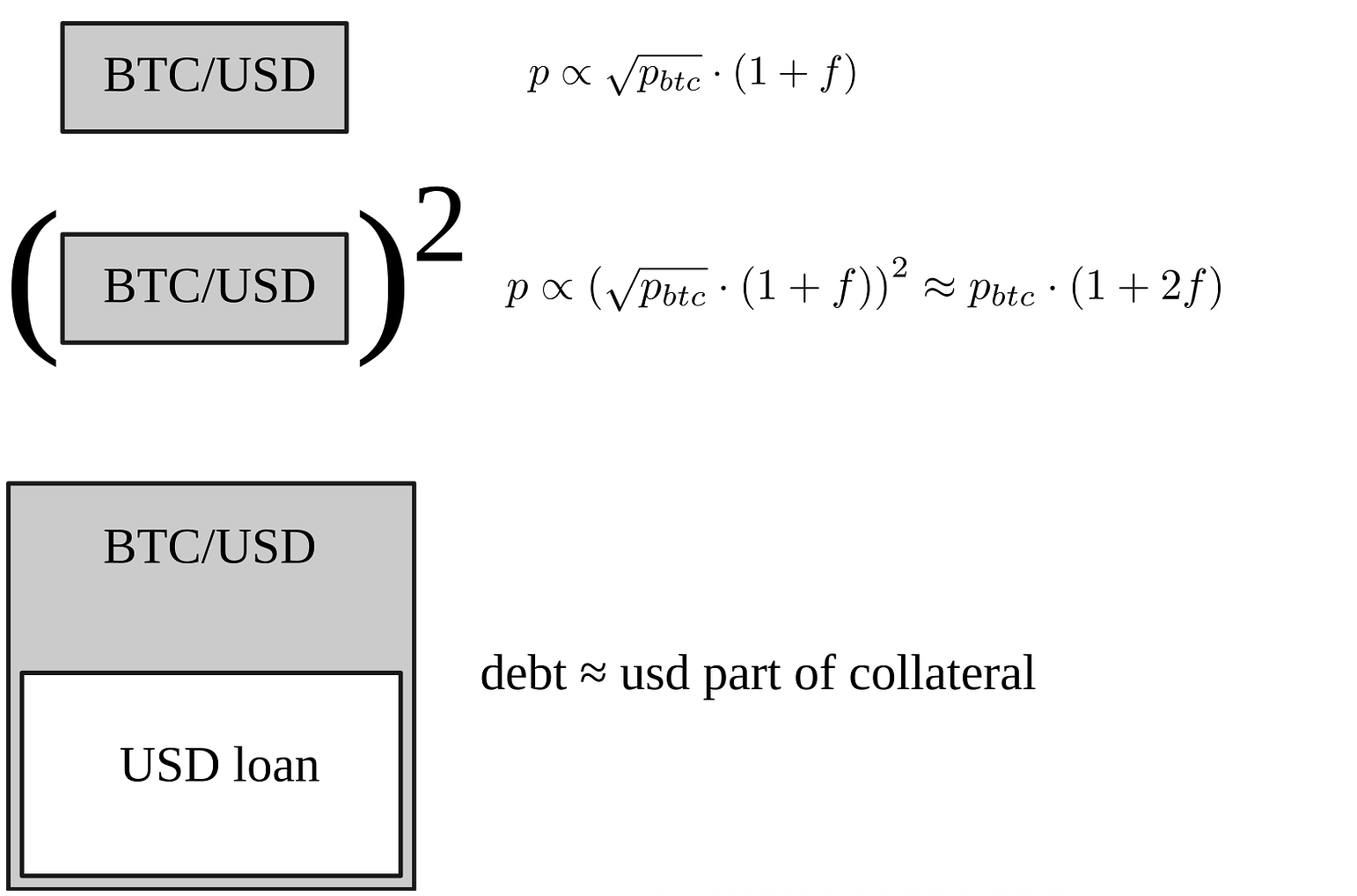

Curve redirects swap fees and amplifies returns through sophisticated DeFi strategies. No magic, just math—staking rewards compound while liquidity incentives get supercharged. Suddenly, holding CRV means collecting real cash flow, not just hoping for price appreciation.

Why TradFi Should Sweat

This isn't another crypto gimmick. Curve targets the core weakness of traditional finance: stagnant yield products. While banks offer pathetic savings rates, DeFi protocols now generate institutional-grade returns—and finally share them directly with token holders.

The Bottom Line

Yield Basis could redefine value accrual in crypto. If successful, CRV becomes more than a voting token—it becomes a dividend-paying asset. One cynical note: Wall Street will probably copy this model in five years and call it innovation. Welcome to DeFi—where the future happens first.

Impermanent loss occurs when the value of assets locked in a liquidity pool changes compared with holding the assets directly, leaving liquidity providers with fewer gains (or greater losses) once they withdraw.

The new protocol comes against a backdrop of financial turbulence for Egorov himself. The Curve founder has suffered several high-profile liquidations in 2024 tied to Leveraged CRV purchases.

In June, more than $140 million worth of CRV positions were liquidated after Egorov borrowed heavily against the token to support its price. That episode left Curve with $10 million in bad debt.

Most recently, in December, Egorov was liquidated for 918,830 CRV (about $882,000) after the token dropped 12% in a single day. He later said on X that the position was linked to funds from the uWu hack and represented repayment of a promise by uWu’s founder.

CRV ROSE around 1% in the past 24 hours.