Fed’s Sept 17 Rate Cut: Short-Term Volatility Meets Long-Term Bitcoin, Gold & Stock Supercharge

Markets brace for impact as the Federal Reserve prepares to slash rates on September 17—expect turbulence upfront but serious long-haul gains for crypto and traditional safe havens.

Why Bitcoin thrives when dollars dilute

Rate cuts typically weaken the dollar—and Bitcoin feasts on dollar weakness. The digital gold narrative strengthens every time traditional monetary policy goes loose. Forget hedge funds—the real smart money's already positioning.

Gold's timeless rally gets a modern catalyst

Gold doesn't need an explanation—it's been storing value for millennia. But add rate cuts to the mix? You get a perfect storm of institutional and retail demand chasing the ultimate safe haven. Because sometimes the oldest solutions are the most reliable.

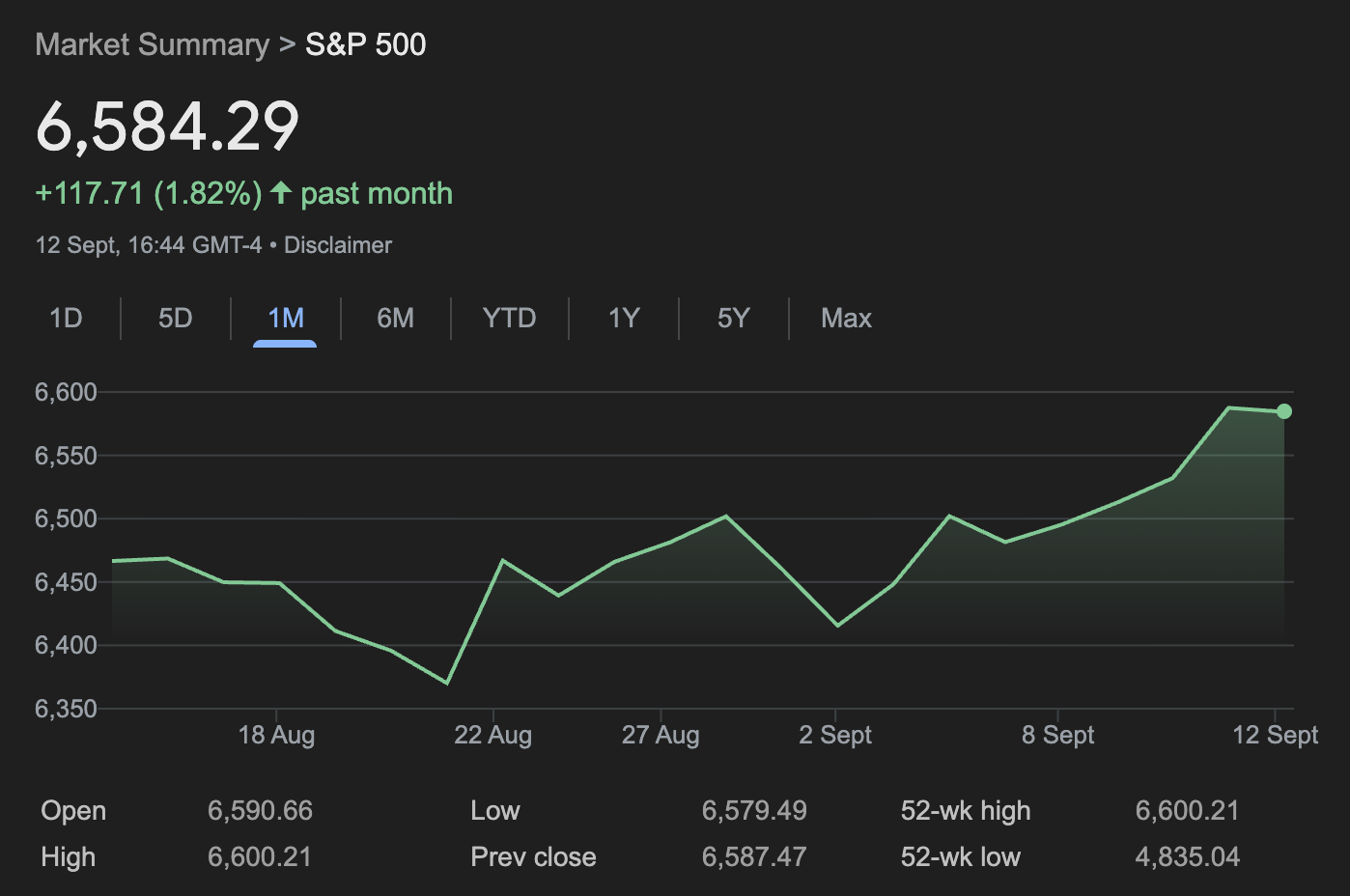

Equities: The unexpected beneficiaries

Cheap money flows somewhere—and historically, it floods into stocks. Tech stocks especially love lower rates. It's almost like the market enjoys free capital—who would've thought?

Short-term pain for long-term gain isn't just a cliché—it's how smart investors play the Fed's game. While traders panic over daily swings, strategic holders keep accumulating. After all, Wall Street's fear is Main Street's opportunity—and this time, crypto's invited to the party.

The Nasdaq Composite also notched five straight record highs, ending at 22,141, powered by gains in megacap tech stocks, while the Dow slipped below 46,000 but still booked a weekly advance.

Crypto and commodities have rallied alongside.

Bitcoin is trading at $115,234, below its Aug. 14 all-time high near $124,000 but still firmly higher in 2025, with the global crypto market cap now $4.14 trillion.

Gold has surged to $3,643 per ounce, NEAR record highs, with its one-month chart showing a steady upward trajectory as investors price in lower real yields and seek inflation hedges.

Historical precedent supports the cautious optimism.

Analysis from the Kobeissi Letter — reported in an X thread posted Saturday — citing Carson Research, shows that in 20 of 20 prior cases since 1980 where the Fed cut rates within 2% of S&P 500 all-time highs, the index was higher one year later, averaging gains of nearly 14%.

The shorter term is less predictable: in 11 of those 22 instances, stocks fell in the month following the cut. Kobeissi argues this time could follow a similar pattern — initial turbulence followed by longer-term gains as rate relief amplifies the momentum behind assets like equities, Bitcoin and gold.

The broader setup explains why traders are watching the Sept. 17 announcement closely.

Cutting rates while inflation edges higher and stocks hover at records risks denting credibility, yet staying on hold could spook markets that have already priced in easing. Either way, the Fed’s message on growth, inflation, and its policy outlook will likely shape the trajectory of markets for months to come.