Solana Skyrockets as Galaxy Digital Snatches $700M+ Tokens Off Exchanges

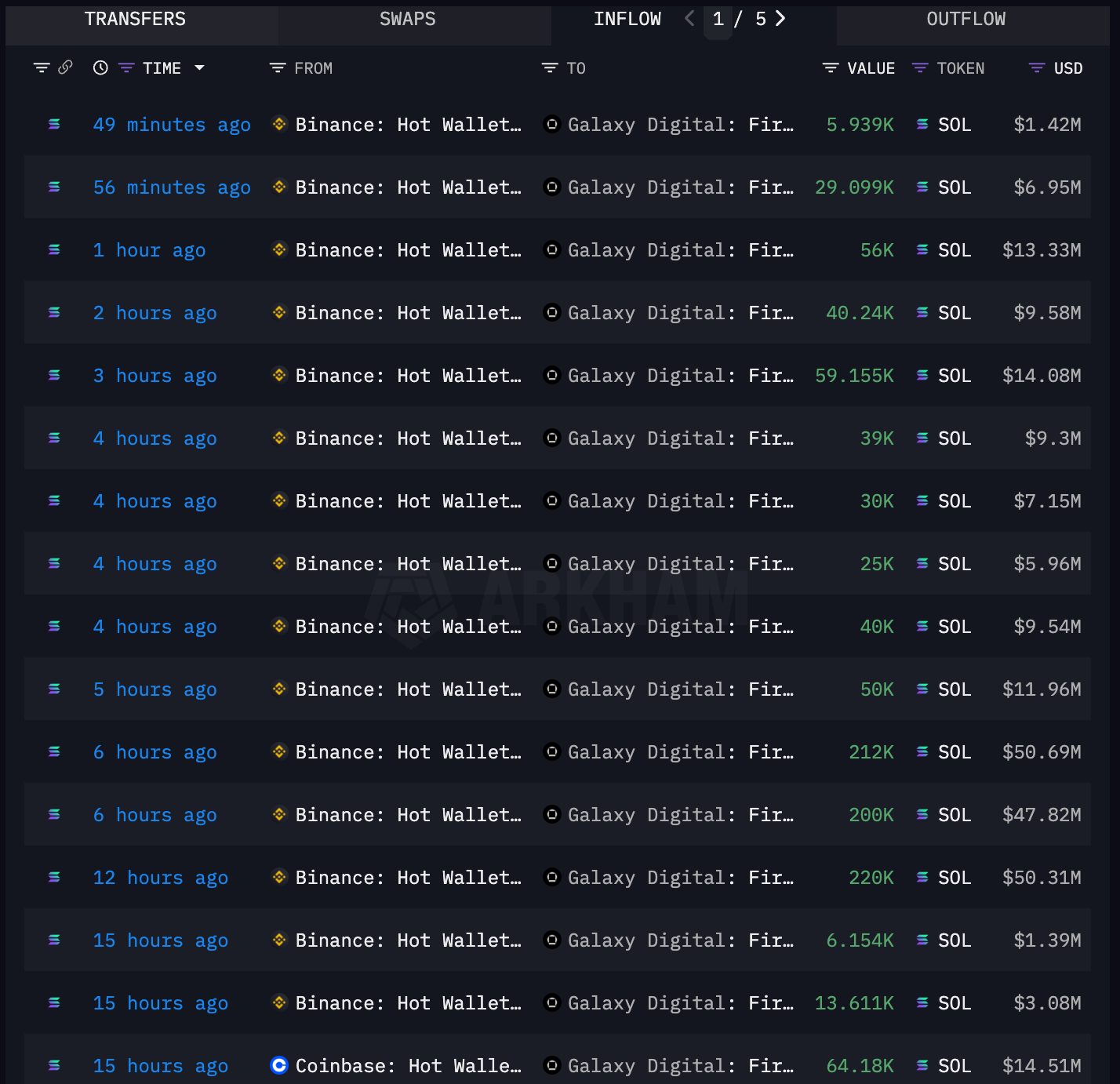

Galaxy Digital just pulled off one of the largest crypto moves of the year—grabbing over $700 million in Solana tokens from exchanges in a single swoop.

Why This Matters

When a major player like Galaxy vacuums up that much liquidity, it signals massive institutional confidence. They’re not just betting on a bounce—they’re positioning for a long-term surge.

Market Impact

Solana’s price shot up almost instantly. Supply shock meets bullish demand—classic recipe for a breakout. Exchanges are now scrambling as large-volume buyers follow Galaxy’s lead.

The Bigger Picture

This isn’t just another crypto pump. It’s a statement. Galaxy’s move screams conviction in Solana’s tech and ecosystem—even while traditional finance pundits still call it ‘just a meme chain.’ Guess someone forgot to tell them the memes are making millions.

Final Take

In a market full of noise, actions speak louder than tweets. A $700M buy isn’t a gamble—it’s a calculated power play. And for the rest of us? It’s a reminder that while Wall Street debates ETFs, real money is moving on-chain.

The transactions may have to do with Forward Industries (FORD), the digital asset strategy company with a $1.65 billion cash pile to build a solana treasury. Galaxy was a lead investor in the fundraising round, while its asset management division was tasked to "actively manage" Forward's war chest, according to a press release.

Solana season

Solana's outperformance could continue, Bitwise CIO Matt Hougan forecasted earlier this week, as incoming demand from treasury companies and spot ETF anticipation could have an outsized impact and SOL, given its smaller market capitalization compared to bitcoin (BTC) and ether (ETH).

Mike Novogratz, CEO of Galaxy, echoed that view in a Thursday CNBC interview, saying that the market could be entering the "season of SOL." He pointed to crypto investment firm Pantera's upcoming Solana treasury company and the potential approval of SOL ETFs, bringing in fresh money for the crypto.

His firm also chose the Solana blockchain to tokenize its stock with Superstate earlier this month.