Yield Hunters Flock to HyperLiquid Staking Ecosystem to Farm Kintetiq’s Airdrop

DeFi's latest gold rush ignites as HyperLiquid's staking platform becomes ground zero for Kintetiq's token distribution frenzy.

The Airdrop Arms Race Heats Up

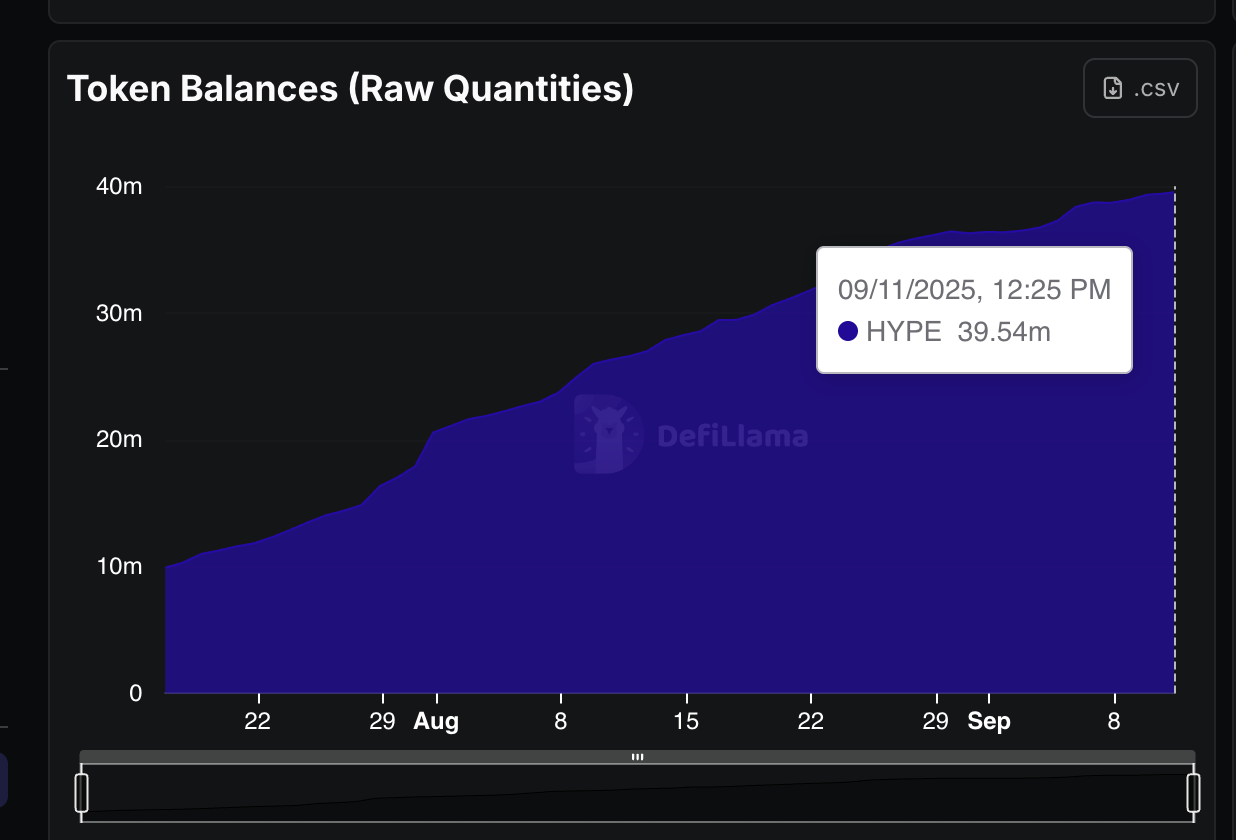

Yield-seeking degens are piling into HyperLiquid's ecosystem, leveraging every available staking strategy to maximize their shot at Kintetiq's upcoming airdrop. The protocol's TVL surged 40% in September alone as farmers deploy complex liquidity positions—because nothing says 'decentralized finance' like chasing free tokens from anonymous teams.

Staking Mechanics Unleash Capital Flood

HyperLiquid's multi-tiered staking architecture lets users compound yields while accumulating airdrop points. The platform's novel proof-of-liquidity model rewards early participants with higher allocation weights—creating a virtuous cycle of capital inflow and protocol growth.

Wall Street's Watching—And Scratching Their Heads

Traditional finance veterans still can't comprehend why people would lock millions in smart contracts for hypothetical token rewards. Then again, these are the same people who thought 2008 was a 'liquidity event' rather than systemic failure.

The yield farming revolution continues bypassing traditional gatekeepers—one airdrop at a time.

The surge demonstrates the growing influence of Hyperliquid, which is fast becoming a DeFi heavyweight as liquidity, trading activity and staking demand migrate onto its ecosystem.

Points programs in particular, where protocols distribute future token allocations to early participants, continue to pull in yield-hungry crypto investors. By staking HYPE through Kinetiq, users not only earn standard staking rewards but also accumulate points toward a potential Kinetiq token airdrop.

For many DeFi traders, that double yield opportunity has proven irresistible, some have shared on X.

Read more: Native Markets Leads Early Voting for Hyperliquid’s USDH Stablecoin Contract