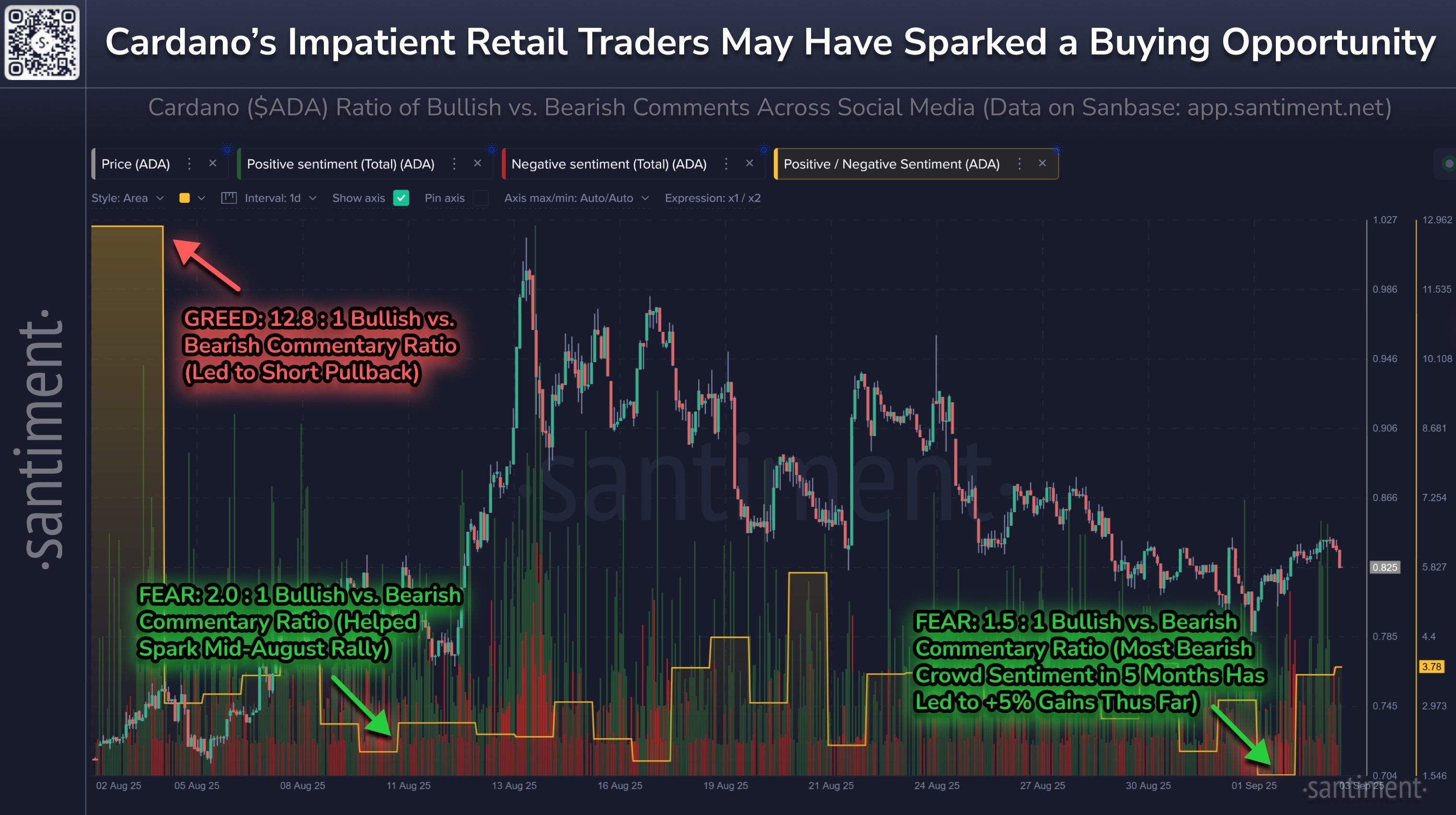

Cardano’s Bearish Retail Crowd Hands Whales a Golden Buying Opportunity

Retail panic meets whale opportunism as Cardano's sentiment flip creates prime accumulation conditions.

Market Dynamics Shift

While small investors flee ADA's recent pressure, institutional players and high-net-worth individuals circle like sharks sensing blood in the water. The divergence between retail fear and whale accumulation patterns signals potential momentum reversal.

Liquidity Grab

Mass liquidations at retail level provide unprecedented liquidity for major players to establish positions without moving markets significantly. This classic whale strategy often precedes major price movements—because nothing makes money like buying when everyone else is too scared to hold.

Sentiment Paradox

The very pessimism driving retail selling creates the ideal entry conditions for sophisticated investors. It's almost poetic how fear in the small accounts consistently fuels opportunity in the large ones—the financial ecosystem's version of trickle-up economics.

Sentiment extremes matter because crypto markets are unusually sensitive to retail psychology. When Optimism peaks, the crowd often buys into tops. When pessimism sets in, larger players use the selling pressure to accumulate. That pattern has been visible across multiple assets this year, including bitcoin and XRP.

For Cardano, the shift suggests whales could use current weakness to build positions, especially if retail continues to capitulate.

The crowd-versus-price divergence remains one of crypto’s more reliable short-term trading signals. For now, ADA’s impatient traders may have just handed longer-term investors their entry point.