Chinese Stock Margin Debt Hits Record High—Fueling Global Risk-On Rally and Bitcoin Surge

Margin debt on Chinese exchanges just smashed through all-time highs—and the ripple effects are turbocharging risk assets worldwide.

Speculative Fever Spreads

Investors are piling into leveraged bets like there's no tomorrow. That surge in Chinese margin trading isn't just a local story—it's flashing a giant green light for global risk appetite.

Bitcoin Catches the Wave

Digital gold's riding the momentum straight up. When traditional markets get this frothy, crypto often becomes the outlet of choice for turbocharged speculation—no permission needed.

The Big Picture

It’s almost poetic: while regulators fret over leverage in one market, they’re accidentally fueling it in another. Classic financial irony—where there's a yield, someone will find a way. Even if it means borrowing to bet on borrowed growth.

Moderate risk-on in crypto

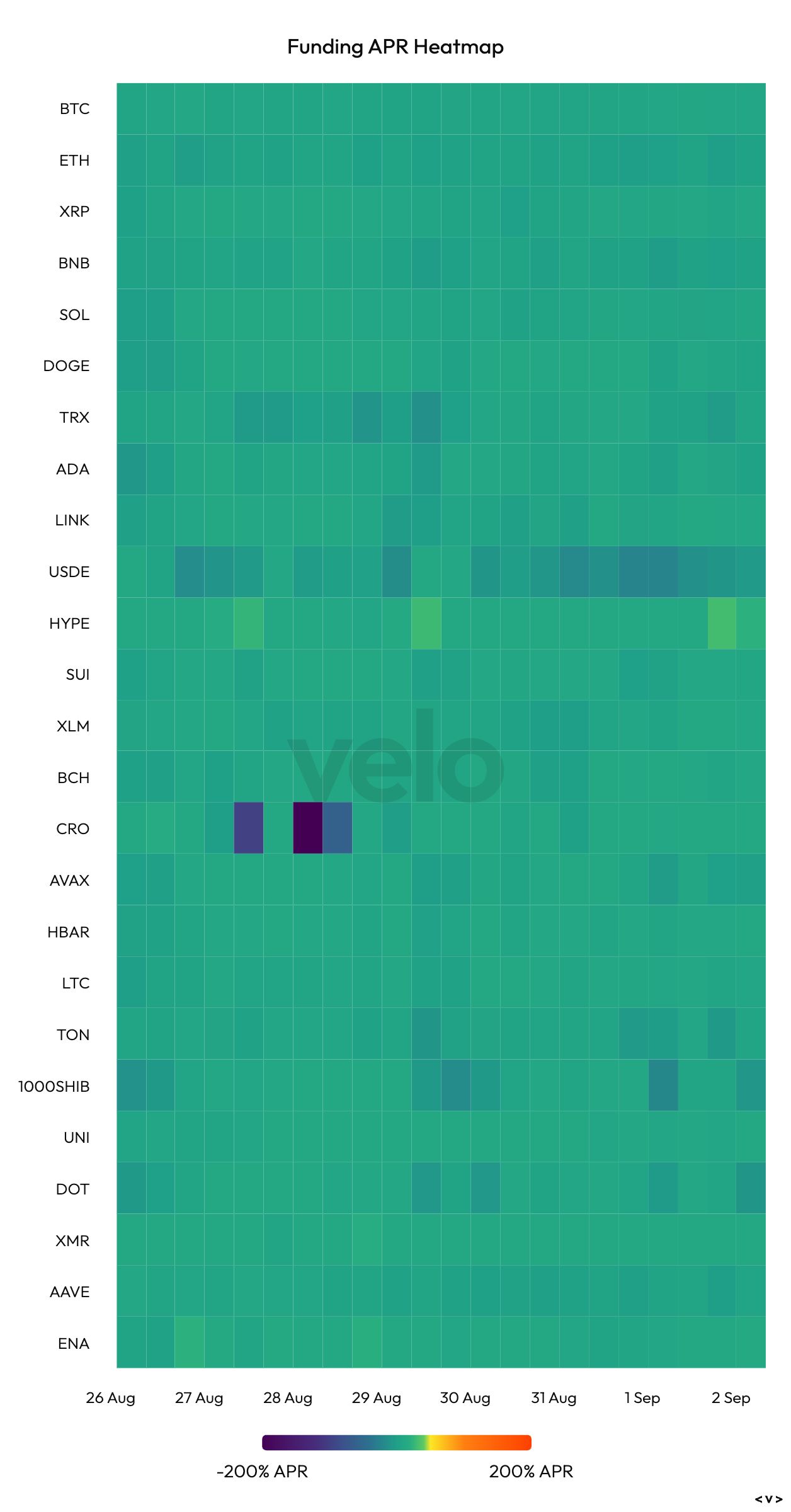

While there is no standardized metric to measure margin debt across the entire crypto industry, traders often use perpetual funding rates as a proxy to gauge overall demand for leverage. These rates indicate the cost of holding Leveraged positions and reflect market sentiment toward risk.

Currently, funding rates for the top 25 cryptocurrencies are hovering between 5% and 10%, signaling a moderate level of bullish leverage among traders. This suggests that while there is demand for leveraged long positions, market participants remain cautious, striking a balance between Optimism and risk management.