Gold’s Explosive Rally Has One Massive Catalyst - And Bitcoin’s Set to Soar Alongside It

Gold isn't just shining—it's skyrocketing. And that same rocket fuel could propel Bitcoin to new heights.

The Macro Melt-Up

Traditional safe-havens are getting a steroid injection from institutional panic. When gold moves, crypto often follows—just faster and more violently.

Digital Gold 2.0

Bitcoin's correlation with the yellow metal strengthens every time legacy finance flinches. Smart money isn't choosing between gold and crypto anymore—it's loading up on both.

Because nothing says 'confidence in the system' like hedging against it with two entirely different asset classes. Welcome to modern portfolio theory—where everything's a hedge and traditional bankers are still trying to short both.

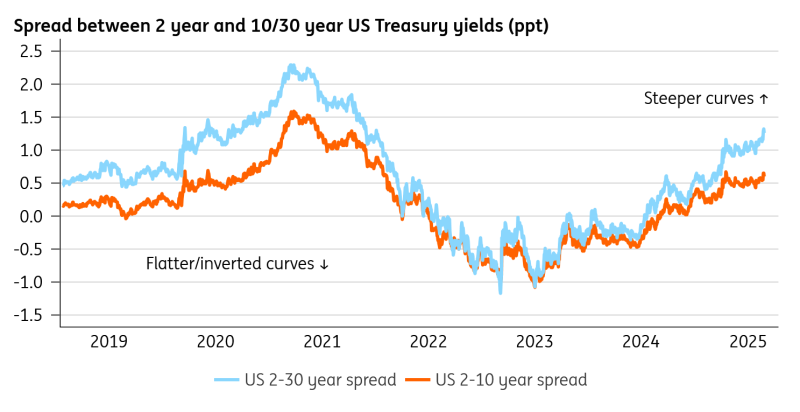

Meanwhile, the relative resilience of longer-duration yields is attributed to expectations of sticky inflation and other factors, which also support the bullish case in gold and BTC.

"The U.S. Treasury curve has unsurprisingly steepened: lower rates today risk inflaming inflation further ahead, which is bad news for bonds," analysts at ING said in a note to clients Friday.

Hansen explained that much of the relative resilience in the 10-year yield stems from inflation breakevens, currently at around 2.45%, and the rest represents the real yield.

"[It] signals that investors are demanding greater compensation for fiscal risks and potential political interference with monetary policy. This environment typically supports gold as both an inflation hedge and a safeguard against policy credibility concerns," Hansen noted.

The nominal yield is made up of two components: Firstly, the inflation breakeven, which reflects the market's expectation for average inflation over the bond's maturity. This portion of the yield compensates for the loss of purchasing power due to inflation. The second component is the real yield, which represents the additional compensation that purchasers demand above and beyond inflation.

Bull steepening is bearish for stocks

Historically, gold and gold miners have been among the best performers during prolonged periods of bull steepening in the yield curve, according to analysis by Advisor Perspectives. Conversely, stocks tend to underperform in these environments.

Overall, bitcoin finds itself in an intriguing position, given its dual nature as an emerging technology that often moves with the Nasdaq, while also sharing gold-like qualities as a store of value.