Bitcoin’s Perfect Storm: Retail and Institutions Are Stacking Relentlessly—And a Major Breakout Is Brewing

Forget sideways action—Bitcoin's building toward something massive.

Retail traders and institutional whales are accumulating at a pace that defies typical market cycles. They're not just buying dips; they're stacking relentlessly.

What’s Driving the Accumulation?

Institutions see regulatory clarity finally emerging—even if it took them years to figure out what a blockchain actually does. Retail, meanwhile, is front-running the usual FOMO cycle, grabbing coins before the next leg up truly kicks in.

This isn’t speculative gambling. It’s strategic positioning.

Market mechanics suggest supply is tightening where it counts. Exchange reserves are thinning, and large holders aren’t selling—they’re moving coins into cold storage, signaling long-term conviction rather than quick-flip energy.

And the timing? Impeccable, if you ignore the fact that Wall Street always shows up late to the party.

When both Main Street and Wall Street align like this, volatility tends to follow—but so do breakout opportunities. The only thing missing? A catalyst. And in crypto, those have a habit of appearing right when complacency sets in.

So keep your eyes on the charts. This might just be the calm before the storm—the kind that makes or breaks portfolios, and reminds everyone why they got into crypto in the first place.

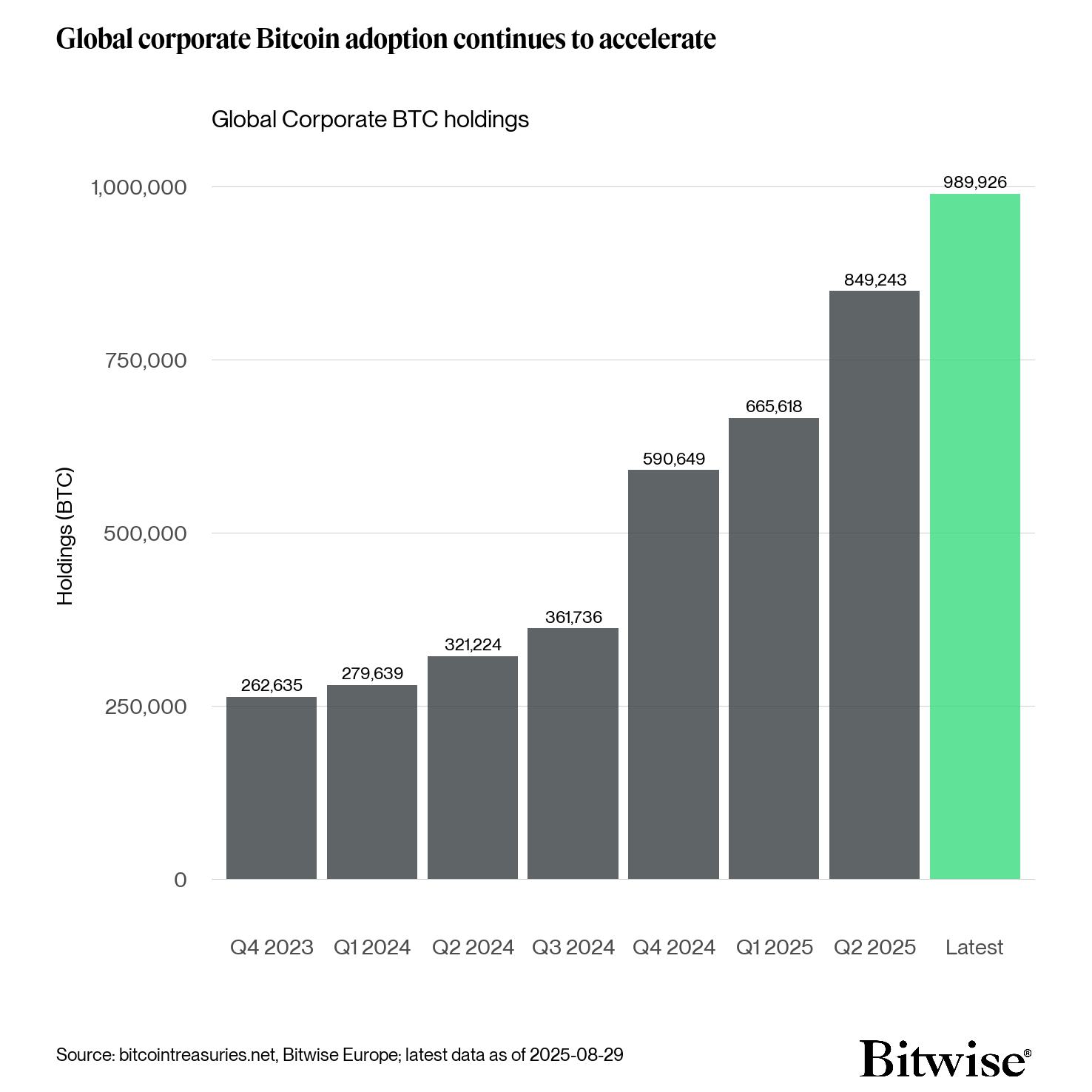

Moments later, Dragosch addressed a popular narrative among analysts that bitcoin could “top out” in 2025 because of post-halving cycle patterns seen in earlier years. He argued that such thinking overlooks the scale of institutional demand today.

![]()

His chart showed that as of Aug. 29, 2025, institutional demand has absorbed over 690,000 BTC, compared with a new supply of just over 109,000 BTC, making demand roughly 6.3 times larger than supply.

While Dragosch described it as nearly seven times, the precise ratio still illustrates an extraordinary imbalance that challenges historical cycle comparisons. For investors, the implication is that halving-driven supply dynamics may matter less in the current era of institutional adoption.

Two days earlier, on Aug. 27, Dragosch pointed to retail buying as another driver. He said the rate of accumulation across all bitcoin wallet cohorts — from small holders to whales — had reached its highest level since April. In his words, investors appear to be “stacking relentlessly.”

The Bitwise chart attached showed sharp upward moves across wallet groups, suggesting that retail demand is lining up with institutional flows. Historically, synchronized accumulation across cohorts has often preceded major upside moves, making the current environment notable for bulls.

![]()

Despite the accumulation of data, bitcoin is little changed at $108,716 in the past 24 hours, according to CoinDesk Data, as markets await clearer catalysts.

(All times are UTC)

- According to CoinDesk Research's technical analysis data model, between Aug. 30 at 15:00 and Aug. 31 at 14:00, BTC traded within a $2,150 range, fluctuating between $107,490 and $109,640.

- Heavy buying support emerged near $107,800, where volumes exceeded daily averages, establishing a key short-term floor.

- Resistance formed around $109,600, where repeated rejections indicated profit-taking pressure.

- In the final 60 minutes of the analysis period, BTC swung from $109,250 to $108,700 before closing near $108,900, showing continued volatility but stable support levels.

Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk's full AI Policy.