Crypto ETF Surge Poised to Reshape Markets—But Brace for Mass Product Failures

Crypto ETFs explode onto the scene—transforming how institutions and retail dive into digital assets. This flood of new products promises unprecedented access but hides a brutal truth: many will crash and burn.

The Darwinian Shakeout

Not every ETF survives the hype cycle. As funds scramble for inflows, weaker products face consolidation or closure—leaving investors stranded in the wreckage. The market cuts losers fast.

Wall Street’s latest gold rush? More like musical chairs—with your assets on the line when the music stops.

Geraci also anticipates strong uptake for index-based crypto ETFs, which he says will give investors and advisors “a straightforward way to gain exposure to the broader digital asset ecosystem.” For smaller, less-known tokens, he admits demand will depend heavily on the strength of each project’s fundamentals.

“As you move further down the crypto market cap spectrum, I expect demand for spot ETFs will be more closely tied to the success of individual projects and the performance of their underlying assets — factors that are difficult to forecast at this stage,” he said.

Seyffart agrees that the pipeline of crypto-related products is about to burst — but he’s more skeptical about how many will stick.

“If all of those filings ultimately launch, there will undoubtedly be some closures within the next few years,” Seyffart said. He expects “decent demand for plenty of these products,” but believes expectations need to be calibrated—especially for altcoins.

“I’m not sure that some of these longer tail altcoins will be able to have 5+ successful ETFs,” he said. “If people are gauging their success on the level of bitcoin ETFs — they will be severely disappointed. But if others are expecting all of them to fail — they will also be severely disappointed.”

In his view, the market is entering a test phase where issuers will throw many products at the wall to see what sticks. “These issuers are gonna launch a lot of products and try to find something that sticks,” Seyffart said. He predicts the next 12 to 18 months will see “hundreds of crypto-related ETP launches.”

Both analysts agree on a central point: the ETF format creates a highly competitive landscape where investor interest is the ultimate arbiter of success. While SEC approval might open the gates, it’s asset flows that will determine who stays afloat.

In the ETF world, product closures are a feature — not a flaw. Just like in the stock market, low demand or poor performance can lead funds to shut down. For investors, that means not every new crypto ETF will be worth betting on, even if it carries the name of a popular blockchain project.

For example, a solana ETF might find buyers if the underlying token continues to attract developers and users. But five separate ETFs based on the same coin? That’s where both Seyffart and Geraci say the market will likely intervene.

“If demand doesn’t show up, those products will close,” Seyffart said.

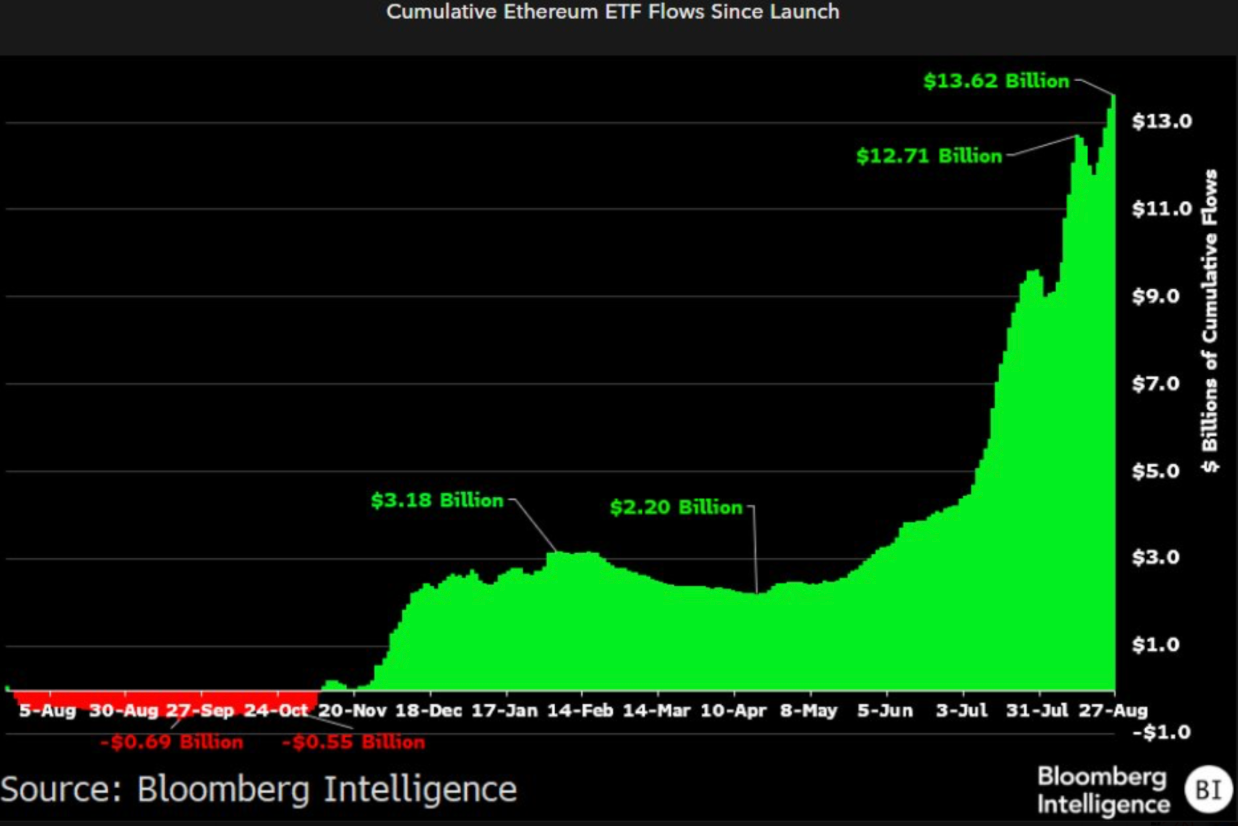

Behind this boom is the broader institutional acceptance of crypto. Since the SEC approved spot bitcoin and ether ETFs last year, asset managers have rushed to file new offerings tied to Solana (SOL), XRP, Dogecoin (DOGE) and many others and even basket funds tracking multiple coins. These products give traditional investors a regulated way to access crypto markets without setting up wallets or managing private keys.

But with that access comes the responsibility to be discerning.

“In the end, investors will decide which products make sense and which don’t,” Geraci said. “That’s how the ETF market has always worked.”

And with hundreds of crypto funds potentially hitting the market soon, that decision may need to come quickly.