Whales Gobble Bitcoin Dip Amid Massive Liquidations: Crypto Daybook Americas

While retail traders got wrecked in yesterday's bloodbath, crypto whales executed a classic buy-the-dip maneuver—proving once again that panic sells while smart money accumulates.

Strategic Accumulation Under Pressure

Major players scooped up Bitcoin at discounted prices as leveraged positions evaporated across exchanges. The liquidation carnage—totaling hundreds of millions—created perfect cover for institutional accumulation patterns.

Market Mechanics Favor Deep Pockets

Whales used cascading liquidations to enter positions without moving markets upward. Their calculated buys demonstrate sophisticated execution strategies that retail traders simply can't match—unless you consider 'YOLOing' a strategy.

Another day, another reminder that crypto markets redistribute wealth from the impatient to the calculated. But hey, at least the liquidation tweets were entertaining.

What to Watch

- Crypto

- Aug. 27, 3 a.m.: Mantle Network (MNT), an Ethereum layer-2 blockchain, will roll out its mainnet upgrade to version 1.3.1, enabling support for Ethereum’s Prague update and introducing new features for platform users and developers.

- Macro

- Aug. 26, 8:30 a.m.: The U.S. Census Bureau releases July manufactured durable goods orders data.

- Durable Goods Orders MoM Est. -4% vs. Prev. -9.3%

- Durable Goods Orders Ex Defense MoM Prev. -9.4%

- Durable Goods Orders Ex Transportation MoM Est. 0.2% vs. Prev. 0.2%

- Aug. 26, 10 a.m.: The Conference Board (CB) releases August U.S. consumer confidence data.

- CB Consumer Confidence Est. 96.4 vs. Prev. 97.2

- Aug. 27: The U.S. will impose an additional 25% tariff on Indian imports related to Russian oil purchases, raising total tariffs on many goods to about 50%.

- Aug. 28, 8 a.m.: Mexico's National Institute of Statistics and Geography releases July unemployment rate data.

- Unemployment Rate Est. 2.9% vs. Prev. 2.7%

- Aug. 28, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (2nd Estimate) Q2 GDP data.

- Core PCE Prices QoQ st. 2.6% vs. Prev. 3.5%

- GDP Growth Rate QoQ Est. 3.1% vs. Prev. -0.5%

- GDP Price Index QoQ Est. 2% vs. Prev. 3.8%

- GDP Sales QoQEst. 6.3% vs. Prev. -3.1%

- PCE Prices QoQ Est. 2.1% vs. Prev. 3.7%

- Real Consumer Spending QoQ Est. 1.4% vs. Prev. 0.5%

- Aug. 28, 1:30 p.m.: Uruguay's National Statistics Institute releases July unemployment rate data.

- Unemployment Rate Prev. 7.3%

- Aug. 28, 6:00 p.m.: Fed Governor Christopher J. Waller will speak on “Payments” at the Economic Club of Miami Dinner, Miami, Fla. Watch live.

- Aug. 26, 8:30 a.m.: The U.S. Census Bureau releases July manufactured durable goods orders data.

- Earnings (Estimates based on FactSet data)

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

- Aug. 28: IREN (IREN), post-market, $0.18

Token Events

- Governance votes & calls

- IOTA (IOTA) is voting on whether to "go all-in IOTA infrastructure and growth with Tangle DAO." Voting closes Aug. 26.

- IoTeX (IOTX) is voting on whether to introduce slashing for underperforming IoTeX delegates. Voting closes Aug. 26.

- Aug. 26: Zebec Network (ZBCN) to host ask me anything with World Mobile at 10 a.m.

- Aug. 26: Solana (SOL) to host Solana Live at 4.30 p.m.

- Unlocks

- Aug. 28: Jupiter (JUP) to unlock 1.78% of its circulating supply worth $26.36 million.

- Sep. 1: Sui (SUI) to release 1.25% of its circulating supply worth $153.1 million.

- Sep. 2: Ethena (ENA) to release 0.64% of its circulating supply worth $25.64 million.

- Token Launches

- Aug. 26: Centrifuge (CFG) to list on Bybit and Bitrue.

- Aug. 26: alt.town (TOWN) to list on Gate.io and Bitget.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Aug. 26: WebX 2025 (Tokyo)

- Aug. 27: Blockchain Leaders Summit 2025 (Tokyo)

- Aug. 27-28: Stablecoin Conference 2025 (Mexico City)

- Aug. 28-29: Bitcoin Asia 2025 (Hong Kong)

Token Talk

By Shaurya Malwa

- Blue-chip NFT collections faced steep weekly losses as ether (ETH) pulled back from record highs, wiping more than 10% off the value of most top projects.

- Pudgy Penguins, the leading collection by trading volume, dropped 17% to a 10.32 ETH floor, showing that even the sector’s strongest liquidity magnet couldn’t escape the downturn.

- Bored Ape Yacht Club (BAYC) lost 14.7% to 9.59 ETH, while Doodles recorded one of the sharpest corrections, falling 18.9% to 0.73 ETH.

- Secondary projects also slumped: Moonbirds fell 10.5%, and Lil Pudgys shed 14.6%, reflecting how price pressure cascaded across both flagship and derivative collections.

- CryptoPunks proved most resilient, losing just 1.35% over the week, underscoring its status as the market’s defensive benchmark when risk appetite collapses.

- Despite lower floors, trading activity stayed high. Pudgy Penguins saw 2,112 ETH ($9.36 million) in weekly volume, followed by Moonbirds (1,979 ETH), CryptoPunks (1,879 ETH), and BAYC (809 ETH).

- Overall NFT market capitalization shrank nearly 5% to $7.7 billion, down from a $9.3 billion peak on Aug. 13. The $1.6 billion drawdown highlights how quickly capital flees when ETH slumps.

- The sharp contrast between resilient CryptoPunks and sliding newer collections strengthens its appeal as a collateral asset. Its liquidity holds up even as broader NFT floors collapse.

- For investors, the sell-off signals that NFT blue chips remain high-beta ETH proxies, with only legacy projects like CryptoPunks showing the defensive value that makes them the safer long-term institutional bet.

Derivatives Positioning

- Leveraged crypto bulls have been burned, with futures bets worth $940 million liquidated in the past 24 hours. More than $800 million were long positions betting on price gains. Ether alone accounted for $320 million in liquidations.

- Still, overall open interest (OI) in BTC remains elevated near lifetime highs above 740K BTC. In ether's case, the OI has pulled back to 14 million ETH from 14.60 million ETH.

- OI in SOL, XRP, DOGE, ADA, and LINK also dropped in the past 24 hours, indicating net capital outflows.

- Despite the price volatility, funding rates for most major tokens, excluding SHIB, ADA and SOL, remains positive to suggest dominance of bullish long positions.

- OI in the CME-listed standard BTC futures has fallen back to 137.3K from 145.2K, reversing the minor bounce from early this month. It shows that institutional interest in trading these regulated derivatives remains low. OI in options, however, has continued to increase, reaching its highest since late May,

- CME's ether futures OI remains elevated at 2.05 million ETH, just shy of the record 2.15 million ETH on Aug. 22. Meanwhile, OI in ether options is now at its highest since September last year.

- On Deribit, the impending multibillion-dollar expiry on Friday shows a bias towards BTC puts, indicative of concerns prices are set to drop further. The impending ether expiry paints a more balanced picture.

- Flows on the OTC desk at Paradigm have been mixed, featuring strategies such as outright put buying and put spreads in BTC, as well as calls and risk reversals in ETH.

Market Movements

- BTC is up 0.55% from 4 p.m. ET Monday at $111,825.43 (24hrs: -0.66%)

- ETH is up 1.55% at $4,420.50(24hrs: -2.56%)

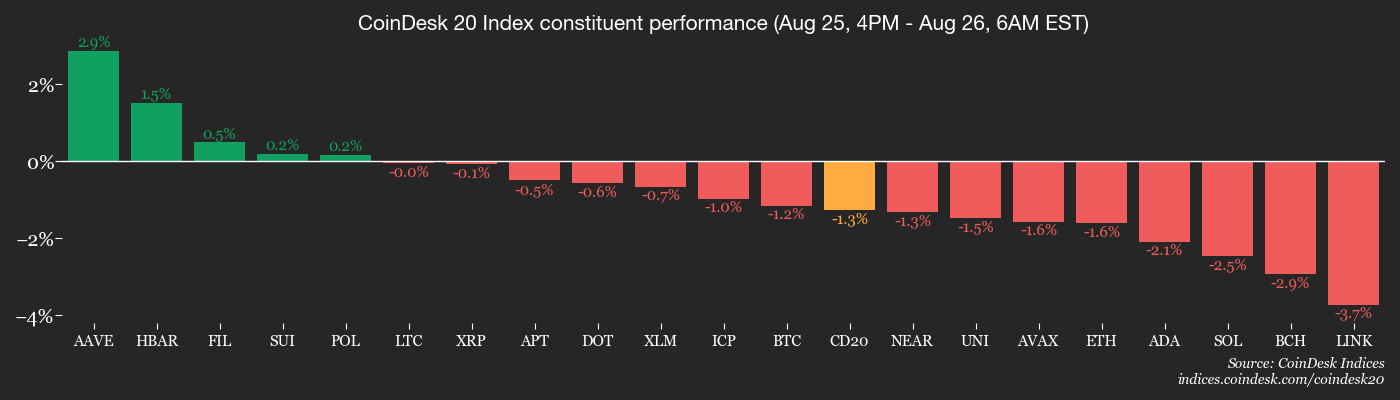

- CoinDesk 20 is up 1.45% at 4,003.25 (24hrs: -2.14%)

- Ether CESR Composite Staking Rate is up 12 bps at 2.95%

- BTC funding rate is at 0.0038% (4.1194% annualized) on Binance

- DXY is down 0.11% at 98.32

- Gold futures are unchanged at $3,419.60

- Silver futures are down 0.36% at $38.56

- Nikkei 225 closed down 0.97% at 42,394.40

- Hang Seng closed down 1.18% at 25,524.92

- FTSE is down 0.61% at 9,264.86

- Euro Stoxx 50 is down 0.87% at 5,396.84

- DJIA closed on Monday down 0.77% at 45,282.47

- S&P 500 closed down 0.43% at 6,439.32

- Nasdaq Composite closed down 0.22% at 21,449.29

- S&P/TSX Composite closed down 0.58% at 28,169.94

- S&P 40 Latin America closed down 0.38% at 2,727.04

- U.S. 10-Year Treasury rate is up 2.5 bps at 4.30%

- E-mini S&P 500 futures are down 0.12% at 6,447.75

- E-mini Nasdaq-100 futures are down 0.13% at 23,468.75

- E-mini Dow Jones Industrial Average Index are down 0.13% at 45,293.00

Bitcoin Stats

- BTC Dominance: 58.6% (-0.33%)

- Ether-bitcoin ratio: 0.04007 (0.79%)

- Hashrate (seven-day moving average): 944 EH/s

- Hashprice (spot): $53.67

- Total fees: 2.85 BTC / $318,222

- CME Futures Open Interest: 137,315 BTC

- BTC priced in gold: 32.6 oz.

- BTC vs gold market cap: 9.27%

Technical Analysis

- BTC's recent breakdown of the ascending channel and a horizontal support line (right) looks quite similar to the bearish turnaround from $110,000 from early this year.

- The latest move could invite stronger selling pressure, potentially yielding a deeper pullback as seen in March and early April.

Crypto Equities

- Strategy (MSTR): closed on Monday at $343.2 (-4.17%), unchanged in pre-market

- Coinbase Global (COIN): closed at $306 (-4.33%), +0.49% at $307.49

- Circle (CRCL): closed at $125.24 (-7.26%), unchanged in pre-market

- Galaxy Digital (GLXY): closed at $24.55 (-3.99%), -0.45% at $24.44

- Bullish (BLSH): closed at $65.18 (-7.96%), -1.20% at $64.40

- MARA Holdings (MARA): closed at $15.4 (-5.46%), -0.32% at $15.35

- Riot Platforms (RIOT): closed at $13.28 (+0.45%), -1.28% at $13.11

- Core Scientific (CORZ): closed at $13.68 (+0.96%), -0.44% at $13.62

- CleanSpark (CLSK): closed at $9.45 (-3.77%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $28.61 (+1.13%), -0.63% at $28.43

- Semler Scientific (SMLR): closed at $30.02 (-4.49%)

- Exodus Movement (EXOD): closed at $26.26 (-3.92%), unchanged in pre-market

- SharpLink Gaming (SBET): closed at $19.17 (-8.15%), +0.78% at $19.32

ETF Flows

Spot BTC ETFs

- Daily net flows: $219.1 million

- Cumulative net flows: $54 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily net flows: $443.9 million

- Cumulative net flows: $12.89 billion

- Total ETH holdings ~6.34 million

Source: Farside Investors

Chart of the Day

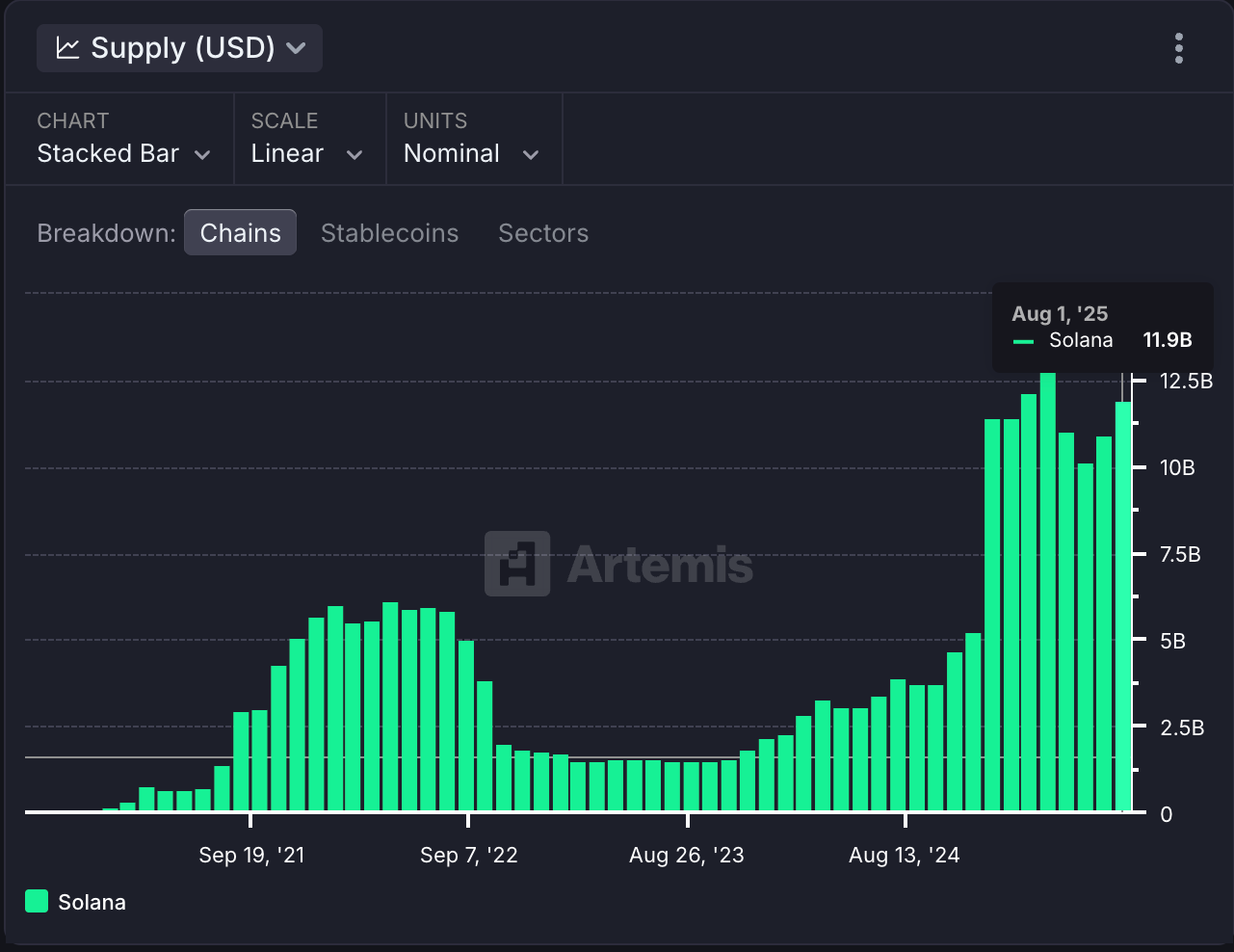

- The total stablecoin supply on the Solana blockchain has increased by $11.9 billion this month, the highest since April.

- However, the transaction volume has held low near $200 billion, having peaked at over $2 trillion in December.

- It shows that while stablecoin supplies continue to increase, the on-chain activity has cooled.

While You Were Sleeping

- Massive $14.6B Bitcoin and Ether Options Expiry Shows Bias for Bitcoin Protection (CoinDesk): On Deribit, Friday’s expiry shows traders piling into bitcoin puts around $110,000 for protection from declines, while ether positions look more evenly split between bullish and bearish bets.

- Bitcoin Suffers Technical Setback, Loses 100-Day Average as XRP, ETH and SOL Hold Ground (CoinDesk): Bitcoin faces a bearish outlook after losing key support, with XRP stuck in uncertainty, while ETH and SOL maintain stronger footing that could let them outperform BTC and XRP in risk-on conditions.

- Polymarket Bettors Doubt Trump Can Topple Jerome Powell or Lisa Cook This Year (CoinDesk): The decentralized crypto-based prediction market sees only a 10% chance of Powell exiting before his term ends in May 2026 and a 27% chance that Cook departs her post this year.

- ‘Powerful Optics’: China’s Xi To Welcome Putin, Modi in Grand Show of Solidarity (Reuters): Although the Shanghai Cooperation Organization has brought little economic cooperation, analysts say next week’s summit gives China a stage to parade Global South solidarity against the U.S. amid geopolitical uncertainty.

- Peter Thiel-Backed Crypto Exchange Bitpanda Rules Out U.K. Listing (Financial Times): Co-founder Eric Demuth said Bitpanda ruled out a London IPO, citing thin share liquidity on the LSE and the fact it earns more in mainland Europe than the U.K.

- Lisa Cook Says She Will Not Step Down From the Fed (The New York Times): Trump cited unproven mortgage-fraud allegations to justify firing the Fed governor. Her lawyer called the move unlawful and warned it could undermine the central bank’s independence.

In the Ether

![]()

![]()

![]()

![]()

![]()