Bitcoin’s Flash Crash Could Ignite Altcoin Season: Here’s Why

Bitcoin's sudden plunge sparks altcoin speculation frenzy

Market Rotation Signal

When Bitcoin stumbles, altcoins often sprint. Traders are betting that capital fleeing BTC's volatility will flood into smaller digital assets—just like previous cycles where altcoins outperformed after Bitcoin corrections.

Historical Precedent

Patterns don't lie. The 2017-2018 and 2020-2021 cycles both saw altcoins explode following Bitcoin's sharp pullbacks. This time, Ethereum, Solana, and other major alts are positioned to capture the momentum.

Traders Shift Strategies

Smart money rotates while traditional investors panic—another reminder that crypto markets move faster than your average hedge fund's decision-making committee. The altcoin pump typically follows within weeks, not months.

Seasonal Timing

August volatility often sets up September rallies. With institutional adoption growing and DeFi ecosystems expanding, the infrastructure for an altcoin surge is already in place. The pieces are lining up for what could be the next major crypto market rotation.

What to Watch

- Crypto

- Aug. 27, 3 a.m.: Mantle Network (MNT), an Ethereum layer-2 blockchain, will roll out its mainnet upgrade to version 1.3.1, enabling support for Ethereum’s Prague update and introducing new features for platform users and developers.

- Macro

- Aug. 25, 3 p.m.: The Central Bank of Paraguay releases July producer price inflation data.

- PPI YoY Prev. 4.8%

- Aug. 26, 8:30 a.m.: The U.S. Census Bureau releases July manufactured durable goods orders data.

- Durable Goods Orders MoM Est. -4% vs. Prev. -9.3%

- Durable Goods Orders Ex Defense MoM Prev. -9.4%

- Durable Goods Orders Ex Transportation MoM Est. 0.1% vs. Prev. 0.2%

- Aug. 26, 10 a.m.: The Conference Board (CB) releases August U.S. consumer confidence data.

- CB Consumer Confidence Est. 98 vs. Prev. 97.2

- Aug. 27: The U.S. will impose an additional 25% tariff on Indian imports related to Russian oil purchases, effectively raising total tariffs on many goods to approximately 50%.

- Aug. 25, 3 p.m.: The Central Bank of Paraguay releases July producer price inflation data.

- Earnings (Estimates based on FactSet data)

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

- Aug. 28: IREN (IREN), post-market, $0.18

Token Events

- Governance votes & calls

- dYdx (DYDX) is voting on whether to approve a whitelist update to the VIP Affiliate Program. Voting closes on Aug. 25.

- Aug. 25: Supra (SURPA) to host community call at 08:00.

- Unlocks

- Aug. 25: Venom (VENOM) to unlock 2.34% of its circulating supply worth $9.45 million.

- Aug. 28: Jupiter (JUP) to unlock 1.78% of its circulating supply worth $26.36 million.

- Sep. 1: Sui (SUI) to release 1.25% of its circulating supply worth $153.1 million.

- Token Launches

- Aug. 25: Kek (KEK) to list on Poloniex.

- Aug. 25: DNA (DNA) to list on BitMart.

- Aug. 25: Cudis (CUDIS) to list on Gate.io.

- Aug. 26: Centrifuge (CFG) to list on Bybit.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Aug. 25-26: WebX 2025 (Tokyo)

- Aug. 27: Blockchain Leaders Summit 2025 (Tokyo)

- Aug. 27-28: Stablecoin Conference 2025 (Mexico City)

- Aug. 28-29: Bitcoin Asia 2025 (Hong Kong)

Token Talk

By Shaurya Malwa

- Hyperliquid hit a new 24-hour spot volume ATH of $3.4B, powered by surging BTC and ETH deposits and trading via Hyperunit.

- This spike positioned Hyperliquid as the second-largest venue for spot BTC trading, across both centralized and decentralized platforms, with $1.5B in BTC volume alone.

- Such volume milestones improve Hyperliquid’s appeal by proving its ability to handle institutional-scale order flow.

- The platform’s architecture — built on HyperCore (Layer‑1 with HyperBFT consensus) and HyperEVM — delivers sub-second finality, high throughput, and EVM compatibility, making it highly attractive to both high-frequency traders and DeFi builders.

- Its growing volume, especially in BTC spot markets, strengthens Hyperliquid’s value proposition as a liquidity layer in DeFi, reinforcing its “AWS of liquidity” thesis driven by performance and infrastructure depth.

- Spot growth complements its perpetuals dominance—where the platform already captures 60–70% of DEX market share, delivering more on-chain revenue than even Ethereum.

- High spot volume translates into real benefits for HYPE holders — its token benefits from regular buybacks funded by trading fee flows via its Assistance Fund, tying platform usage directly to long-term token value.

Derivatives Positioning

- BTC and HYPE's global futures open interest have increased by 1% and 3%, respectively, in the past 24 hours, bucking the broader trend of outflows observed in other top 10 tokens.

- Cumulative open interest in USD and USDT-denominated perpetual futures across leading exchanges such as Binance, Bybit, OKX, Deribit, and Hyperliquid remained flat on Friday despite the price rally. However, since then, open interest has risen from approximately 260,000 contracts to 282,000, indicating a “sell on rally” sentiment among traders. (check chart of the day section).

- The opposite is the case in the ether market, where the OI ticked higher during Friday's rally and has retreated with the price pullback. This pattern suggests a temporary pause in bullish momentum rather than the establishment of new short positions, indicating a bullish breather rather than a shift toward bearish sentiment.

- Speaking of funding rates, except for ADA, most tokens see positive rates, indicating a net bias for bullish long positions.

- Altcoin futures OI exploded by more than $9.2 billion in a single day on Friday, pushing the combined total tally to a new high of $61.7 billion. "Such rapid inflows highlight how altcoins are increasingly driving leverage, volatility, and fragility across digital asset markets," Glassnode said.

- On the CME, open interest in ether options hit a notional record high of over $1 billion on Friday. This follows a record number of large holders in the futures market early this month. Ether futures OI hit a new high above 2 million ETH.

- Notional open interest in BTC options rose to $4.85 billion, the highest since April, as futures activity remained subdued.

- On Deribit, BTC options continued to show a bias for puts out to the December expiry, contradicting the post-Powell bullish sentiment in the market. In ether's case, calls traded at a slight premium.

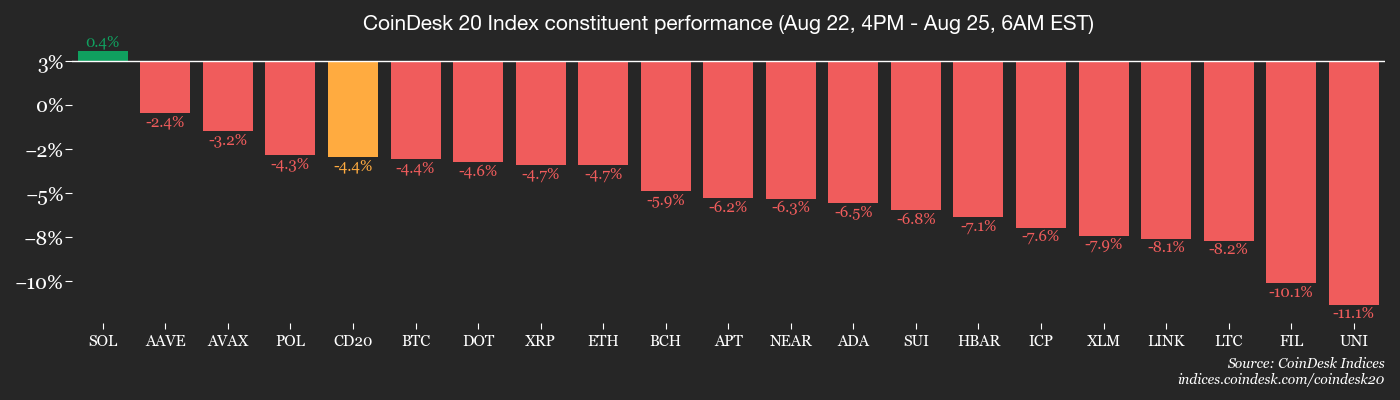

Market Movements

- BTC is down 4.45% from 4 p.m. ET Friday at $111,825.43 (24hrs: -2.63%)

- ETH is down 4.84% at $4,612.09 (24hrs: -2.89%)

- CoinDesk 20 is down 4.23% at 4,125.81 (24hrs: -2.93%)

- Ether CESR Composite Staking Rate is down 14 bps at 2.83%

- BTC funding rate is at 0.0096% (10.5525% annualized) on Binance

- DXY is up 0.19% at 97.90

- Gold futures are down 0.28% at $3,408.80

- Silver futures are down 0.88% at $38.71

- Nikkei 225 closed up 0.41% at 42,807.82

- Hang Seng closed up 1.94% at 25,829.91

- FTSE is up 0.13% at 9,321.40

- Euro Stoxx 50 is down 0.49% at 5,461.49

- DJIA closed on Friday up 1.89% at 45,631.74

- S&P 500 closed up 1.52% at 6,466.91

- Nasdaq Composite closed up 1.88% at 21,496.54

- S&P/TSX Composite closed up 0.99% at 28,333.13

- S&P 40 Latin America closed up 2.87% at 2,737.36

- U.S. 10-Year Treasury rate is up 1.1 bps at 4.269%

- E-mini S&P 500 futures are down 0.23% at 6,468.50

- E-mini Nasdaq-100 futures are down 0.32% at 23,495.25

- E-mini Dow Jones Industrial Average Index down 0.21% at 45,619.00

Bitcoin Stats

- BTC Dominance: 58.21% (+0.45%)

- Ether-bitcoin ratio: 0.04123 (-2.07%)

- Hashrate (seven-day moving average): 954 EH/s

- Hashprice (spot): $54.38

- Total fees: 3.478 BTC / $387,601

- CME Futures Open Interest: 1453,320 BTC

- BTC priced in gold: 33.1 oz.

- BTC vs gold market cap: 9.36%

Technical Analysis

- XRP currently trades within the Ichimoku cloud, suggesting uncertainty.

- A drop below the lower end of the cloud would signal a continuation of the broader downtrend.

- XRP peaked at $3.65 last month with a tweezer top bearish candlestick pattern.

Crypto Equities

- Strategy (MSTR): closed on Friday at $358.13 (+6.09%), -3.76% at $344.65 in pre-market

- Coinbase Global (COIN): closed at $319.85 (+6.52%), -2.47% at $311.96

- Circle (CRCL): closed at $135.04 (+2.46%), +0.19% at $135.30

- Galaxy Digital (GLXY): closed at $25.57 (+7.03%), -4.5% at $24.42

- Bullish (BLSH): closed at $70.82 (+1.46%), -4.08% at $67.93

- MARA Holdings (MARA): closed at $16.29 (+5.03%), -4.05% at $15.63

- Riot Platforms (RIOT): closed at $13.22 (+7.74%), -3.48% at $12.76

- Core Scientific (CORZ): closed at $13.55 (-1.74%), -0.52% at $13.48

- CleanSpark (CLSK): closed at $9.82 (+5.25%), -3.56% at $9.47

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $28.29 (+5.25%)

- Semler Scientific (SMLR): closed at $31.43 (+4.42%), -2.16% at $30.75

- Exodus Movement (EXOD): closed at $27.33 (+4.51%)

- SharpLink Gaming (SBET): closed at $20.87 (+15.69%), -3.21% at $20.20

ETF Flows

Spot BTC ETFs

- Daily net flows: -$23.2 million

- Cumulative net flows: $53.8 billion

- Total BTC holdings ~1.29 million

Spot ETH ETFs

- Daily net flows: $337.7 million

- Cumulative net flows: $12.45 billion

- Total ETH holdings ~6.27 million

Source: Farside Investors

Chart of the Day

- Open interest in BTC perpetual futures listed on major exchanges has increased alongside a drop in prices since Saturday.

- A combination of rise in open interest alongside a drop in a price is said to confirm the downtrend.

While You Were Sleeping

- Bitcoin Reverses Powell Spike With a Flash Crash as Options Market Signals Jitters Ahead (CoinDesk): A whale’s $300 million bitcoin selloff briefly sent prices under $111,000, erasing Powell-fueled gains. Options data shows puts costing more than calls as traders brace for further downside.

- Philippine Congressman Proposes Bitcoin Reserve to Attack National Debt (CoinDesk): The bill requires the central bank to amass 10,000 BTC over five years, locked for two decades and usable only to reduce national debt, with sales capped at 10% every two years.

- Japan's Finance Minister Says Crypto Assets Can be Part of Diversified Portfolio (CoinDesk): Katsunobu Katō's remark, made Monday while speaking at an event in Tokyo, comes amid concerns over Japan's high debt-to-GDP ratio and the potential for financial repression and yen depreciation.

- Why Bitcoin Treasury Companies Are a Fool’s Paradise (Financial Times): Although such firms offer advantages over holding bitcoin directly — especially in jurisdictions where regulatory obstacles prevent this — their leveraged strategy could backfire badly when the bull market ends.

- Dollar Basis Premium Hints at Weakening Appetite for Treasuries (Bloomberg): The dollar’s premium in FX derivatives markets has nearly disappeared for the first time in five years, with foreign investors now holding only a third of Treasuries versus around half in 2012.

- 5 Years On, China’s Property Crisis Has No End in Sight (The New York Times): Today's delisting of China Evergrande underscores the property sector’s unraveling, yet Beijing avoids a sweeping bailout, wary of repeating its 2015 debt-fueled rescue, even as prices sink, vacancies swell and smaller firms fail.

In the Ether

![]()

![]()

![]()

![]()

![]()

![]()