Bitcoin Flash Crash Erases Powell Gains as Options Market Flashes Red Ahead

Bitcoin just pulled a classic crypto move—skyrocketing on Fed chatter before imploding in a violent flash crash. Powell's comments sparked momentary euphoria, but the rally proved thinner than a trader's patience.

Options Markets Scream Caution

Behind the scenes, derivatives traders are betting big on turbulence. Put options are stacking up faster than excuses at a failed hedge fund. The smart money isn't buying the bounce—they're hedging for another leg down.

Volatility Isn't a Bug—It's a Feature

This isn't some glitch in the matrix. Bitcoin's 10% whipsaw fits perfectly into its chaotic DNA. Traders got Powell-drunk, forgot to check the charts, and now face the hangover. Meanwhile, institutional players keep stacking—because nothing says 'confidence' like buying the dip with leverage.

So here we are again: another day, another 20% swing. The only thing more predictable than Bitcoin's volatility? Wall Street fund managers still calling it a 'fraud' while secretly trading it on their phones.

Powel spike reversed

The price drop has erased gains seen after Friday, after the Fed Chair Jerome Powell appeared to support the idea of rate cuts, while playing down the long-term inflationary impact of President Trump's tariffs during his annual speech at Jackson Hole.

The so-called dovish speech saw BTC rally nearly 4% from $112,500 to $116,900 alongside a risk-on rally in U.S. stocks and the decline in the dollar index.

Over the weekend, the analyst community expressed confidence that a rate cut would occur in September, potentially leading to new all-time highs in Bitcoin and ether.

Options disagree

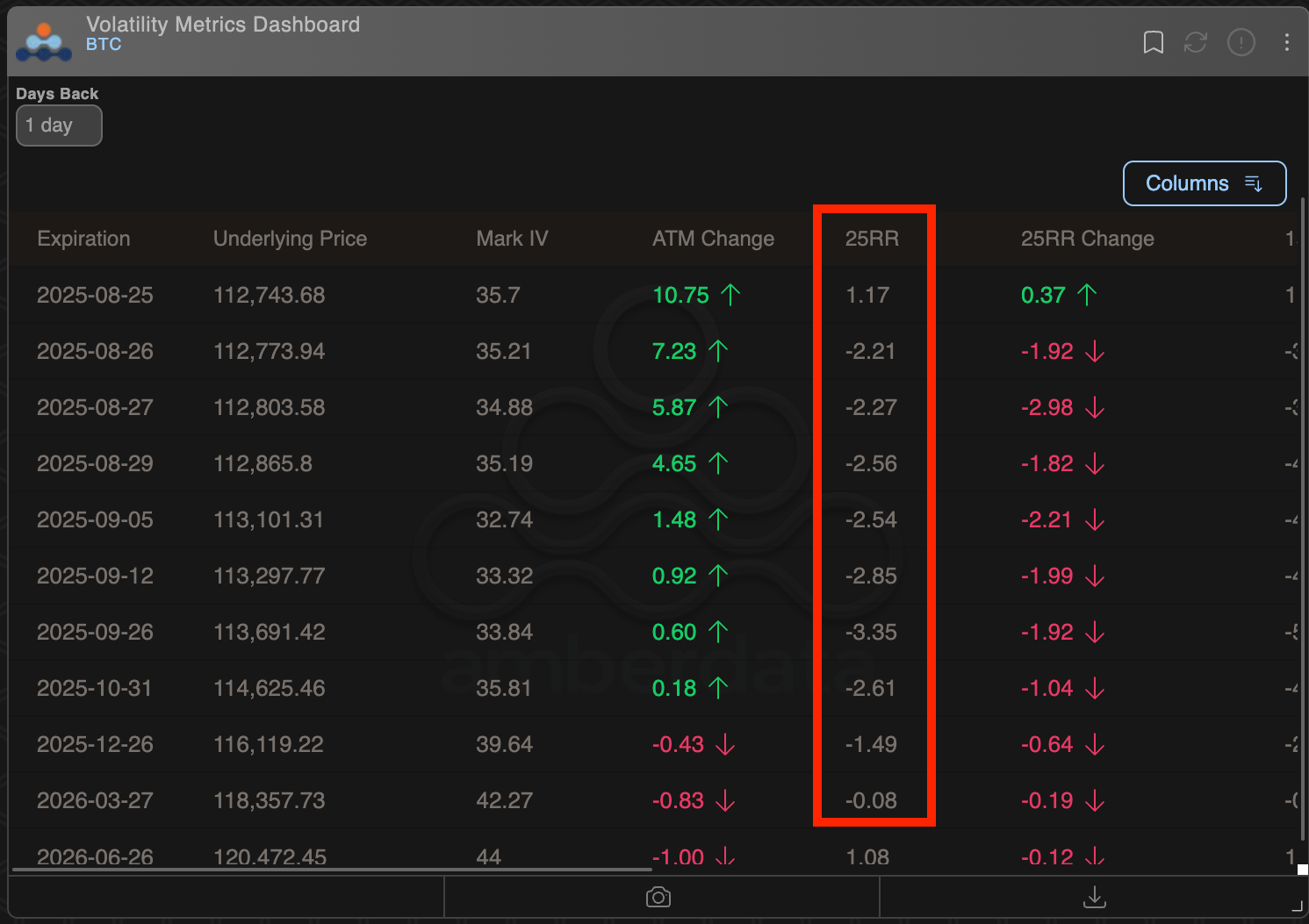

The Deribit-listed bitcoin options reveal a lingering risk aversion, according to data tracked by Amberdata.

Specifically, the 25-delta risk reversals, a measure of investor sentiment comparing calls to puts, continue to trade in the negative territory through the December expiry, reflecting hedging activity and a bearish title.

A negative risk reversal means that put options, which offer insurance against price declines, are more expensive than call options.

In other words, despite the so-called dovish pivot by Powell, BTC options traders continue to price in uncertainty, bracing for a potential downside volatility.