Wall Street Titans Brevan Howard, Goldman Sachs & Harvard Go All-In on Bitcoin ETFs—Billions Flood In

Institutional heavyweights just placed their biggest bet yet on crypto’s legitimacy—and it’s dripping with irony.

The Whale Movement

Brevan Howard’s hedge fund mavericks, Goldman’s blue-chip traders, and Harvard’s Ivy League endowment—yes, *that* Harvard—are leading a stampede into Bitcoin ETFs. No more sneering from marble lobbies; now they’re front-running the retail crowd.

The Punchline

Funny how ‘digital gold’ gets real when Wall Street’s fee machines smell a fresh revenue stream. Meanwhile, the same banks that once called Bitcoin a fraud are now quietly accumulating—because nothing converts skeptics like a 12-month bull run.

The Bottom Line

When suits and scholars alike bet billions, the message is clear: crypto’s casino phase is over. The house always wins—but this time, the house is *you*.

Harvard, Wells Fargo and more

Other major IBIT investors include Harvard University, which reported a $1.9 billion stake in the ETF, and Abu Dhabi’s Mubadala Investment Company, which continues to hold $681 million.

In terms of U.S. banks, Wells Fargo nearly quadrupled its holdings of IBIT to $160 million, up from $26 million in the previous quarter, while maintaining a $200,000 stake in the Grayscale Bitcoin Fund (GBTC).

Cantor Fitzgerald also boosted its holdings to over $250 million while also increasing stakes in crypto-related stocks, including Strategy (MSTR), Coinbase (COIN) and Robinhood (HOOD), among others.

Trading firm Jane Street revealed holding a $1.46 billion stake in IBIT, which represents the largest single position in its portfolio after Tesla (TSLA) at $1.41 billion. It increased its stake in MSTR while reducing its holdings of FBTC.

Spot bitcoin ETFs like IBIT, which launched in January, allow investors to gain exposure to bitcoin’s price without directly holding the cryptocurrency. That structure offers traditional institutions an avenue to participate in the crypto market through familiar brokerage accounts and custodial arrangements.

Norway buys more

For some overseas entities, gaining exposure to bitcoin is easier through U.S.-listed companies that hold large amounts of BTC on their balance sheets.

That’s the approach being taken by Norway’s sovereign wealth fund, along with several other European state-backed investors, which are opting for equity stakes in crypto-adjacent firms rather than holding the crypto directly.

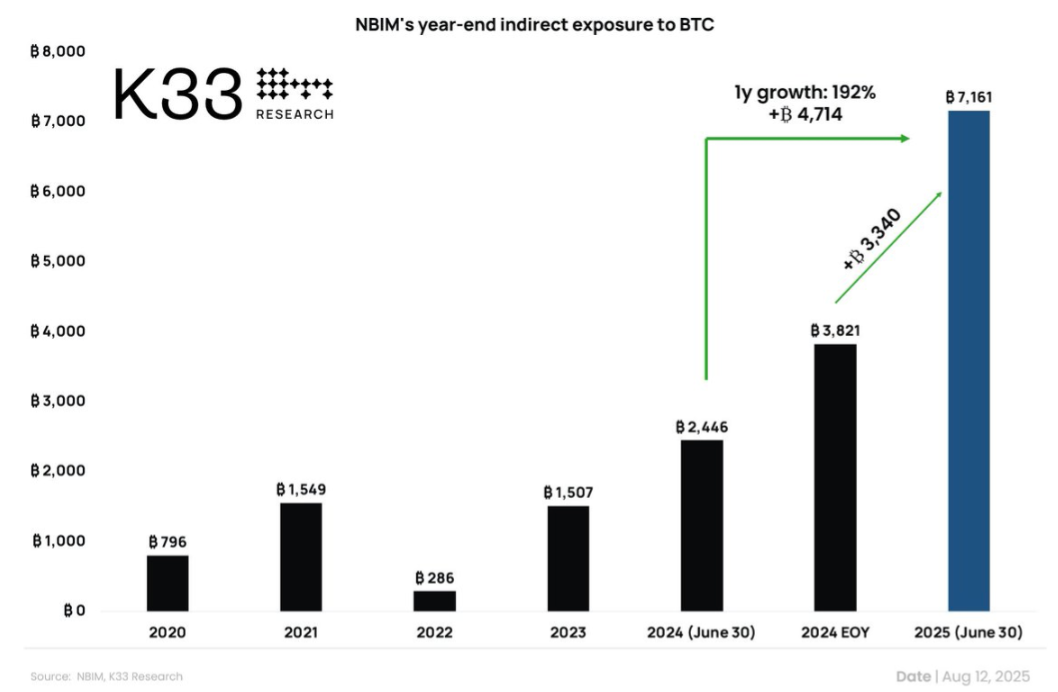

Norges Bank Investment Management (NBIM), the investment arm of the Norwegian central bank and the entity that manages the country’s $2 trillion pension fund, now indirectly holds 7,161 BTC, according to a new note from K33 Research. That figure is up 192% from 2,446 BTC a year ago, and up 87% from the 3,821 BTC it held at the end of 2024.

The largest portion of its exposure — 3,005 BTC — comes through shares in Strategy. The rest is spread across companies like Marathon Digital, Coinbase, Block, and Metaplanet. K33 also counted GME (GameStop) and several smaller holdings as contributing to the total.

Still, the exposure remains tiny in context. Norway’s fund owns stakes in thousands of companies across global markets, and the value of its bitcoin-linked investments is a fraction of its total holdings. At a current market price of $117,502 per BTC, the fund’s 7,161 BTC is worth around $841 million — or less than 0.05% of the $2 trillion portfolio.

The sharp increase over the past year may signal growing institutional comfort with the asset class, but it doesn’t represent a major strategic shift—yet.