$1B Leverage Wiped Out in Crypto Shakeout—But Traders Call It a ‘Healthy Detox’

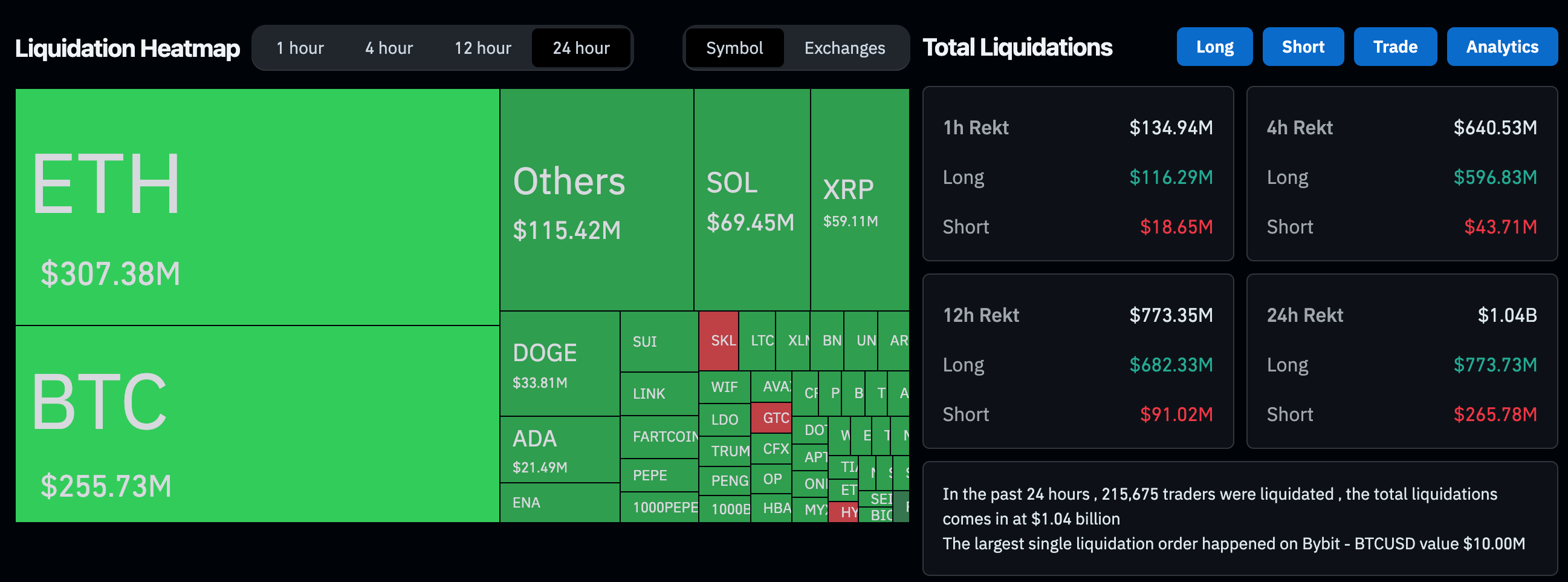

Crypto just took a cold shower—and $1 billion in overleveraged positions got flushed down the drain. Markets bled overnight as Bitcoin sliced through key support levels, triggering a cascade of liquidations.

Why this isn’t doom-and-gloom: Veteran traders see the pullback as necessary market hygiene. ‘Leverage resets like this prevent bigger crashes later,’ says one analyst, noting open interest needed a haircut after weeks of frothy speculation.

The silver lining: Spot buyers are already stepping in, with exchange reserves hitting 3-month lows as coins move to cold storage. Even Wall Street’s crypto-curious are calling this a ‘buyable dip’—though their last ‘can’t-miss opportunity’ was a 40% drop ago.

One thing’s certain: the market’s flushing weak hands before the next leg up. Just don’t tell that to the hedge fund intern who just liquidated his Lambo downpayment.

That's the largest long liquidation since at least the late July-early August plunge. That time, BTC dipped below $112,000 and many altcoins saw double-digit pullbacks, eventually carving out the local bottom for most of the digital asset market.

"The 'I guess opening a 50x long after a 7-day 50% MOVE was not the best idea' type of shakeout here," well-followed trader Bob Loukas said in an X post.