Stablecoins to Dominate: $1T Annual Payments by 2030, Says Keyrock

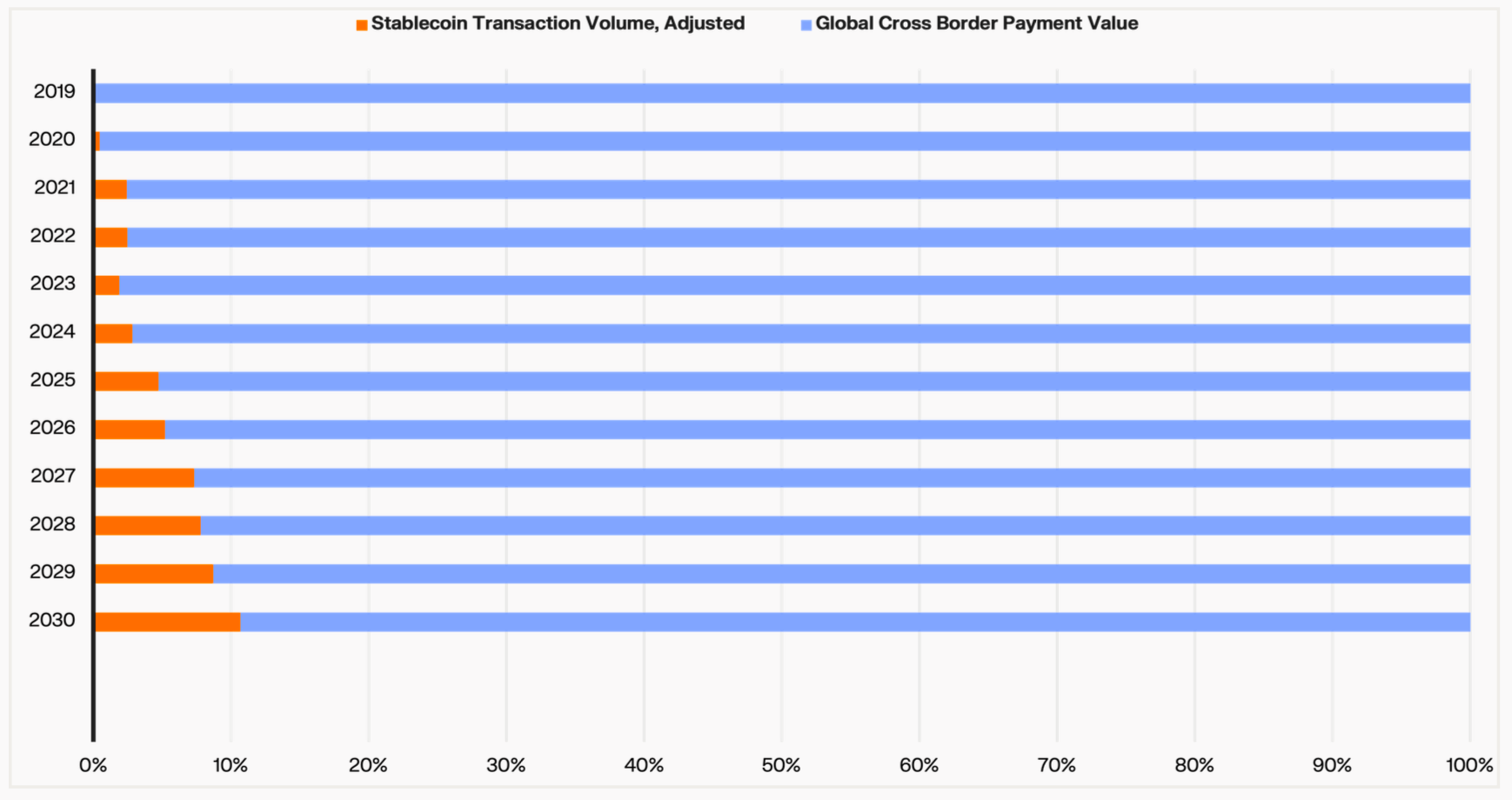

Stablecoins aren’t just surviving—they’re on track to eat traditional finance’s lunch. Market maker Keyrock projects these crypto-backed tokens will process over $1 trillion in annual payments by 2030.

Why the surge? Blame banks for being slow and expensive—or credit crypto for being fast and borderless. Stablecoins now handle everything from remittances to corporate treasury ops, dodging legacy bottlenecks like a VPN bypassing censorship.

Wall Street’s response? A mix of FOMO and regulatory tantrums. (Funny how ‘innovation’ only counts when it pads their balance sheets.)

One thing’s clear: money’s future won’t wait for permission. The trillion-dollar question? Who’ll control the pipes—decentralized networks or the same old gatekeepers.

Given the opportunities, the authors forecasted that every major fintech firms will eventually integrate stablecoin infrastructure over the few next years, just as software-as-a-service (SaaS) tools became ubiquitous.

In practice, that could mean wallets and payment platforms moving value on-chain, treasury desks holding stablecoins and deploying for a yield and merchants settling instantly in multiple currencies.

The rapid growth of stablecoins, which have a market cap of $260 billion, could also have Ripple effects on monetary policy. Stablecoin supply could reach 10% of the U.S. M2 money supply in a bull case, up from 1% today, and represent roughly a quarter of the U.S. Treasury bill market and influence how the Federal Reserve manages short-term interest rates.