Corporate America Dumps Recession Panic—Even as Tariffs Hit 1910-Level Highs

Wall Street’s fear gauge is flatlining—and no, it’s not just the Fed’s liquidity injections this time.

Defying Gravity (and Tariffs)

CEOs are shrugging off the highest average tariff rate in 115 years like it’s a minor supply chain hiccup. Either that, or they’ve all got secret crypto hedges the SEC hasn’t uncovered yet.

The Bull Case (With Asterisks)

Costco-sized optimism is creeping back into earnings calls, even as customs paperwork piles up. Pro tip: When CFOs start name-dropping ‘resilience’ more than ‘recession,’ grab your trading algo’s off switch.

Bottom Line

The market’s pricing in a soft landing so perfect it belongs in a private equity firm’s pitch deck. Just don’t ask what happens when the ‘transitory’ tariffs meet ‘persistent’ inflation—some truths are too ugly for even Bloomberg terminals to display.

Trump recently unveiled sweeping tariffs in addition to those announced in April in a MOVE aimed at sparking a manufacturing boom. That has lifted the average U.S. tariff rate to 20.1%, the highest sustained level since the 1910s, according to estimates released by the World Trade Organization and the International Monetary Fund.

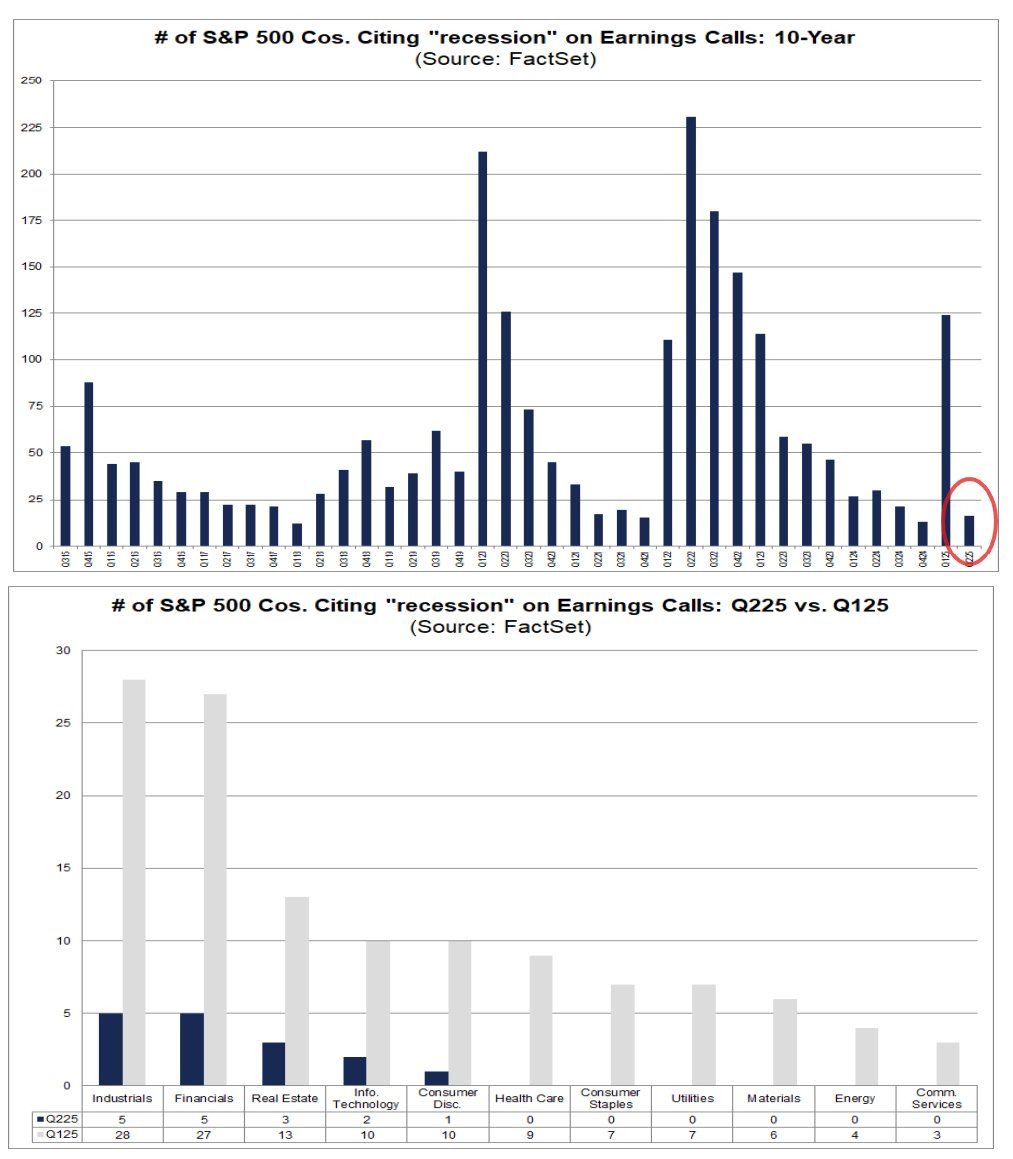

Markets, too, have largely looked past tariff-induced recession fears, with the S&P 500 rising 28% since the early April dip. Bitcoin, the leading cryptocurrency by market value, has risen to $122,000 from roughly $75,000, a 62% surge in four months, CoinDesk data show.

According to JPMorgan, traders have been focusing on resilient corporate earnings and the expected economic recovery following the interim slowdown.

More than 80% of S&P 500 companies have recently reported their second-quarter earnings, with over 80% beating earnings expectations and 79% surpassing revenue forecasts. That's the strongest performance in four years.