XRP Rockets 12% as Traders Deploy High-Stakes ’Straddle’ Plays for Volatility Windfall

XRP just ripped past resistance with a 12% surge—and traders are piling into complex options strategies to bet on even bigger moves ahead.

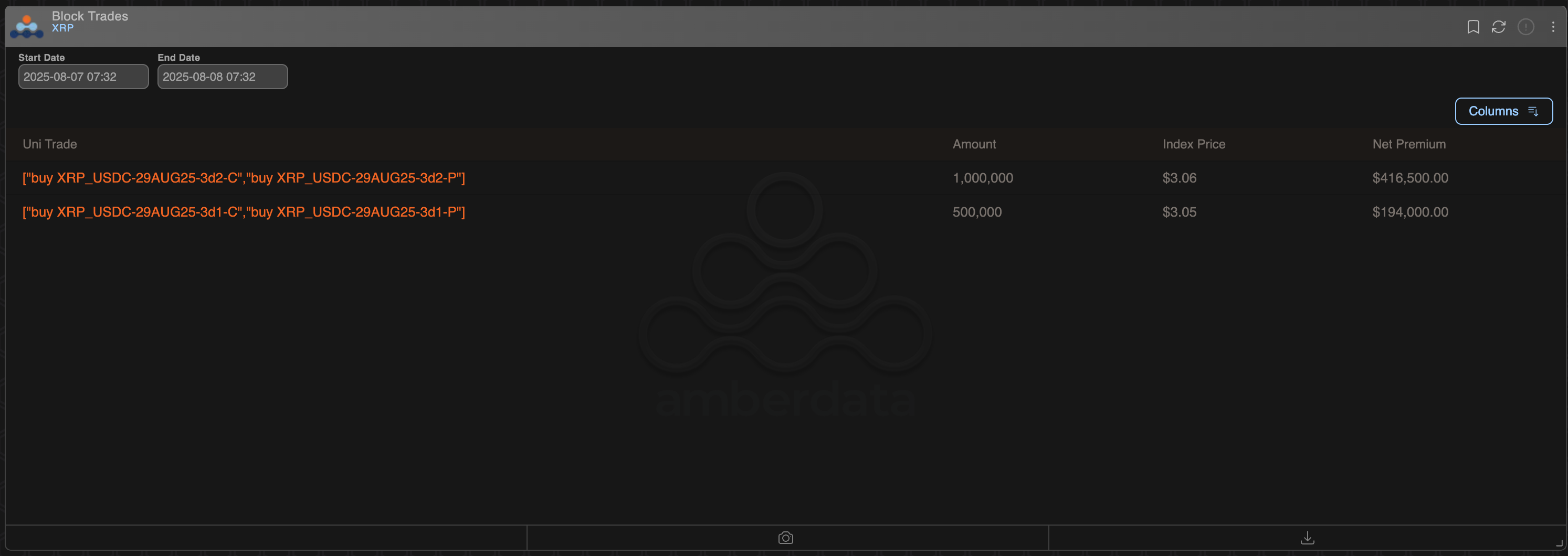

Straddles in play: Savvy whales are buying both calls and puts, banking on explosive volatility regardless of direction. When the crypto market gets this jumpy, somebody’s about to get very rich… or very rekt.

Institutional FOMO? The sudden rally comes amid whispers of fresh institutional interest (or maybe just another round of speculative hot potato). Either way, derivatives markets are pricing in fireworks.

Remember kids: In crypto, ‘strategies’ are often just gambling with extra steps. But when the music stops this time, at least the options traders will have paperwork to cry over.

Traders use straddles when anticipating a major volatility event – such as a big earnings report, a key court ruling, or a significant product launch – but are uncertain whether the impact WOULD be bullish or bearish. The risk-reward profile of a long straddle is defined by unlimited profit potential and limited risk.

Coincidentally, on Thursday, the Securities Exchange Commission and Ripple jointly agreed to drop their appeals in the Second Circuit court case, bringing to an end to a prolonged legal tussle. Ripple uses XRP in faciliating cross-border transactions.

Limited loss, unlimited gain strategy

The maximum loss in long straddles is capped at the total premium paid for both the call and the put.

The maximum profit, however, is unlimited as the price can theoretically MOVE up or down indefinitely. To break even, the price must move in either direction by an amount equal to the total premium paid.

Options are derivative contracts designed to protect traders from bullish or bearish volatility. A call option provides cover against uptrends in the underlying asset, while a put option offers insurance against market swoons.