Brace for Impact: Bitcoin’s August Volatility Surge Looms as VIX Seasonality Flashes Bullish Signals

Strap in, crypto traders—Bitcoin's price is about to get wilder than a Wall Street analyst's price target guesses.

The VIX's historical August behavior suggests we're in for a rollercoaster month. Forget sideways action—this is when BTC either makes heroes or bagholders.

Why August eats volatility for breakfast

Seasonal patterns don't lie. When traditional markets twitch, crypto convulses—and the VIX is the canary in this coal mine. No crystal balls needed when history keeps repeating.

How to trade the coming storm

Leverage? Only if you enjoy donating to the exchange's insurance fund. Smart money's watching liquidity levels like hawks while retail FOMO merchants prepare to be liquidated—again.

Remember: In crypto, 'bullish volatility' is just polite code for 'your stop-loss is about to get hunted.' Happy trading, and may the spreads be ever in your favor (they won't be).

History repeating itself?

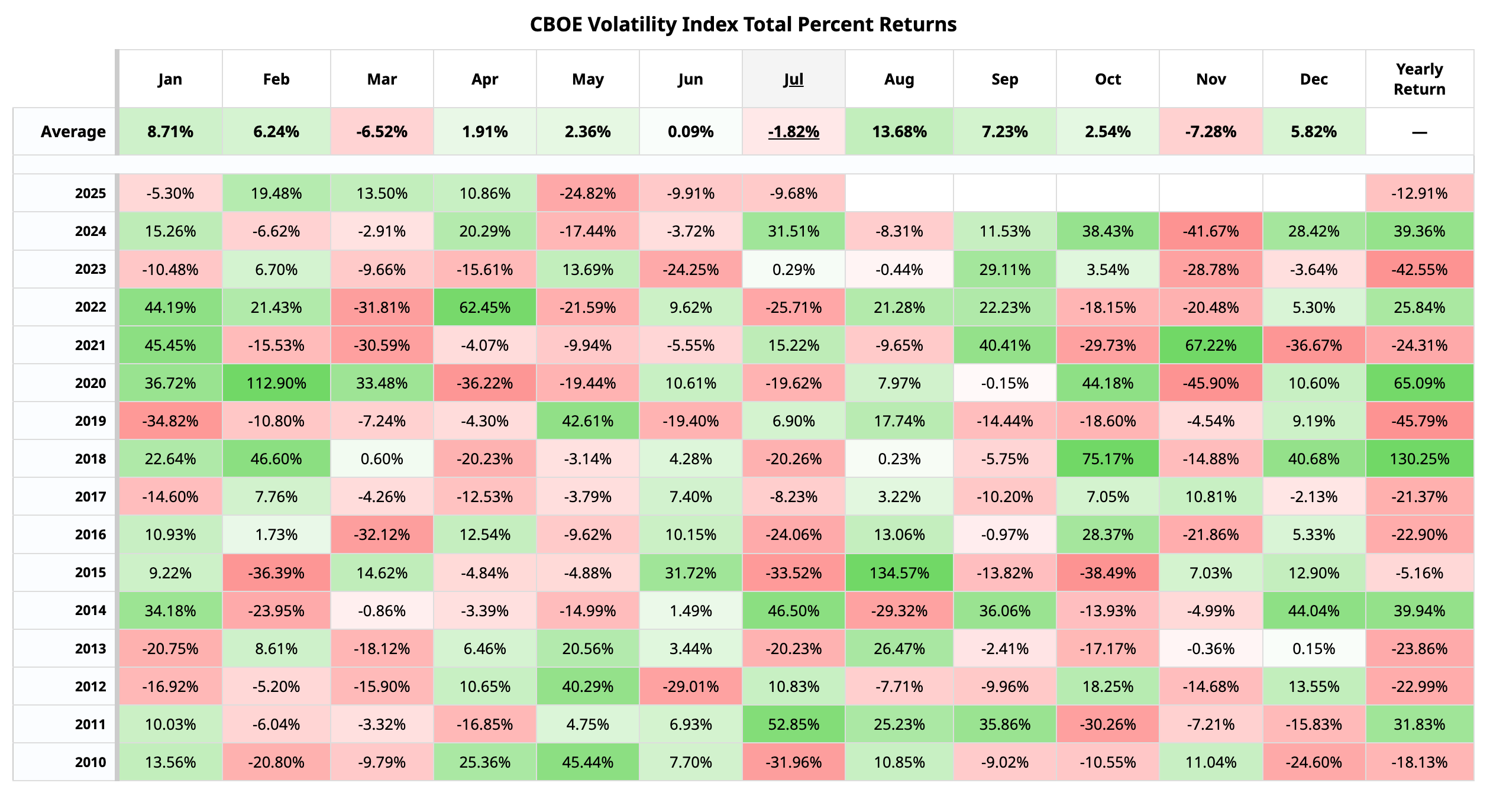

The VIX fell for a third straight month in July, extending the slide from April highs. It hit a five-month low of 14.92 on Friday, according to data source TradingView.

If history is a guide, this decline is likely setting the stage for the August boom in volatility and risk aversion on Wall Street. The VIX, which has been nicknamed the Fear Gauge, spikes higher when stock prices decline and falls when they rise.

In other words, the expected volatility boom on Wall Street could be marked by a stock market swoon, which could spill over into the Bitcoin market.

Bitcoin tends to track the sentiment on Wall Street, especially in the technology stocks, fairly closely. BTC's implied volatility indices have developed a strong positive correlation with the VIX, signaling a steady evolution into VIX-like fear gauges. Since November, BTC's 30-day implied volatility indices have declined sharply, ending the positive correlation with the spot price.