Fartcoin Rockets Into Top 10 by Derivatives Open Interest—Solana Memecoin Mania Hits Fever Pitch

Move over, blue chips—there’s a new speculative darling in crypto town. Fartcoin, the Solana-based memecoin that started as a joke, just bulldozed its way into the top 10 by derivatives open interest. Traders are piling in like it’s 2021 all over again.

### When Memecoins Become Derivatives Darlings

No roadmap, no utility, just pure degenerate momentum. Open interest data shows traders are betting big on Fartcoin’s volatility—whether they understand what they’re buying or not. The Solana ecosystem’s low fees and high-speed trading are fueling the fire, turning what should be a cautionary tale into a self-fulfilling prophecy.

### The Institutional Elephant in the Room

While ‘serious’ investors dismiss this as noise, the numbers don’t lie: Fartcoin’s derivatives volume now rivals mid-cap altcoins with actual use cases. Somewhere, a hedge fund manager is quietly allocating 0.1% of their portfolio ‘for research purposes’ while lecturing about market maturity.

Memecoins: the asset class that keeps proving Wall Street’s ‘greater fool theory’ works—until the music stops.

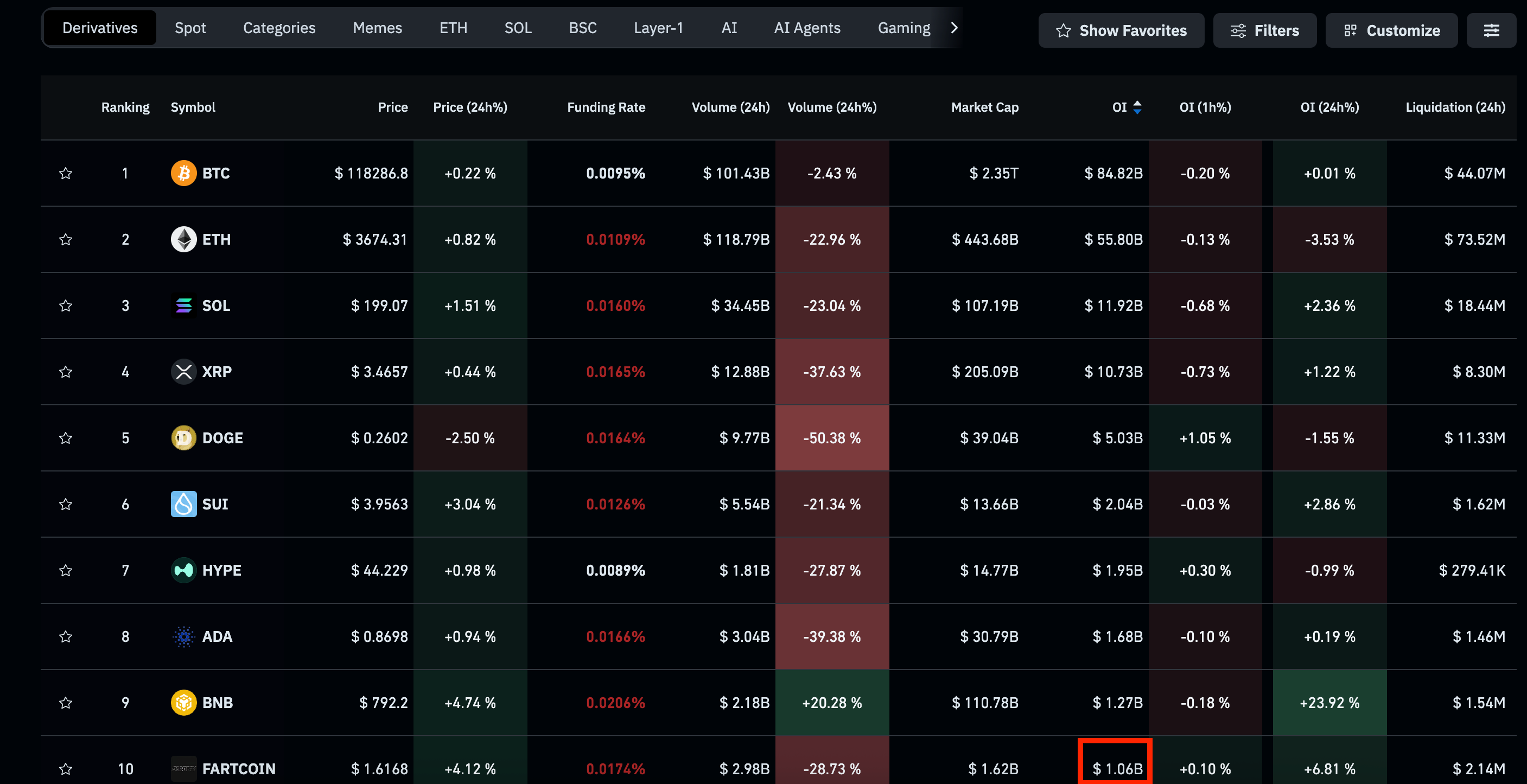

What's more alarming is that fartcoin's open interest now equals 65% of its market capitalization of $1.62 billion. By market value, FARTCOIN ranks 83rd in the world. Meanwhile, the $84.7 billion open interest in bitcoin derivatives amounts to just 3.5% of the leading cryptocurrency's market value of $2.36 trillion.

Fartcoin's unusually high open interest relative to its market cap indicates a buildup of speculative excesses typically seen during the crypto market bull runs, which drives retail investors to take significant risks in cheaper tokens.

A similar trend is seen in other smaller coins, according to data tracked by Alphractal.

"From the Top 300 down, Open Interest becomes disproportionately high compared to Market Cap — a strong risk signal. What does this mean? These altcoins will eventually liquidate 90% of traders, whether they’re long or short. They are also much harder to analyze with consistency," founder and CEO of Alphractal, noted on X.