Why Your Crypto Portfolio Allocation Is Wrong—And How to Fix It in 2025

Crypto isn't just surviving—it's thriving. Yet most investors still treat it like a speculative side bet. Here's why that needs to change.

The 5% Fallacy

Traditional finance types love capping crypto at 5% of portfolios. Meanwhile, Bitcoin's eaten 60% of gold's market share since 2020—and decentralized finance protocols now clear $100B in TVL. That's not fringe activity; it's mainstream adoption wearing a trench coat.

Rebalancing for Reality

Portfolios anchored to 20th-century asset classes ignore the 800-pound algorithmic gorilla. Ethereum processes more settlement value than Visa. Stablecoins move more dollars than PayPal. The 'correct' allocation isn't a rounding error—it's a strategic position.

The Institutional Double Standard

Funny how BlackRock's crypto ETF push gets called 'diversification' while retail investors get lectured about 'gambling.' Maybe those warnings would hold weight if Wall Street wasn't quietly building exposure through the back door.

Adapt or watch your returns get left in the blockchain dust. The smart money already has.

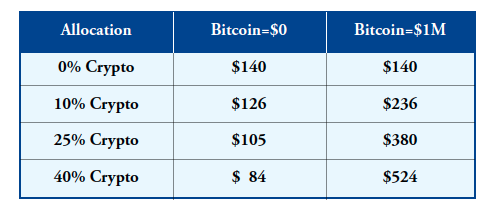

Bitcoin’s price appreciation isn’t speculation – it’s just supply and demand. In Q1 2025, public companies purchased 95,000 bitcoins – more than double the new supply. And that’s from just one category of buyers – it ignores additional demand from retail investors, financial advisors, family offices, hedge funds, institutional investors and sovereign wealth funds. This massive imbalance between supply and demand is driving bitcoin’s price to all-time highs. I predict that bitcoin will reach $500,000 by 2030 – a 5x increase as of this writing.

The adoption curve has tremendous room to run – supporting the thesis that there is substantial upside yet to come in bitcoin’s price. Read the white paper for more.