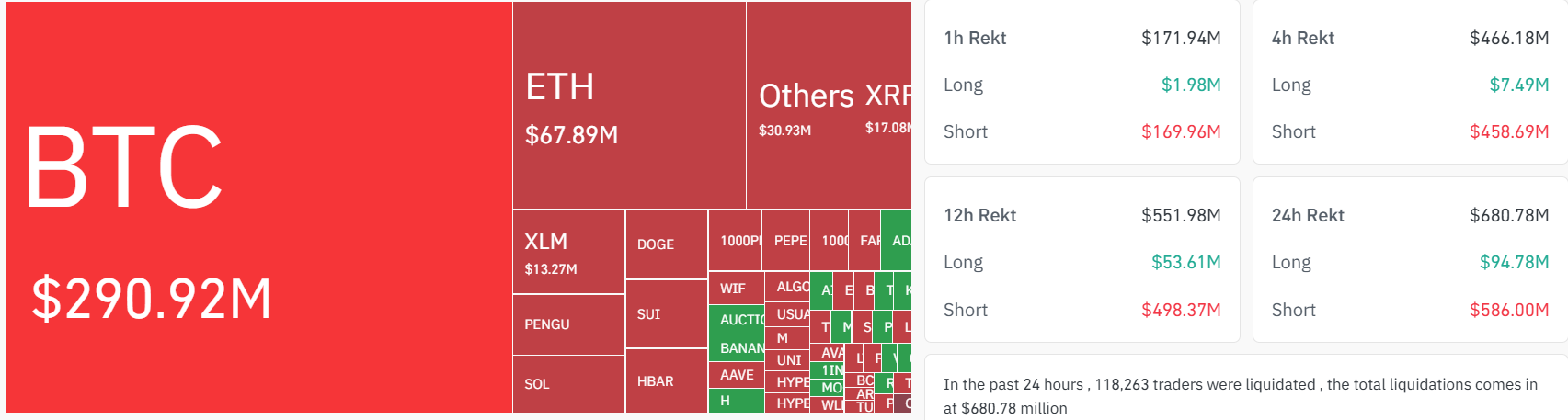

Bitcoin Bulls Crush Bears: $426M Short Squeeze Wipes Out Traders—Including One $92M Loser

Blood in the crypto water as Bitcoin's surge triggers mass liquidations.

Short sellers got steamrolled—again—as BTC's rally turned into a wrecking ball for leveraged positions. One unlucky (or overconfident) trader alone got hit with a $92M loss—proof that betting against crypto's resilience is still a dangerous game.

The $426M liquidation massacre shows what happens when the market flips from 'crypto winter' to 'raging bull' overnight. Exchanges happily collected their margin calls while skeptics scrambled—another reminder that in crypto, the house always wins (even when it's decentralized).

Funny how these 'smart money' traders keep shorting Bitcoin right before it moons. Almost like they enjoy donating to the diamond hands club.

Meanwhile, Dogecoin (DOGE), Solana's SOL (SOL), and SUI (SUI) saw rising open interest, though with relatively smaller drawdowns, indicative of higher spot-based demand.

Liquidations occur when traders using leverage are forced to close their positions due to margin calls. While they often signal excessive positioning, they also serve as a reset mechanism for markets, flushing weak hands and clearing the way for new directional flow.

Bitcoin’s rally in the past week has sparked a broader breakout across major crypto assets. Traders say that market structure is evolving under the weight of institutional influence — with eyes on the $130,000 mark in the short term.