Bitcoin & XRP Hold Steady at $110K and $2.3—While Ether Braces for Stormy Seas

Crypto markets cling to stability—or at least the illusion of it—as Bitcoin and XRP lock in at $110K and $2.3 respectively. Meanwhile, Ether’s price action looks ready to ride a rollercoaster.

The Anchors Hold (For Now)

Bitcoin’s $110K floor and XRP’s $2.3 support level suggest a rare moment of calm. Traders whisper about ‘institutional accumulation’—or maybe just hope masquerading as strategy.

Ether’s Looming Storm

Volatility isn’t just coming—it’s already priced in. ETH’s chart resembles a EKG after a double espresso, leaving swing traders sweating and degens salivating.

The Fine Print

Of course, ‘stability’ in crypto lasts about as long as a VC’s attention span. One macro tremor could send these levels crumbling faster than a yield-farming rug pull.

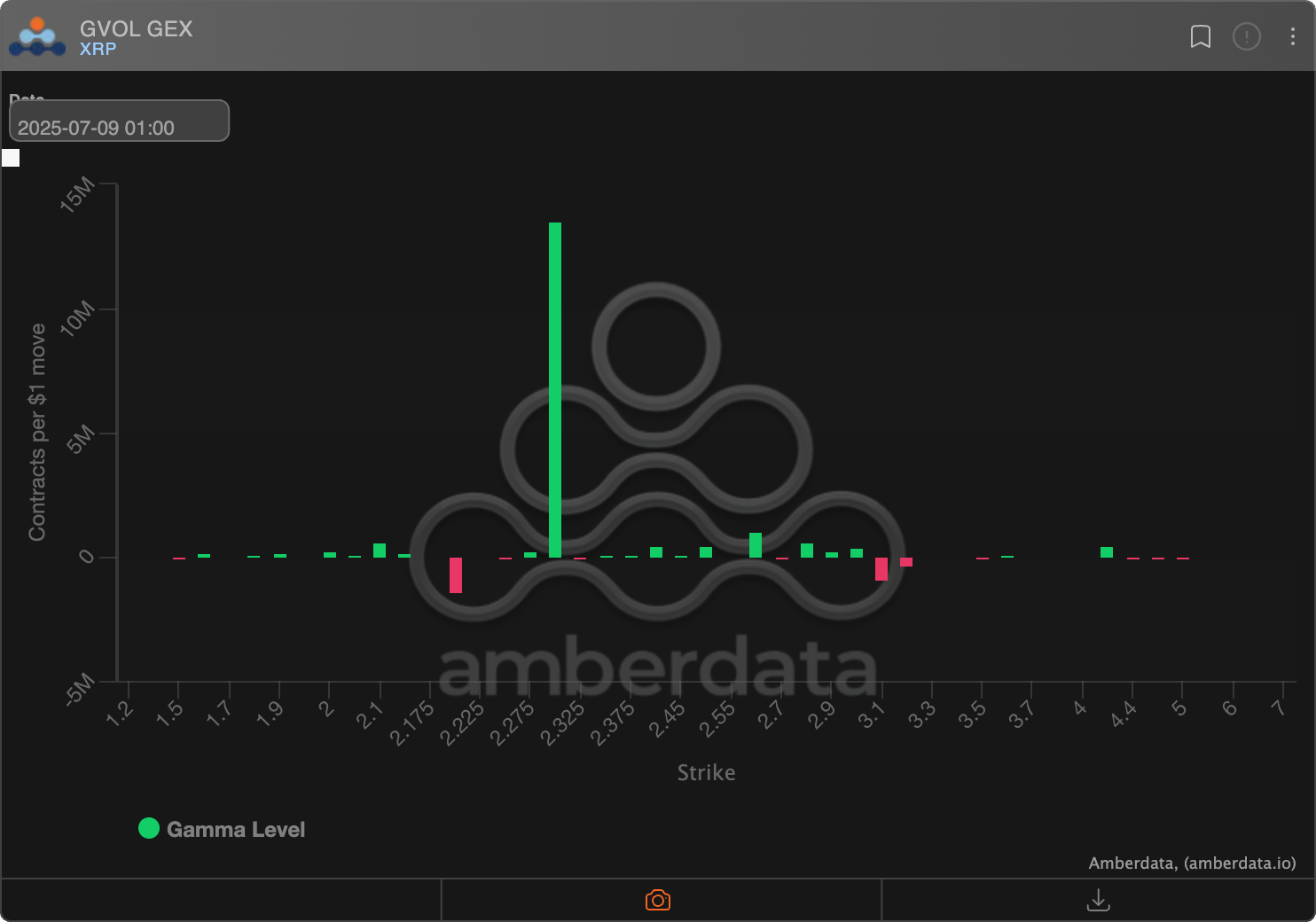

A similar dynamic seems to be playing out in the XRP market, where a large positive market Maker gamma build up is observed at the $2.30 strike price. That calls for maker makers to buy low and sell high around that level capping volatility.

Ether prone to volatility

Ethereum's native token ether, the second-largest cryptocurrency by market value, hit a high of $2,647 early today, the level last seen on June 16.

The MOVE has pushed ether into a "negative market maker gamma" zone of $2,650-$3,500. When dealers hold negative gamma, they tend to trade in the direction of the market, exacerbating bullish/bearish moves.

In other words, their hedging activities could add to ether's bullish momentum, exacerbating volatility, assuming other things being equal.