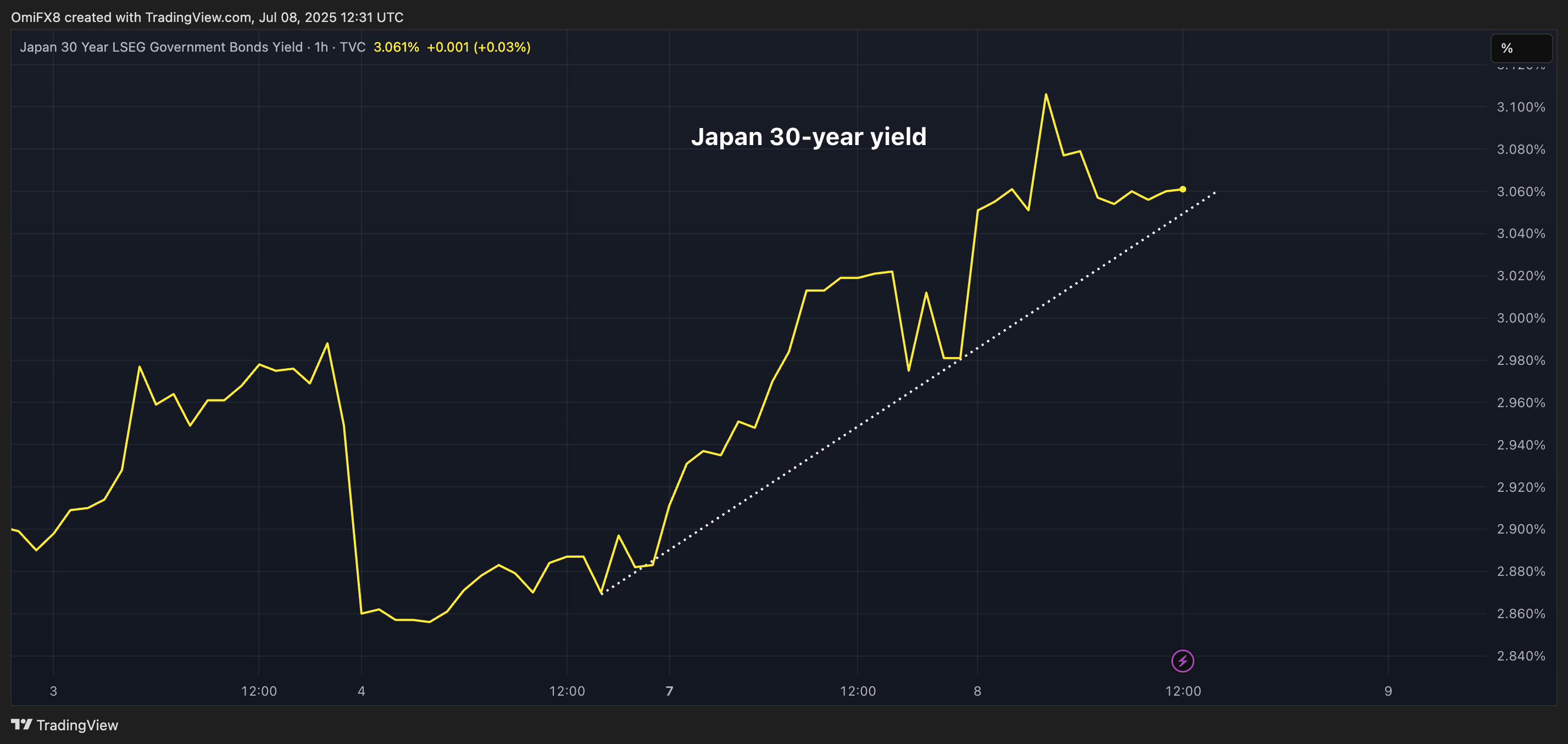

Japan’s 30-Year Yield Surge: A Red Flag for Risk Assets in 2025

Japan's bond market just fired a warning shot—and risk assets might be in the crosshairs.

The 30-year yield spike isn't just a local tremor—it's shaking the foundations of global risk appetite. When the world's most dovish debt market starts cracking, even crypto bulls should check their leverage.

Why this hurts more than your average yield jump:

- Liquidity vacuum: Japan's massive balance sheet has been the ultimate safety net. Now it's fraying.

- Domino effect: Pension funds and insurers chasing yield abroad could reverse flows overnight.

- Volatility spillover: The BOJ's 'whatever it takes' era is over. Market makers know it.

Meanwhile, traditional finance keeps playing whack-a-mole with crises—but at least they've got those fancy Excel models to predict the next meltdown. Crypto? We've got memes and diamond hands.

One thing's clear: In 2025's financial Hunger Games, may the odds—and your stop-losses—be ever in your favor.

The uptick likely represents markets' concerns about fiscal profligacy ahead of the impending Upper House election in Japan later this month. Last week, Japan's Prime Minister Shigeru Ishiba defended his plans to distribute cash handouts as the opposition called for tax cuts.

Further, President Donald Trump's decision to impose a 25% tariff on Japan may be causing stress in the market.

Watch out for rates volatility

The latest uptick in the Japanese ultra-long bond yields could add to the momentum in yields in the U.S. and other countries, whose governments are spending beyond their means.

That, in turn, may lift rates volatility, potentially causing financial tightening and weighing over risk assets, including bitcoin. crypto bulls, therefore, may want to keep track of the MOVE index, which measures the options-based 30-day implied volatility in the U.S. Treasury notes.

Historically, majors tops in BTC have corresponded to bottoms in the MOVE index and vice versa.

Focus on Thursday's auction

The volatility in JGB and other bond markets may increase later this week if the Japanese Ministry of Finance’s sale of 20-year bonds on Thursday disappoints expectations.

According to Bloomberg, the 20-year bond auction has a history of disappointing outcomes, leading to volatility in longer-duration bond yields.

Japan is no longer a source of low rates

For years, Japan maintained ultra-low bond yields through a cocktail of unconventional monetary policy measures. That effectively exerted downward pressure on yields across the advanced world, while underpinning the Japanese yen's role as funding currency for the risk-on carry trades.

However, since 2023, Japan has slowly normalized its monetary policy, greasing the rally in yields worldwide.