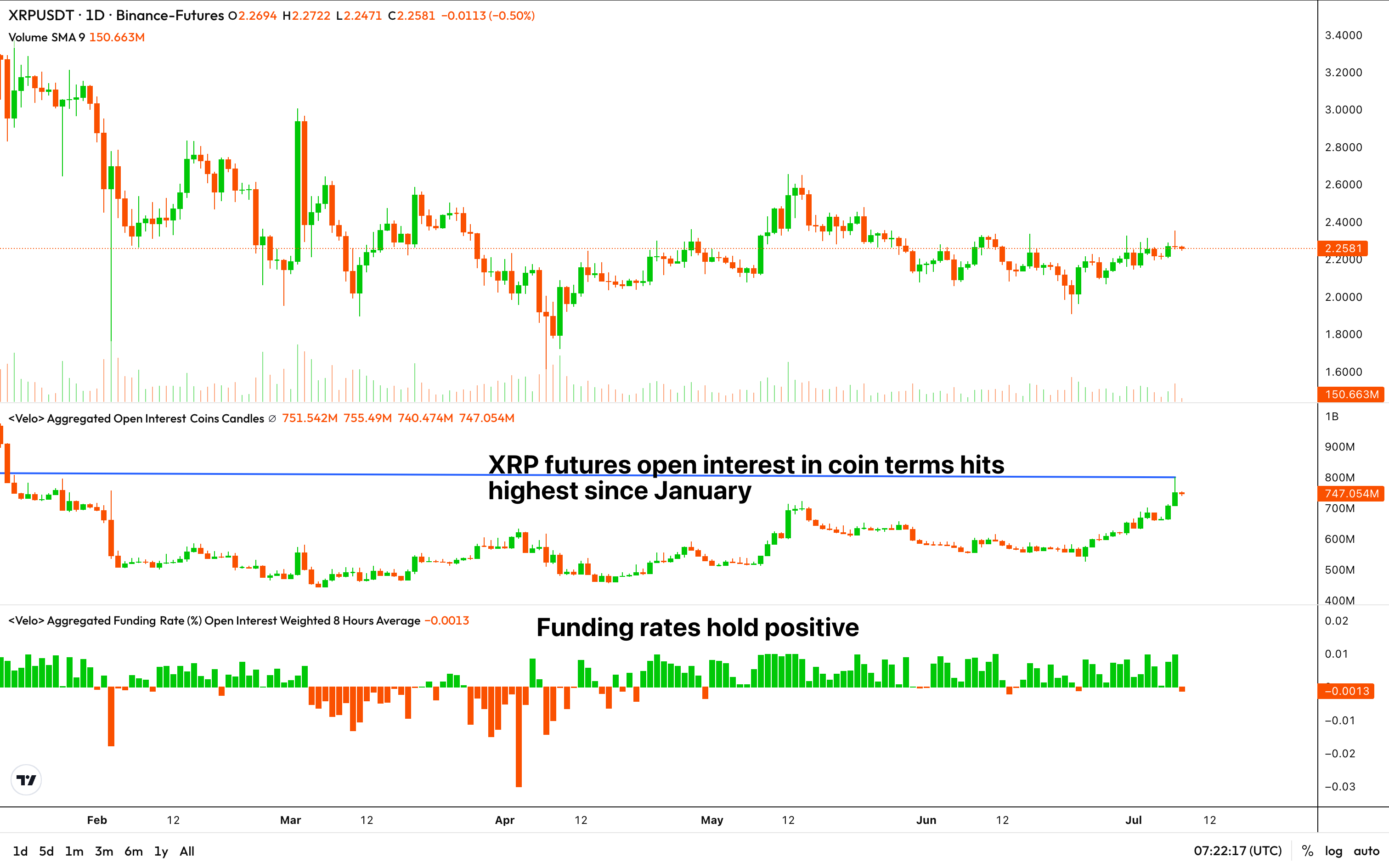

XRP Futures Open Interest Surges to 5-Month Peak as Traders Double Down on Bullish Bets

XRP futures are heating up—open interest just hit its highest level since February 2025. Traders are piling in, betting big on a comeback for the embattled token.

Why the sudden frenzy? Speculation’s running wild that Ripple’s legal battles might finally be winding down—or maybe it’s just the crypto crowd chasing the next dopamine hit after months of sideways action.

Wall Street’s still pretending not to watch, of course. Nothing like a little regulatory ambiguity to keep the suits on the sidelines while degens front-run the inevitable institutional FOMO.

Also pointing to the bullish mood in the market is the "top trader long/short ratio" in the Binance-listed XRP/USDT market. As of writing, the ratio tracked by Coinglass stood at 1.90, implying that for every short, there are two long positions open. Short positions profit when the cryptocurrency declines.

Last week, the Deribit-listed options market saw traders chase the higher strike XRP calls.

Still, the cryptocurrency's spot price is yet to see notable bullish volatility. On Monday, prices ROSE to a high of $2.35, the level last seen at the end of May, only to quickly fall back to $2.25 and remain around that level.