Bitcoin Nears ATH as Traders Go All-In on Shorts—Greed or Genius?

Bitcoin's knife-edge dance with its all-time high has traders betting against the rally. Are they prescient—or just prey for the bulls?

The squeeze play: Short positions balloon as BTC flirts with historic peaks. Everyone's convinced they'll time the top perfectly (spoiler: they won't).

Market irony: The same leverage fueling this rally could trigger the mother of all liquidations. Wall Street's 'smart money' would never fall for this... right?

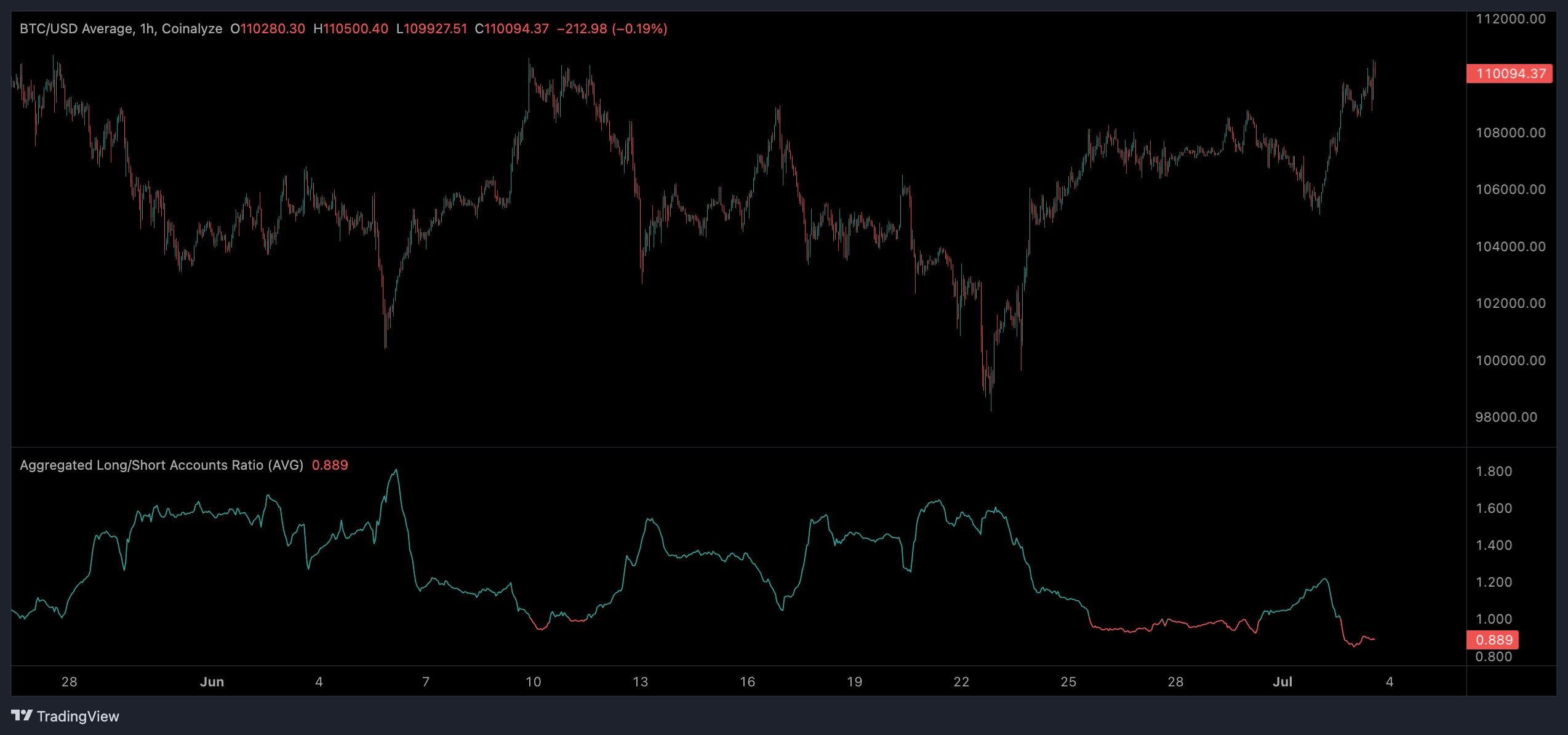

Bitcoin has been trapped in a relatively tight range since early May, trading between $100,000 and $110,000 with three tests of each level of support and resistance.

Technical indicators like relative strength index (RSI) continue to paint a bearish image with several drives of bearish divergence, with RSI weakening on each test of $110,000.

The recent influx of short positions could well be lower timeframe traders capitalizing on the range, shorting resistance before reversing their trade at each test of $100,000.

This rang true on June 22 when the long/short ratio shot up to 1.68 as bitcoin momentarily slumped through $100,000 before bouncing.

There is a potential bull case with the increase in short positions: a short squeeze. This WOULD occur if bitcoin begins to trigger liquidation points and stop losses above a record high, which would cause an impulse in buy pressure and continuation to the upside.