XRP, TRX, DOGE Outshine Bitcoin With Bullish Funding Rates as Crypto’s ’Weak Season’ Kicks Off

Forget the 'summer slump' narrative—these altcoins are defying gravity while BTC hibernates.

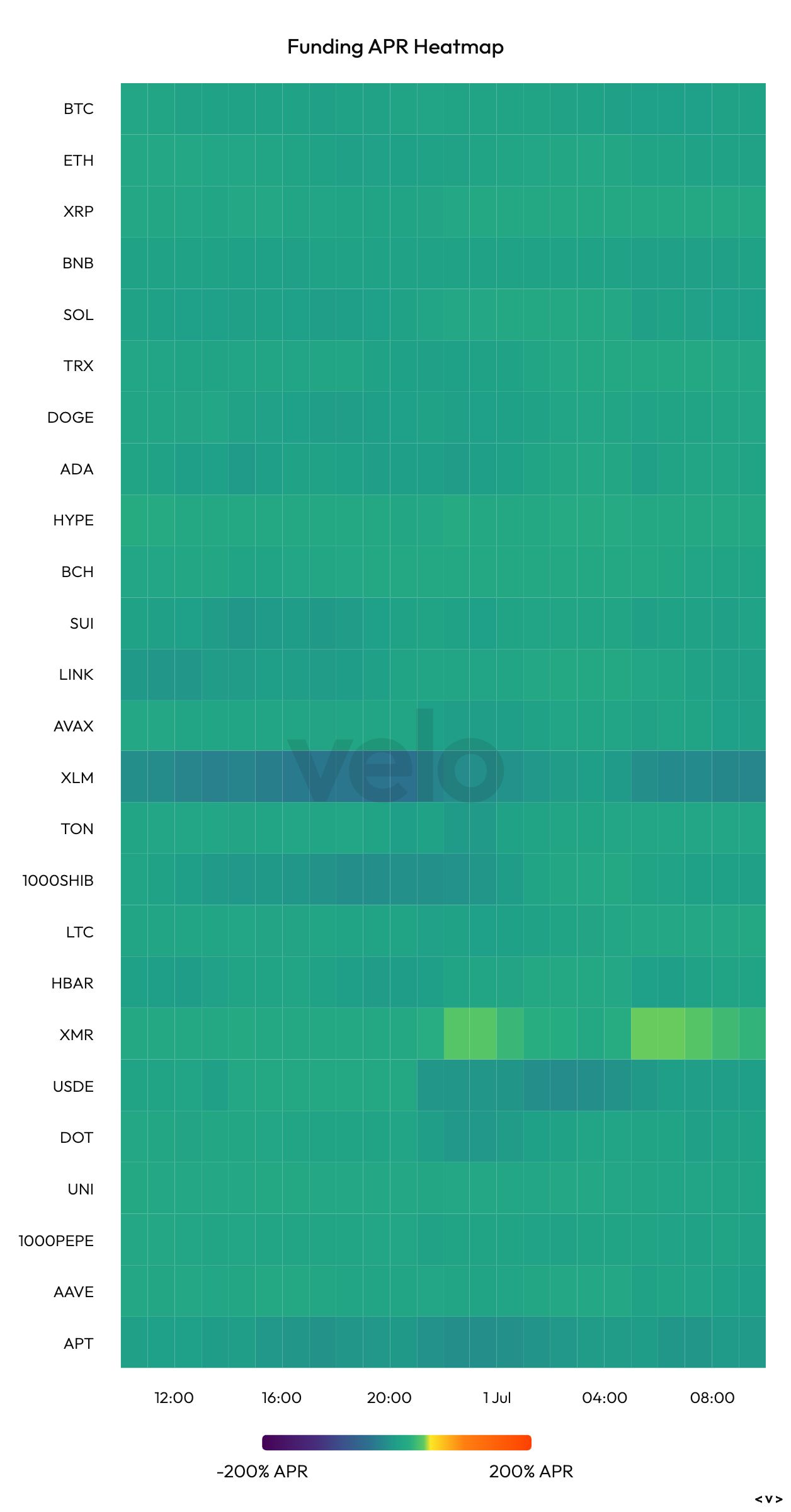

XRP, TRX and DOGE just flashed their strongest bullish signal in months, with positive funding rates suggesting traders are betting big on further upside. Meanwhile, Bitcoin enters its historically worst quarter looking like a drowsy bull.

The funding rate phenomenon

When perpetual swap traders pile into long positions, exchanges balance the books by charging bulls a small fee—the funding rate. Positive rates mean the crowd's leaning bullish. Right now, the crowd's screaming 'risk on' for these three majors.

Bitcoin's Q3 blues

Seasonality charts show July-September typically delivers BTC's worst returns. But this time, the altcoin gang might just rewrite the script—or at least cash in while Wall Street's favorite crypto takes its annual nap.

One hedge fund manager quipped: 'Traders chasing yield in dog coins? Must be a slow quarter for macro strategists.' The market giveth, and the market taketh away—just don't tell your CFA instructor.

Privacy-focused Monero (XMR) stood among tokens beyond the top 10 list with a funding rate of over 23%, while Stellar's XLM token signaled a strong bias for bearish bets with a funding rate of 24%.

Seasonally weak quarter

Historically, the third quarter has been a weak period for bitcoin, with data indicating an average gain of 5.57% since 2013, according to Coinglass. That's a far cry compared to the fourth quarter's 85% average gain.

BTC's spot price remained flat at around $107,000 at press time, offering no clear direction bias. Valuations have been stuck largely between $100,000 and $110,000 for nearly 50 days, with selling by long-term holder wallets counteracting persistent inflows into the U.S.-listed spot exchange-traded funds (ETFs).

Some analysts, however, expect a significant MOVE to occur soon, with all eyes on Fed Chairman Jerome Powell's speech on Tuesday and the release of nonfarm payrolls on Friday.