Bitcoin Dominates Crypto in H1 2025 While Altcoins Implode – What’s Coming Next?

Bitcoin just flexed its muscles—again. As altcoins bled out through Q2 2025, the OG crypto held the line. Here’s why the king isn’t stepping off its throne anytime soon.

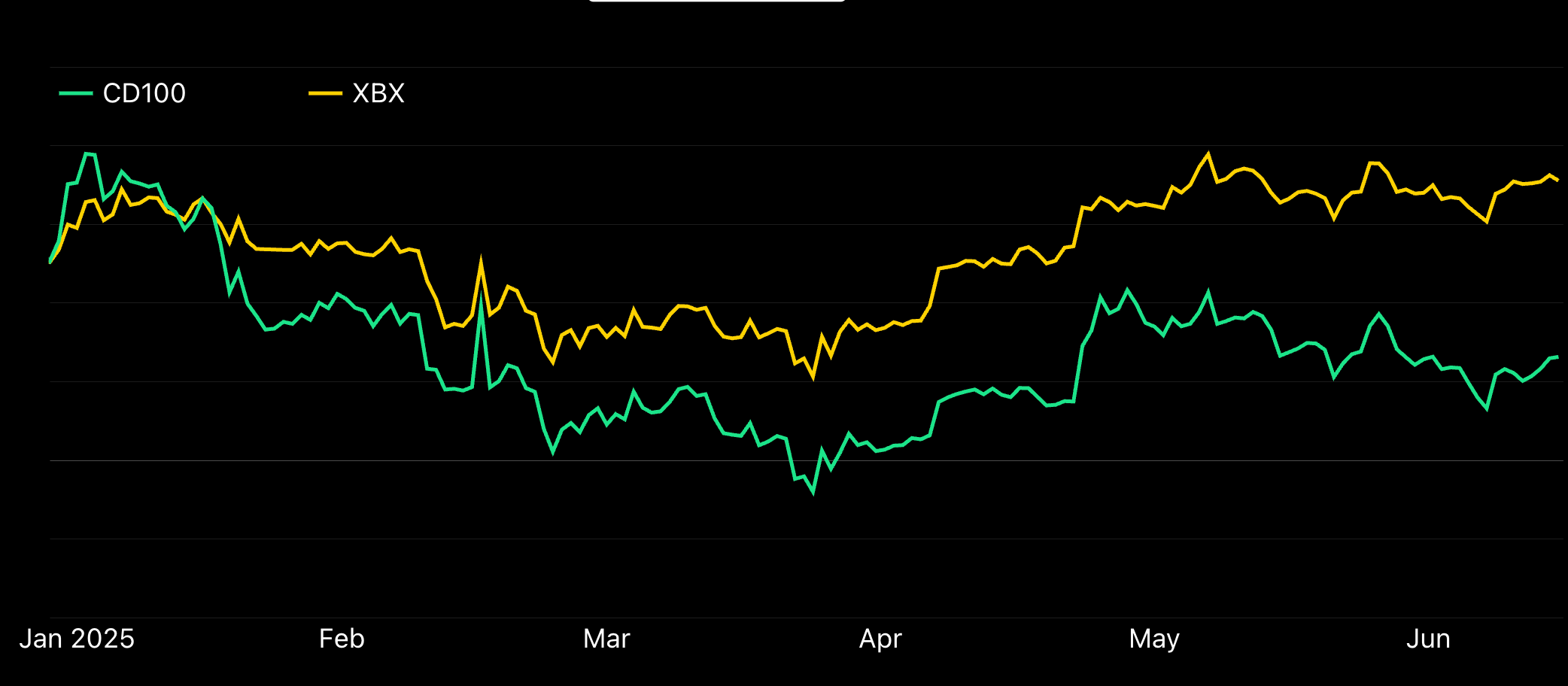

The Great Altcoin Unraveling

While BTC posted single-digit gains (hey, it’s a bear market), most top-20 alts got wrecked. Ethereum barely clung to its $3K psychological floor. Solana? More like So-long-na after another network outage. And don’t even ask about memecoins—unless you enjoy post-mortems.

Institutional Money Talks

BlackRock’s spot BTC ETF now holds more coins than MicroStrategy. Meanwhile, altcoin ETFs got rejected—again. Wall Street wants the blue-chip crypto, not your aunt’s favorite sh*tcoin.

The Road Ahead

With the Fed still playing interest-rate whack-a-mole, crypto’s fate hinges on macro. But one thing’s clear: when storms hit, traders still rush into Bitcoin’s arms. The ‘digital gold’ narrative? Very much alive—unlike some altcoin projects’ GitHub repos.

Funny how ‘decentralized finance’ still dances to the Fed’s tune.

What's next?

Despite the modest start to the year, some analysts see room for renewed upside. Joel Kruger, market strategist at LMAX Group, noted that July has historically been a strong month for crypto, averaging 7.56% returns since 2013.

“We enter a period that has traditionally delivered stronger returns,” said Kruger. “With the second half of the year historically producing outsized gains, the broader setup remains encouraging.”

Kruger also highlighted that the crypto treasury strategy trend is increasingly expanding beyond bitcoin, with firms announcing plans to accumulate digital assets like ETH.

Coinbase analysts also maintained a positive outlook for crypto through the second half of the year, driven by favorable macroeconomic backdrop, potential rate cuts by the Federal Reserve and increasing regulatory clarity in the U.S. with lawmakers advancing legislation for stablecoins and the broader crypto market structure.

Still, the next couple months could be lackluster, Bitfinex analysts warned. The next quarter-year starting with July has been historically the weakest for bitcoin, averaging only 6% gains since 2013, they said in a Monday report.

"This is also where average volatility is subdued, adding to our bias of range bound price action continuing for longer," the authors noted.