Bitcoin Braces for $14B Options Expiry as Put-Call Ratio Spikes—Bull Trap or Bear Signal?

All eyes are on Bitcoin’s $14B options expiry this week—but the real story is the surging put-call ratio. Is this a hedge against volatility, or are whales betting on a crash?

Why the put-call ratio matters

When traders stack puts over calls, it’s either insurance or a bearish omen. With Bitcoin hovering near key levels, the market’s split between ‘buy the dip’ and ‘short the rip.’

The institutional poker face

Wall Street’s playing both sides—loading up on puts while quietly accumulating spot. Classic ‘risk management’… or just another way to fleece retail when liquidity dries up?

Bottom line: This expiry could trigger fireworks. Either Bitcoin shakes off the FUD and rallies, or we’re in for a gamma squeeze that’ll make 2024’s crashes look tame. Place your bets—just don’t cry when the house wins (again).

Options expiry worth $14 billion looming

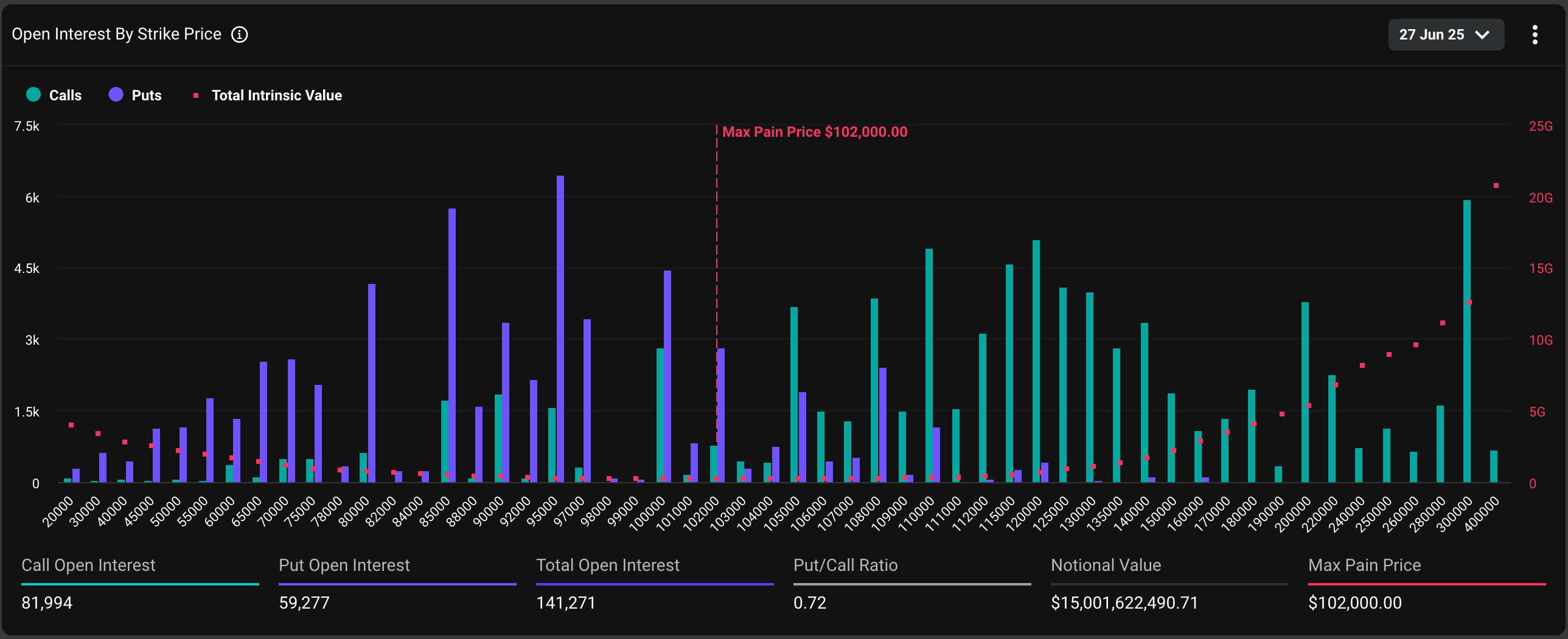

On Friday, at 08:00 UTC, a total of 141,271 BTC options contracts, worth over $14 billion, representing more than 40% of the total open interest will expire on Deribit, according to data source Deribit Metrics.

Of the total due for settlement, 81,994 contracts are calls, while the rest are put options. On Deribit, one options contract represents one BTC.

Chen said that nearly 20% of expiring calls are "in-the-money (in profit)," meaning that a large number of market participants hold calls at strikes that are below BTC's current spot market rate of $106,000.

"This suggests call buyers have performed well this cycle, aligning with the persistent inflows into BTC ETFs," Chen noted.

Holders of in-the-money (ITM) calls are already profitable and may choose to book profits or hedge their positions as expiry nears, which can add to market volatility. Alternatively, they might roll over (shift) positions to the next expiry.

"As this is a major quarterly expiry, we expect heightened volatility around the event," Chen said.

Broadly speaking, most of calls are set to expire out-of-the-money or worthless. Notably, the $300 call has the highest open interest, a sign traders likely hoped for an outsized price rally in the first half.

The max pain for the expiry is $102,000, a level where option buyers WOULD suffer the most.

Focus on $100K-$105K range

Latest market flows indicate expectations for back-and-forth trading, with a slight bullish bias as we approach the expiry.

According to data tracked by leading crypto market maker Wintermute, the latest flows are skewed neutral, with traders selling straddles —a volatility bearish strategy — and writing calls around $105,000 and shorting puts at $100,000 for the June 27 expiry.

"For #BTC options, flows skew neutral with straddle/call selling around 105K and short puts at 100K (27 Jun), pointing to expectations of tight price action into expiry. Selective call buying (108K–112K, Jul/Sep) adds a capped bullish tilt. IV remains elevated," OTC desk at Wintermute, told CoinDesk in an email.