Bitcoin Soars on Trump Momentum—But $92K Danger Zone Looms, Warn Analysts

Trump pumps, Bitcoin jumps—but the party might not last. Analysts flag a precarious $92K threshold that could send bulls scrambling.

Here's why the rally feels more like a political sugar rush than organic growth.

Meanwhile, Wall Street still can't decide if crypto is the future or just a very loud distraction from their failing hedge funds.

What to Watch

- Crypto

- June 20: Proof-of-stake blockchain BlackCoin (BLK) activates SegWit on mainnet, improving security and performance. Nodes must be upgraded to release v26.2.0 before this date. Wallets from 13.2 can be used in 26.2.x.

- June 25: ZIGChain (ZIG) mainnet will go live.

- June 30: CME Group will introduce spot-quoted futures, pending regulatory approval, allowing trading in bitcoin, ether and major U.S. equity indices with contracts holdable for up to five years.

- Macro

- June 20, 8:30 a.m.: Statistics Canada releases May producer price inflation data.

- PPI MoM Est. 0% vs. Prev. -0.8%

- PPI YoY Prev. 2%

- June 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases April retail sales data.

- Retail Sales MoM Prev. 0.5%

- Retail Sales YoY Prev. 4.3%

- June 23, 9:45 a.m.: S&P Global releases (Flash) June U.S. data on manufacturing and services activity.

- Composite PMI Prev. 53

- Manufacturing PMI Prev. 52

- Services PMI Prev. 53.7

- June 23, 3 p.m.: Argentina’s National Institute of Statistics and Censuses releases Q1 GDP data.

- GDP Growth Rate QoQ Prev. 1.1%

- GDP Growth Rate YoY Prev. 2.1%

- June 20, 8:30 a.m.: Statistics Canada releases May producer price inflation data.

- Earnings (Estimates based on FactSet data)

- June 23 (TBC): HIVE Digital Technologies (HIVE), post-market, $-0.12

Token Events

- Governance votes & calls

- Compound DAO is set to vote on a proposal to create the Compound Foundation, a non-profit to drive protocol growth and strategy. It calls for an 18-month plan and requests $9 million in COMP. Voting ends June 20.

- Arbitrum DAO is voting on a proposal to launch DRIP, an $80M incentives program targeting specific DeFi activity. Managed by a foundation-led committee, DRIP would reward users directly and allow the DAO to shut it down via vote. Voting ends June 20.

- ApeCoin DAO is voting on whether to sunset the decentralized autonomous organization and launch ApeCo, a new entity established by Yuga Labs with a mission to “supercharge the APE ecosystem.” Voting ends June 24.

- Polkadot Community is voting on launching a non-custodial Polkadot branded payment card to “to bridge the gap between digital assets in the Polkadot ecosystem and everyday spending.” Voting ends July 9.

- Unlocks

- June 30: Optimism (OP) to unlock 1.83% of its circulating supply worth $17.34 million.

- July 1: Sui (SUI) to unlock 1.3% of its circulating supply worth $120.99 million.

- July 2: Ethena (ENA) to unlock 0.67% of its circulating supply worth $11.23 million.

- Token Launches

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight.

- Day 2 of 3: BTC Prague 2025

- June 24-26: Blockworks' Permissionless IV (New York)

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

by Shaurya Malwa and Oliver Knight

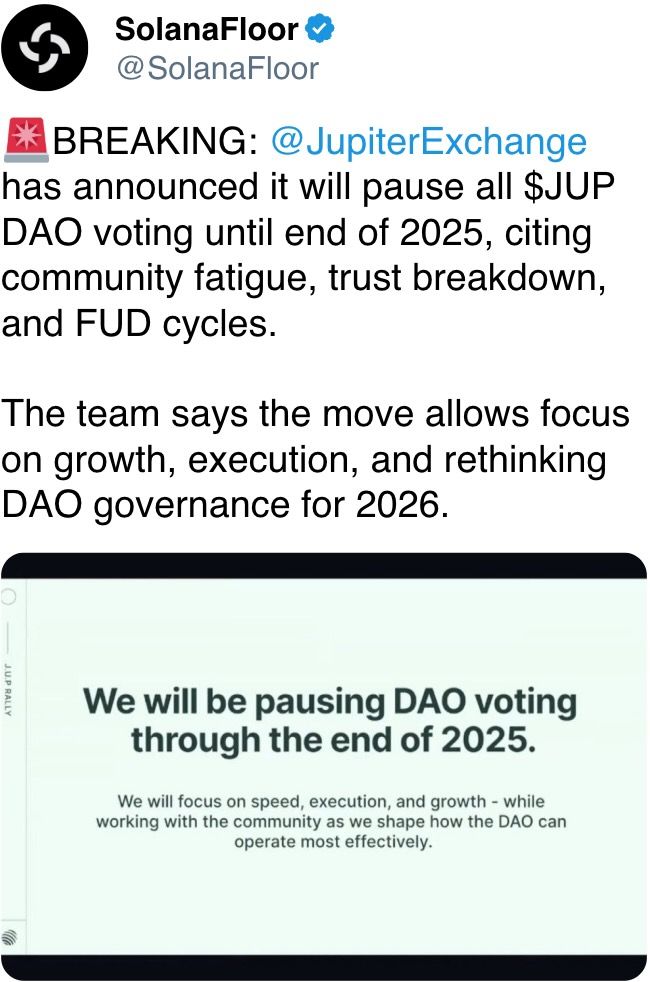

- Jupiter DEX is pausing all DAO votes until end-2025, citing governance issues and a need to reset its structure during a "critical period" for DeFi.

- Exec Kash Dhanda said the current DAO setup breeds mistrust and FUD, preventing the team, holders and platform from working cohesively.

- A new governance model will be introduced next year, aiming to "unify rather than divide" the Jupiter community.

- Staking rewards (ASR) will continue at 50M JUP per quarter, but no new DAO-funded workgroups or emissions will be created in the meantime.

- The JUP token has dropped nearly 22% in the past month, and Friday's governance news had minimal impact, with the price hovering near $0.40.

Derivatives Positioning

- Open interest (OI) across top derivatives venues remains stable, but subdued relative to earlier highs.

- According to Velo data, respective OI sits at $56.73 billion, still well below the $65.95 billion peak seen on June 11.

- Binance has regained ground with $24.5 billion in OI, though this remains short of its previous $27.9 billion high. BCH stands out as a notable mover, recording the third-largest notional OI gain over the last 24 hours with an $83.4 million increase, following BTC and ETH according to Laevitas.

- BTC and ETH options positioning remains concentrated around out-of-the-money strikes, despite a minor expiry today.

- On Deribit, ETH options contract OI reached a yearly high of 2.58 million, with most exposure set to expire on June 27.

- ETH skew remains heavily call-dominated at the $3,200 strike, while BTC interest is clustered between $100,000 and $110,000.

- ETH’s put/call ratio stands at 0.43, and BTC’s at 0.63. Notional flows are similarly aligned, with top-traded contracts including 27JUN25 $2,600C and $100,000P, reflecting both directional interest and tail-risk hedging.

- Funding rate APRs across perpetual swaps remain broadly positive according to Velo data, with BTC and ETH both printing 10.95% on Bybit and Hyperliquid. Binance funding is also elevated at 8.98% for BTC and 10.05% for ETH, while Deribit remains flat.

- In contrast, BNB shows sharp negative prints (–22.73% on Bybit and –13.04% on Hyperliquid), hinting at short pressure amid falling dominance. Altcoin funding is similarly mixed, with names like AAVE and DOGE staying positive while SOL and AVAX are little changed.

- Coinglass data shows $131.89 million in 24-hour liquidations, skewed 56% toward shorts. ETH led notional liquidations at $32.2 million, followed by BTC at $28.7 million.

- Binance heatmaps reveal dense liquidation clusters between $106,000 and $108,000, indicating that recent price action cleared layered short positioning.

- BTC dominance continues to hover around 65%, and while short liquidations hint at squeezed leverage, directional conviction appears measured heading into the next major expiry window.

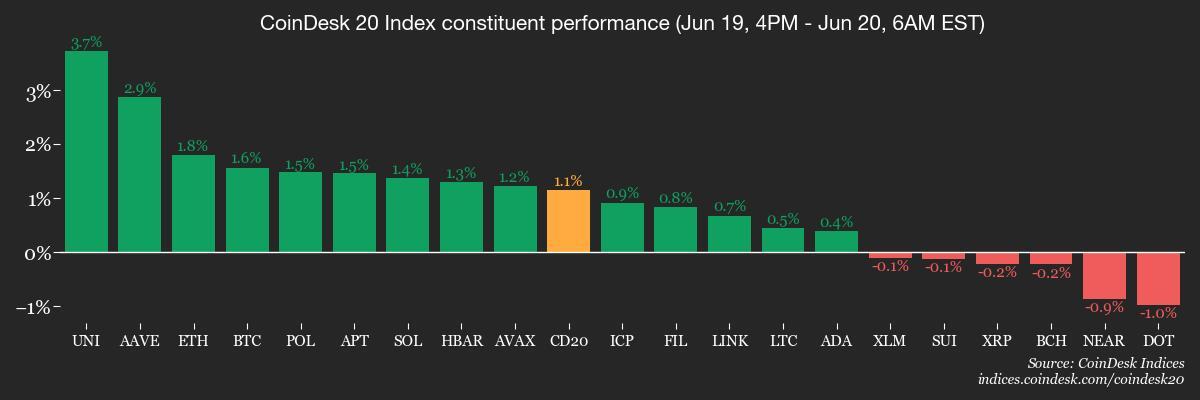

Market Movements

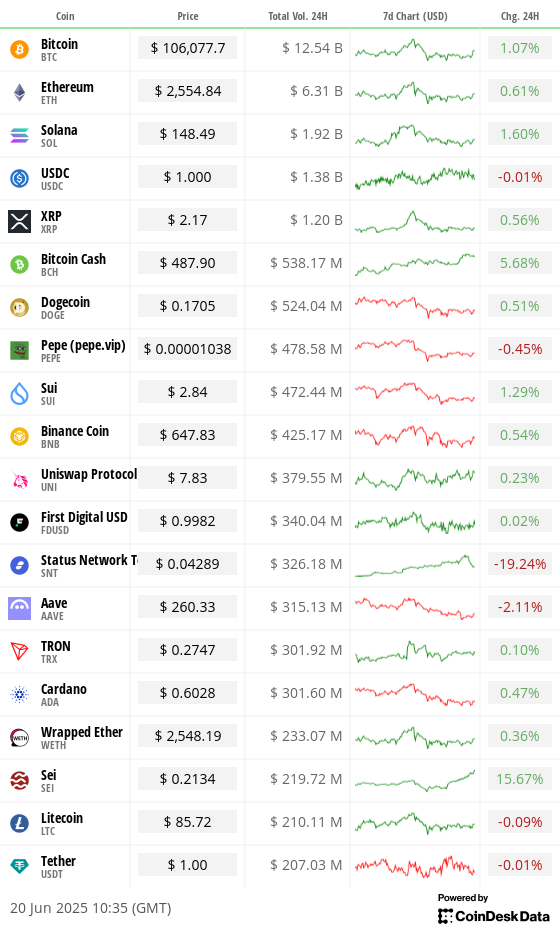

- BTC is up 1.63% from 4 p.m. ET Thursday at $106,015.34 (24hrs: +0.98%)

- ETH is up 1.85% at $2,554.74 (24hrs: +0.46%)

- CoinDesk 20 is up 1.3% at 3,034.29 (24hrs: +0.76%)

- Ether CESR Composite Staking Rate is up 7 bps at 3.05%

- BTC funding rate is at 0.0071% (7.7451% annualized) on OKX

- DXY is down 0.30% at 98.61

- Gold futures are down 0.99% at $3,374.40

- Silver futures are down 2.20% at $36.10

- Nikkei 225 closed down 0.22% at 38,403.23

- Hang Seng closed up 1.26% at 23,530.48

- FTSE is up 0.44% at 8,830.90

- Euro Stoxx 50 is up 0.80% at 5,238.57

- DJIA closed on Wednesday down 0.10% at 42,171.66

- S&P 500 closed down 0.03% at 5,980.87

- Nasdaq Composite closed up 0.13% at 19,546.27

- S&P/TSX Composite closed down 0.20% at 26,506.00

- S&P 40 Latin America closed on Thursday down 0.15% at 2,614.38

- U.S. 10-Year Treasury rate is up 2 bps at 4.42%

- E-mini S&P 500 futures are down 0.24% at 5,967.00

- E-mini Nasdaq-100 futures are down 0.25% at 21,666.75

- E-mini Dow Jones Industrial Average Index are down 0.21% at 42,098.00

Bitcoin Stats

- BTC Dominance: 65% (0.25%)

- Ethereum to bitcoin ratio: 0.02407 (-0.08%)

- Hashrate (seven-day moving average): 864 EH/s

- Hashprice (spot): $53.25

- Total Fees: 5.07 BTC / $537,039.75

- CME Futures Open Interest: 154,500 BTC

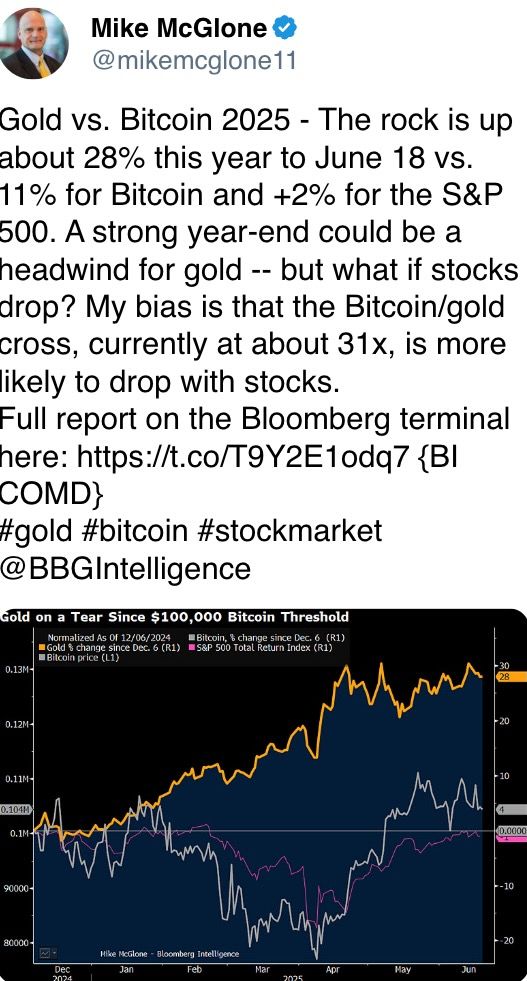

- BTC priced in gold: 31.3 oz

- BTC vs gold market cap: 8.87%

Technical Analysis

- Bitcoin reclaimed its monthly open following a successful retest of the 50-day exponential moving average (EMA), signaling a potential shift in short-term momentum. The asset is now trading above Monday’s low and appears to be making a move to recapture the full Monday range.

- If successful, this would open the path toward the Monday high near $109,000. However, the price is currently capped by the 20-day EMA.

- For bulls to maintain control, it will be crucial for BTC to continue closing above the monthly open.

- A decisive close above the January highs would further invalidate the prevailing weekly swing failure pattern, reinforcing the bullish case and potentially paving the way for a broader continuation to the upside.

Crypto Equities

U.S. markets were closed on Thursday due to Juneteenth federal holiday

Galaxy Digital Holdings (GLXY): closed on Thursday at C$26.65 (+2.03%)

Strategy (MSTR): closed on Wednesday at $369.03 (-1.64%), +1.1% at $373.10 in pre-market

Coinbase Global (COIN): closed at $295.29 (+16.32%), +1.03% at $298.34

Circle (CRCL): closed at $199.59 (+33.82%), +10.53% at $220.60

MARA Holdings (MARA): closed at $14.49 (-1.23%), +1.73% at $14.74

Riot Platforms (RIOT): closed at $9.94 (+2.9%), +1.51% at $10.09

Core Scientific (CORZ): closed at $11.9 (+0.08%), +0.42% at $11.95

CleanSpark (CLSK): closed at $9.18 (+3.15%), +1.42% at $9.31

CoinShares Valkyrie bitcoin Miners ETF (WGMI): closed at $18.7 (+0.11%)

Semler Scientific (SMLR): closed at $31.94 (+11.95%), +8.39% at $34.62

Exodus Movement (EXOD): closed at $30.14 (+0.43%), +3.65% at $31.24

ETF Flows

- Daily net flows: $0

- Cumulative net flows: $46.63 billion

- Total BTC holdings ~1.22 million

- Daily net flows: $0

- Cumulative net flows: $3.92 billion

- Total ETH holdings ~3.98 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Bitcoin dominance has reached 65%, currently trading near the upper boundary of a well-defined parallel channel that has guided the trend since mid-May.

While You Were Sleeping

- Europe Set for Iran Talks as Trump Signals 2-Week Window to Decide on Attack (Financial Times): Britain, France and Germany will meet Iranian officials in Geneva on Friday to restart high-level nuclear talks and push for renewed inspections with full access to Iran’s atomic facilities.

- Bitcoin Steady Above $104K as Traders Eye Historically Bullish Second Half (CoinDesk): Bitcoin may stay stuck between $102K and $108K as traders hedge downside in options markets while month-end flows, rebalancing and weak catalysts weigh on near-term momentum.

- Arizona Moves Closer to Creating Bitcoin Reserve as Bill Passes Final Senate Vote (CoinDesk): The legislation, which still needs House approval, would update Arizona's laws on forfeiture, allowing the state to hold abandoned digital assets as unclaimed property.

- North Korean Hackers Are Targeting Top Crypto Firms With Malware Hidden in Job Applications (CoinDesk): Hackers are using fake career sites impersonating top crypto firms to trick jobseekers into installing a Python-based remote access trojan that steals credentials and wallet data from 80+ browser extensions.

- Iran’s Islamic Revolutionary Guard Poised for More Power (The Wall Street Journal): Israeli strikes have raised the risk of Supreme Leader Ayatollah Khamenei’s fall, giving the Revolutionary Guard an opportunity to install his successor and usher in an even more radical regime.

- U.K. Retail Sales Drop 2.7% in Worrying Sign for Economy (Bloomberg): May’s contraction was far deeper than the 0.5% decline economists forecast, adding pressure to the Labour party’s fiscal plans and raising the risk of tax hikes in Rachel Reeves’ autumn budget.

In the Ether