Bitcoin Soars to $106K Amid Iran-Israel Tensions—But Is This Rally Built on Sand?

Geopolitical tremors send BTC skyrocketing—only for analysts to spot cracks in the foundation.

When missiles fly, crypto buys? Bitcoin''s knee-jerk surge to $106k proves once again that digital gold loves a good crisis. But seasoned traders aren''t popping champagne.

The pullback paradox

Every 10% climb comes with whispered warnings from chart-watching skeptics. ''This isn''t organic growth,'' grumbles one hedge fund manager between sips of $28 artisanal coffee. ''It''s fear capital with an expiration date.''

Meanwhile in traditional finance...

Wall Street''s old guard clutches pearls as Bitcoin eats their lunch—again. ''It''s just a hedge against bad policy!'' protests a CNBC regular, ignoring his own fund''s 2% annual returns.

The bottom line? When the bombs stop falling, will Bitcoin stand tall—or will traders rediscover gravity? One thing''s certain: in crypto, even dead cats bounce like they''ve got SpaceX boosters.

What''s next for bitcoin?

"Nice bounce thus far and lack of follow-through lower," well-followed crypto trader Skew said in a Friday X post. Market participants will likely remain cautious through the weekend with BTC tightly correlated with traditional markets amid heightened geopolitical risks, Skew added.

On the longer timeframe, some analysts see risks of a deeper pullback.

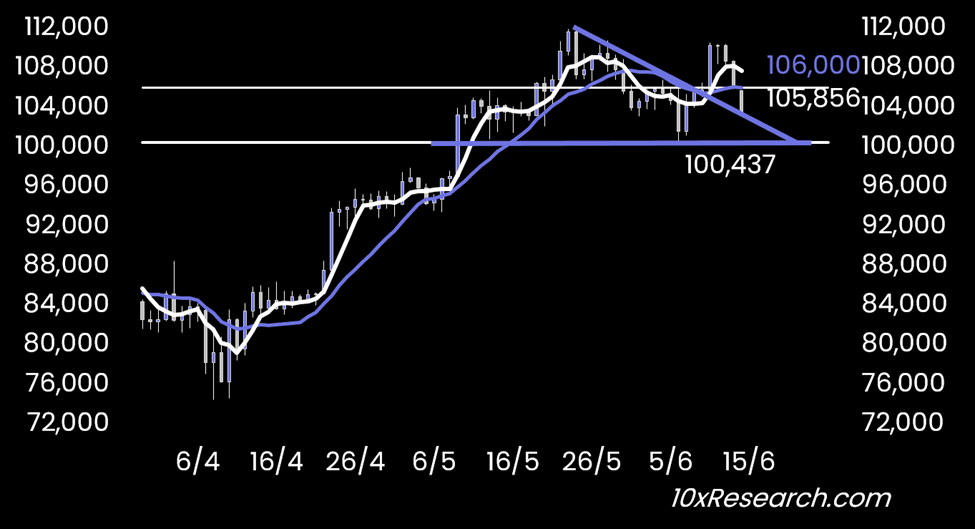

10x Research founder Markus Thielen noted that BTC''s drop below $106,000 translates to a failed breakout, and traders should wait for more favorable setups before rushing to buy the dip.

He highlighted the $100,000-$101,000 zone as key support, warning that a break below could mark a return to the broader consolidation phase similar to last summer.

John Glover, chief investment officer at bitcoin lender Ledn, argued that bitcoin entered a corrective phase from its record highs that could see the largest digital asset drop to $88,000-$93,000.

He said the $90,000 level could offer a favorable entry for opportunistic investors before BTC resumes its uptrend.

"Once this pattern has played out, the next MOVE higher to the $130,000 area is expected to begin," he said.