Asia Eats Wall Street’s Lunch: U.S. Dominance in BTC, ETH, SOL Trading Slips Below 45%

Western crypto traders might want to check their rearview mirrors—Asian markets are gaining fast. The U.S. share of Bitcoin, Ether, and Solana trading volume just dipped under 45%, a wake-up call for those still pretending geography matters in decentralized finance.

While traditional finance clings to 9-to-5 trading desks, the global crypto casino never closes. Maybe those 3am institutional research reports aren’t cutting it anymore.

Bitcoin, the leading cryptocurrency by market value, has surged 40% to $105,000 since hitting lows under $75,000 in early April, according to CoinDesk data. Ether and solana have surged 87% and 68%, respectively, during the same period.

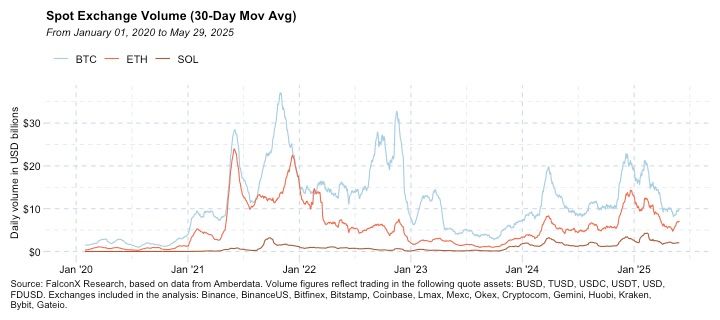

Low-volume BTC rallyAlthough bitcoin’s price has surged to new highs, global spot trading activity hasn’t yet recovered to levels seen early this year.

According to FalconX, daily volume in BTC spot markets, which averaged over $15 billion on a 30-day rolling basis after the November election, declined during the April sell-off and has since held below $10 billion.

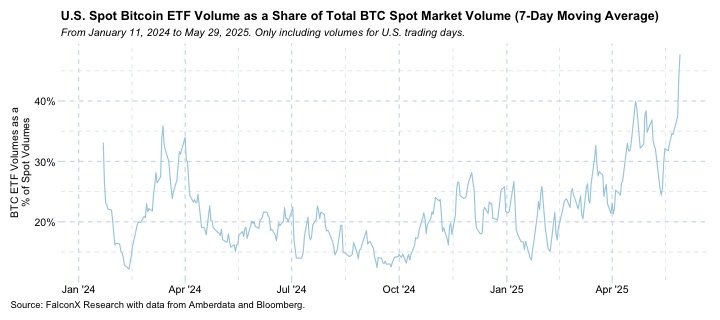

A low-volume rally is often viewed as a bear trap. However, that’s not necessarily the case this time, as ETFs have recently gained popularity as investment vehicles.

According to FalconX, the cumulative volume in the 11 U.S.-listed spot bitcoin ETFs has surged from approximately 25% of the global spot BTC market volume to a record 45% in under two months.

The spike in ETF volume stems mainly from bold directional bets rather than non-directional arbitrage bets like the cash and carry trade, involving a long position in the ETF and a simultaneous short position in the CME BTC futures.

The 11 spot ETFs have amassed $44 billion in net inflows since inception in January 2024, according to data source Farside Investors. BlackRock’s IBIT, the largest of them all, attracted $6.35 billion in May, the most since January 2025, indicating growing institutional demand for BTC amid trade tensions and bond market jitters.

"All of this points to room for growth and suggests that ETFs are likely to remain a major force behind demand in this rally," Lawant said.