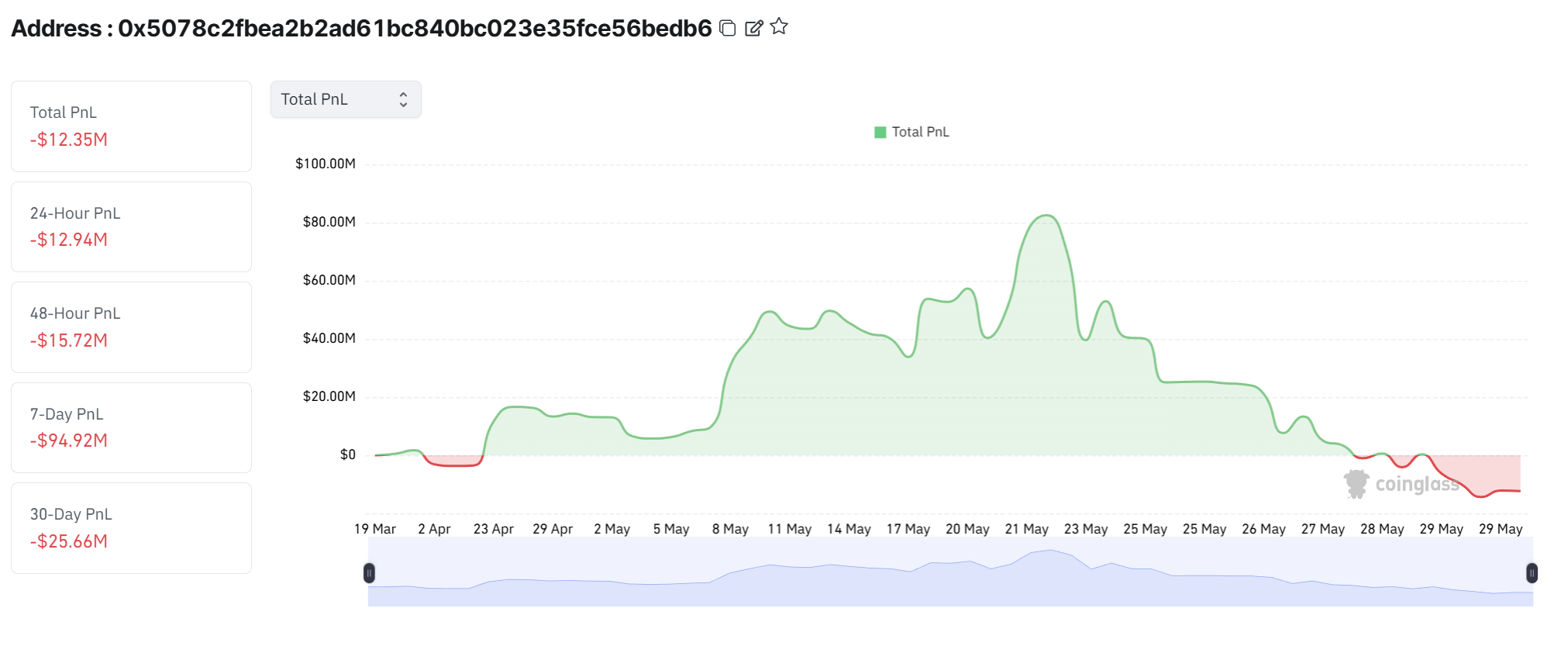

Bitcoin Bull Faces Near-Total Wipeout as Losses Approach $100M

Crypto’s latest cautionary tale unfolds as a once-bullish trader teeters on the brink.

Margin calls don’t discriminate—even true believers get liquidated when the market turns. This time, it’s a $100M lesson in leverage.

Wall Street’s sharks are probably placing bets on who’s next—after all, someone’s gotta profit from the carnage.

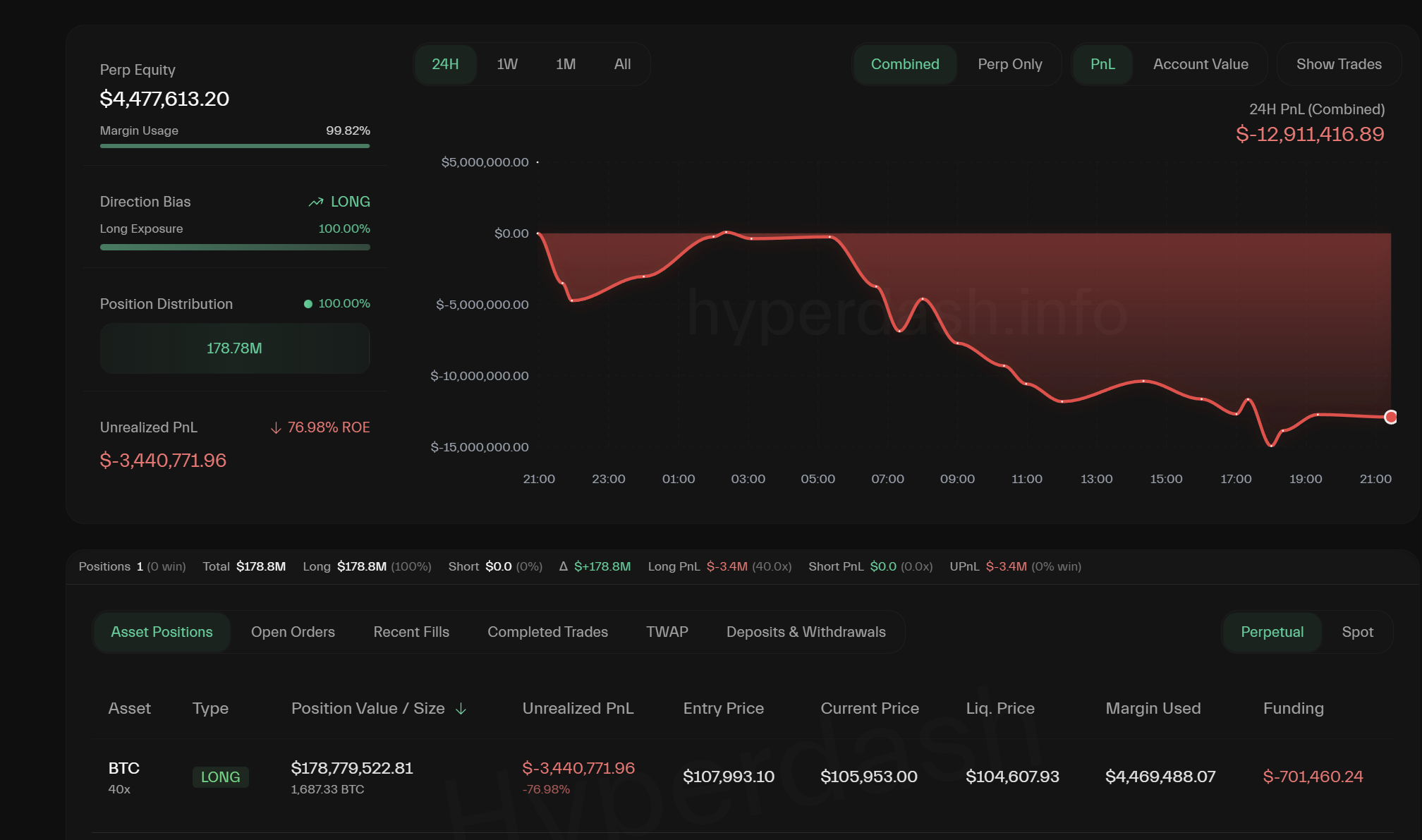

Data from Hyperdash shows that Wynn’s margin usage is nearing 100%, which WOULD result in a total liquidation of his position, though Wynn recently made a deposit of $376,000 to bolster his defenses.

The trader, known for making aggressive bets under the pseudonym "moonpig," currently holds a long position of approximately 1,690 BTC, valued at roughly $178.78 million.

On-chain data shows that Wynn’s 40x leveraged BTC bets now carry an unrealized loss of approximately $3.5 million, representing a negative return of 77%.

But with BTC trading NEAR $106,000, just slightly above Wynn’s liquidation price of around $104,607, any further decline in the asset’s price could trigger automatic forced sales.