Bitcoin and Ether Rally as Court Strikes Down Trump-Era Tariffs—Traders Cheer Regulatory Tailwinds

Cryptocurrencies surge on regulatory relief—because nothing pumps digital assets like a judge clipping legacy finance’s wings.

Bitcoin and Ether jumped after a US court nixed controversial tariffs from the Trump administration, sparking fresh risk appetite. The ruling’s knock-on effects? A textbook ’risk-on’ move where crypto outperforms traditional markets—again.

Wall Street analysts scramble to downgrade tariff-exposed stocks while crypto VCs quietly high-five. Another day, another reminder that decentralized assets thrive when centralized systems stumble.

Bonus jab: Traders now pricing in a 110% chance the SEC will ’reconsider’ its crypto stance—right after their next donor dinner.

What to Watch

- Crypto

- May 30: The second round of FTX repayments starts.

- May 31 (TBC): Mezo mainnet launch.

- June 6, 1-5 p.m.: U.S. SEC Crypto Task Force Roundtable on "DeFi and the American Spirit"

- Macro

- May 29, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April unemployment rate data.

- Unemployment Rate Est. 6.9% vs. Prev. 7%

- May 29, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases Q1 GDP data.

- GDP Growth Rate QoQ (2nd estimate) Est. -0.3% vs. Prev. 2.4%

- GDP Price Index QoQ (2nd estimate) Est. 3.7% vs. Prev. 2.3%

- GDP Sales QoQ (2nd estimate) Est. -2.5% vs. Prev. 3.3%

- May 29, 2 p.m.: Fed Governor Adriana D. Kugler will deliver a speech at the 5th Annual Federal Reserve Board Macro-Finance Workshop (virtual). Livestream link.

- May 30, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases Q1 GDP data.

- GDP Growth Rate QoQ Est. 1.4% vs. Prev. 0.2%

- GDP Growth Rate YoY Est. 3.2% vs. Prev. 3.6%

- May 30, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases April unemployment rate data.

- Unemployment Rate Est. 2.5% vs. Prev. 2.2%

- May 30, 8:30 a.m.: Statistics Canada releases Q1 GDP data.

- GDP Growth Rate Annualized Est. 1.7% vs. Prev. 2.6%

- GDP Growth Rate QoQ Prev. 0.6%

- May 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases April consumer income and expenditure data.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0%

- Core PCE Price Index YoY Est. 2.5% vs. Prev. 2.6%

- PCE Price Index MoM Est. 0.1% vs. Prev. 0%

- PCE Price Index YoY Est. 2.2% vs. Prev. 2.3%

- Personal Income MoM Est. 0.3% vs. Prev. 0.5%

- Personal Spending MoM Est. 0.2% vs. Prev. 0.7%

- May 30, 10 a.m.: The University of Michigan releases (final) May U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 51 vs. Prev. 52.2

- May 29, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April unemployment rate data.

- Earnings (Estimates based on FactSet data)

- None in the near future.

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17, and voting ends on May 29.

- Sui DAO is voting on moving to recover approximately $220 million in funds stolen from the Cetus Protocol hack via a protocol upgrade. Voting ends June 3.

- May 29, 8 a.m.: NEAR Protocol to host a House of Stake Ask Me Anything (AMA) session.

- May 29, 2 p.m.: Wormhole to host an ecosystem call.

- June 4, 6:30 p.m.: Synthetic to host a community call.

- June 10, 10 a.m.: Ether.fi to host an analyst call followed by a Q&A session.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $24.43 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $160.58 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.18 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $15.83 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $60.96 million.

- Token Launches

- June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN)

Conferences

- Day 3 of 3: Bitcoin 2025 (Las Vegas)

- Day 3 of 4: Web Summit Vancouver (Vancouver, British Columbia)

- May 29: Stablecon (New York)

- Day 1 of 2: Litecoin Summit 2025 (Las Vegas)

- Day 1 of 4: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Oliver Knight

- Markets on the Ethereum-based Cork Protocol remain paused after Wednesday’s $12 million smart-contract exploit.

- The attacker manipulated the smart contact’s exchange-rate function by issuing fake tokens, stealing 3,761.8 wrapped staked ether (wstETH) in the process.

- The exploit marked another attack on the decentralized finance (DeFi) industry just days after Sui-based Cetus Protocol lost $223 million to an exploit.

- TRM Labs estimates that $2.2 billion was stolen in crypto exploits and hacks in 2024.

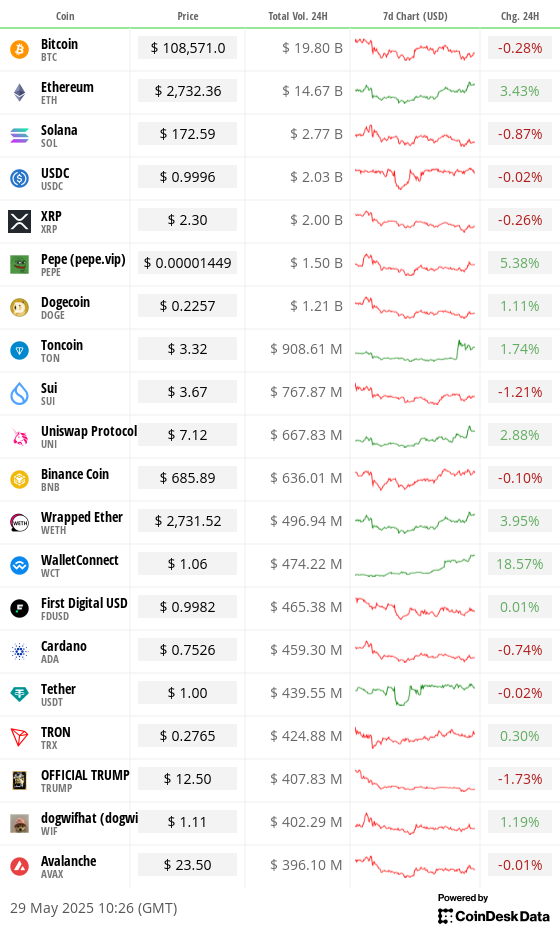

- Ether remains unperturbed by the exploit, leading the market today on the back of renewed institutional interest and spot ETF flows. It is up 3.8% in the past 24 hours while bitcoin is down by 0.17%.

Derivatives Positioning

- TRX, XMR, ETH, LTC and BNB led major cryptocurrencies’ growth in perpetual futures open interest.

- Funding rates for majors, except TON, signal bullish sentiment, but nothing extraordinary.

- On the CME, ETH annualized one-month futures basis topped 10%, while BTC lagged at 8.7%.

- Signs of caution emerged on Deribit, with front-end BTC skew flipping to puts and ETH’s call skew softening. Block flows on Paradigm featured demand for short-dated BTC puts.

Market Movements

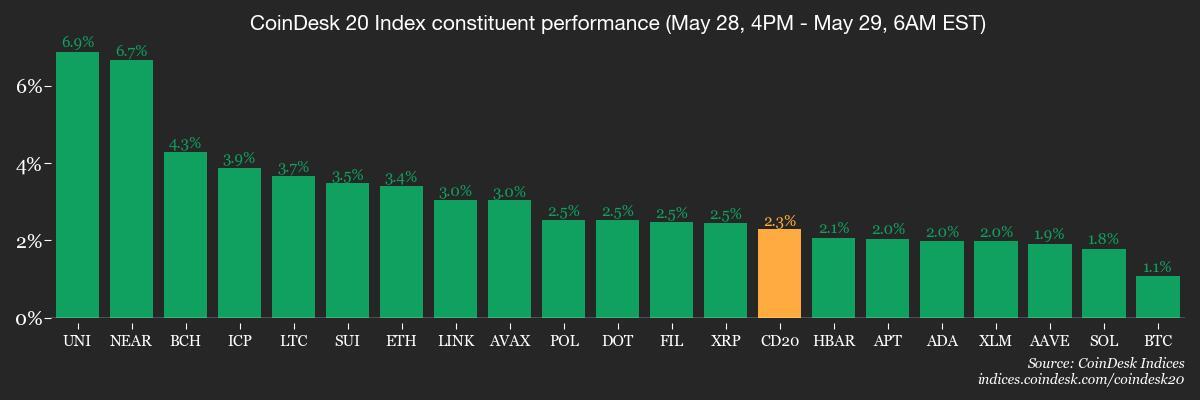

- BTC is up 1.15% from 4 p.m. ET Wednesday at $108,594.41 (24hrs: -0.29%)

- ETH is up 3.9% at $2,738.04 (24hrs: +3.63%)

- CoinDesk 20 is up 2.21% at 3,278.84 (24hrs: +0.66%)

- Ether CESR Composite Staking Rate is unchanged at 3.1%

- BTC funding rate is at 0.0057% (6.3006% annualized) on Binance

- DXY is up 0.12% at 99.99

- Gold is up 0.32% at $3,304.20/oz

- Silver is up 1.24% at $33.41/oz

- Nikkei 225 closed +1.88% at 38,432.98

- Hang Seng closed +1.35% at 23,573.38

- FTSE is unchanged at 8,724.05

- Euro Stoxx 50 is unchanged at 5,378.39

- DJIA closed on Wednesday -0.58% at 42,098.70

- S&P 500 closed -0.56% at 5,888.55

- Nasdaq closed -0.51% at 19,100.94

- S&P/TSX Composite Index closed unchanged at 26,283.50

- S&P 40 Latin America closed -0.76 at 2,599.53

- U.S. 10-year Treasury rate is up 6 bps at 4.54%

- E-mini S&P 500 futures are up 1.53% at 5,993.25

- E-mini Nasdaq-100 futures are up 2.03% at 21,814.25

- E-mini Dow Jones Industrial Average Index futures are up 0.96% at 42,576.00

Bitcoin Stats

- BTC Dominance: 63.71 (-0.06%)

- Ethereum to bitcoin ratio: 0.02517 (1.12%)

- Hashrate (seven-day moving average): 910 EH/s

- Hashprice (spot): $57.0

- Total Fees: 8.03 BTC / $868,310

- CME Futures Open Interest: 152,995 BTC

- BTC priced in gold: 32.8 oz

- BTC vs gold market cap: 9.30%

Technical Analysis

- The VIRTUAL token has topped the 38.2% Fibonacci retracement of the January-April crash.

- The break out above the widely tracked resistance could entice more buyers, yielding a bigger rally.

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $364.25 (-2.14%), +2.43% at $373.09 in pre-market

- Coinbase Global (COIN): closed at $254.29 (-4.55%), +3.01% at $261.95

- Galaxy Digital Holdings (GLXY): closed at C$28 (-6.57%)

- MARA Holdings (MARA): closed at $14.86 (-9.61%), +4.04% at $15.46

- Riot Platforms (RIOT): closed at $8.38 (-8.32%), +2.86% at $8.62

- Core Scientific (CORZ): closed at $10.78 (-4.43%), +2.97% at $11.10

- CleanSpark (CLSK): closed at $9.11 (-7.61%), +3.62% at $9.44

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.27 (-5.32%)

- Semler Scientific (SMLR): closed at $41.32 (-4.77%), +2.95% at $42.54

- Exodus Movement (EXOD): closed at $25.94 (-25.35%), +11.6% at $28.95

ETF Flows

- Daily net flow: $432.7 million

- Cumulative net flows: $45.31 billion

- Total BTC holdings ~ 1.21 million

- Daily net flow: $84.9 million

- Cumulative net flows: $2.9 billion

- Total ETH holdings ~ 3.57 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The MOVE index, which measures the volatility in U.S. Treasury notes, has dropped to the lowest level since March.

- If it drops further, a continued decline is likely to ease financial conditions, greasing the bitcoin bull run.

While You Were Sleeping

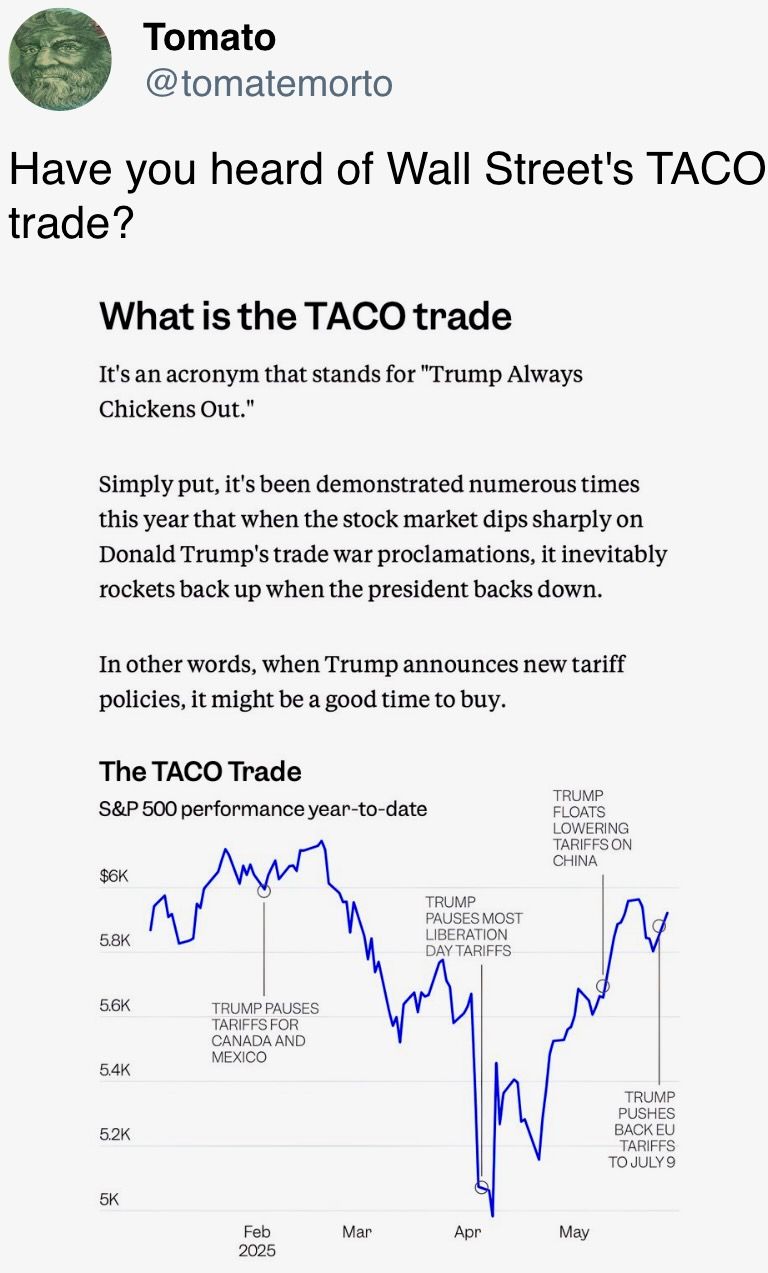

- U.S. Trade Court Strikes Down Trump’s Global Tariffs (The Wall Street Journal): Judges said economic deficits don’t meet the legal threshold for a national emergency, and said unchecked executive authority over levies violates the constitutional separation of powers.

- Solana Scores Twin Institutional Wins With $1B Raise and First Public Liquid Staking Strategy (CoinDesk): Sol Strategies aims to raise $1 billion to expand Solana ecosystem exposure, while DeFi Development said it is the first public firm to hold Solana-based liquid staking tokens.

- Bitcoin Whales Seem to Be Calling a Top as BTC Price Consolidates (CoinDesk): Large holders are offloading BTC and sending it to exchanges after a period of accumulation, while smaller investors continue buying.

- XRP Army Is Truly Global as CME Data Reveals Nearly Half of XRP Futures Trading Occurs in Non-U.S. Hours (CoinDesk): These contracts recorded $86.6 million in volume over six days across 4,032 trades, with 46% of activity logged during overseas sessions.

- Goldman Urges Investors to Buy Gold and Oil as Long-Term Hedges (Bloomberg): Goldman Sachs said surging U.S. debt and concerns over monetary and fiscal governance have eroded trust in long-term Treasuries, making gold and oil essential hedges against inflation and supply shocks.

- UK Seeks to Speed Up Implementation of U.S. Trade Deal (Financial Times): The U.K. business secretary will meet the U.S. Trade Representative in Paris next week to discuss implementation timelines for the bilateral trade deal announced on May 8.

In the Ether