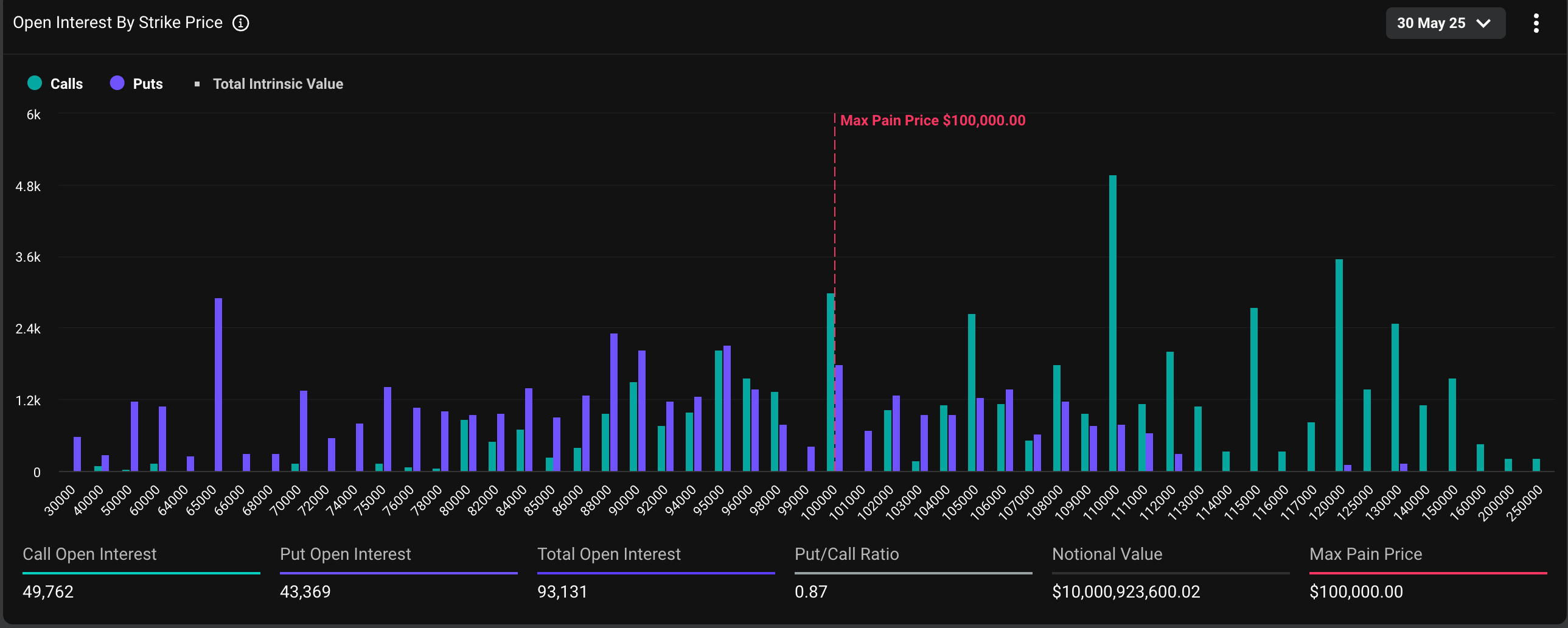

Bitcoin Braces for Volatility as $10B Options Expiry Targets $95K-$105K Range

All eyes on BTC as a massive $10 billion options expiry threatens to shake the market—just another day in crypto casino economics.

The $95K-$105K price zone becomes the battleground for bulls and bears, with traders scrambling to hedge or double down before the ticking time bomb detonates.

Wall Street’s usual ’risk management’ playbook? Probably being used as confetti at a Bitcoin maxi meetup.

At press time, bitcoin changed hands at $107,700, having reached record highs above $111,000 the previous week, according to CoinDesk data.

Deribit’s DVOL index, which represents the options-based 30-day implied or expected volatility, continued to decline, suggesting minimal concern over volatility driven by the upcoming expiry.

Volmex’s annualized one-day implied volatility index ticked slightly higher to 45.4%. That implies a 24-hour price move of 2.37%.