Bitcoin Smashes ATH as Americas Crypto Markets Ride Bullish Momentum

Digital asset markets surge as Bitcoin’s record-breaking rally ignites region-wide FOMO—Wall Street analysts scramble to justify their previous ’bubble’ calls.

Pamp it like you mean it: BTC’s parabolic move drags altcoins upward as traders chase the euphoria. Meanwhile, traditional finance dinosaurs mutter about ’tulips’ between sips of their $8 artisanal coffee.

Technical indicators flash green across exchanges, though that never stopped a crypto correction from arriving fashionably late to the party. Pro tip: Watch those leverage ratios—even rockets need occasional refueling.

What to Watch

- Crypto

- May 22: Bitcoin Pizza Day.

- May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by the U.S. president at the Trump National Golf Club in Washington.

- May 30: The second round of FTX repayments starts.

- May 31 (TBC): Mezo mainnet launch.

- Macro

- Day 3 of 3: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem will co-host the three-day meeting of G7 finance ministers and central bank governors in Banff, Alberta.

- May 22, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases (final) Q1 GDP growth data.

- GDP Growth Rate QoQ Est. 0.2% vs. Prev. -0.6%

- GDP Growth Rate YoY Est. 0.8% vs. Prev. 0.5%

- May 22, 8:30 a.m.: Statistics Canada releases April producer price inflation data.

- PPI MoM Est. -0.5% vs. Prev. 0.5%.

- PPI YoY Prev. 4.7%.

- May 22, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 17.

- Initial Jobless Claims Est. 230K vs. Prev. 229K

- May 23, 8:30 a.m.: Statistics Canada releases (Final) March retail sales data.

- Retail Sales MoM Est. 0.7% vs. Prev. -0.4%

- Retail Sales YoY Prev. 4.7%

- May 23, 10 a.m.: The U.S. Census Bureau releases April new single-family homes data.

- New Home Sales Est. 0.692M vs. Prev. 0.724M

- New Home Sales MoM Prev. 7.4%

- Earnings (Estimates based on FactSet data)

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program to reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

- Lido DAO is voting on adopting Dual Governance (LIP-28), a protocol upgrade that inserts a dynamic timelock between DAO decisions and execution so stETH holders can escrow tokens to pause proposals at 1% of TVL or fully block and “rage-quit” at 10%. Voting ends May 28.

- Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17, and voting ends on May 29.

- May 22: Official Trump to announce its “next Era” on the day of the dinner for its largest holders.

- June 10: Ether.fi to host an analyst call followed by a Q&A session.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $24.67 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $182.58 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.99 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $16.78 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $61.86 million.

- Token Launches

- June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

Conferences

- Day 3 of 7: Dutch Blockchain Week (Amsterdam)

- Day 3 of 3: Avalanche Summit London

- Day 3 of 3: Seamless Middle East Fintech 2025 (Dubai)

- Day 2 of 2: Crypto Expo Dubai

- Day 2 of 2: Cryptoverse Conference (Warsaw)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

- June 15-17: G7 2025 Summit (Kananaskis, Alberta, Canada)

- June 19-21: BTC Prague 2025

Token Talk

By Shaurya Malwa

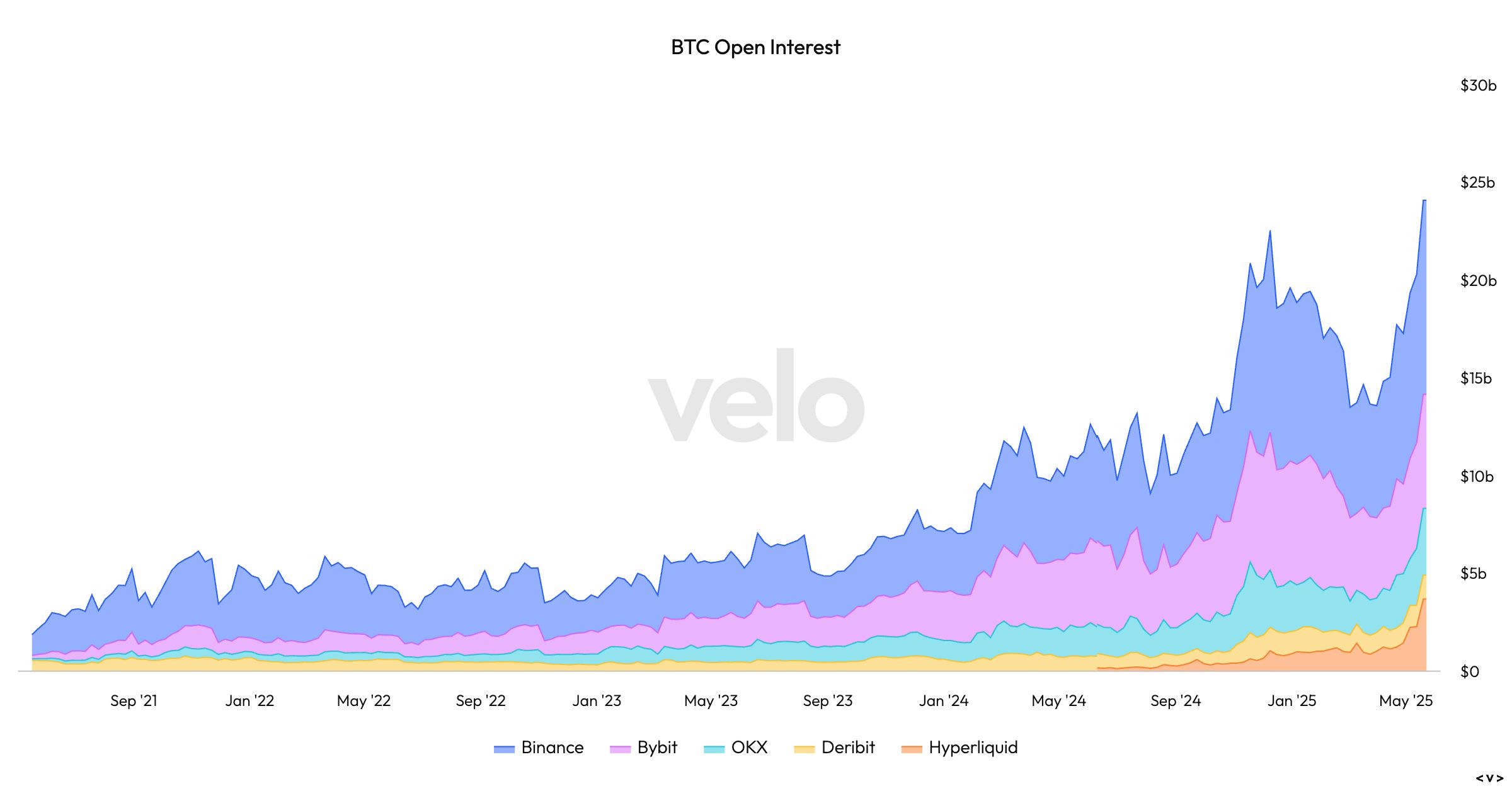

- The HYPE token is in focus after a billion-dollar bitcoin trade boosted Hyperliquid’s fundamentals.

- Pseudonymous trader James Wynn opened a $1.1 billion long on BTC using 40x leverage via Hyperliquid in one of the largest on-chain DEX trades ever recorded.

- The position, tied to wallet "0x507," was entered when BTC was priced at $108K and now sits on over $40 million in unrealized profit.

- Wynn booked partial profits early Thursday by closing 540 BTC (~$60 million), to net $1.5 million.

- His prior exits were followed by BTC declines, so traders are watching closely, as reported.

- Hyperliquid runs on its custom L1, HyperEVM, using the HyperBFT consensus (200K+ TPS) with CEX-level features like real-time order books and deep liquidity — no KYC required.

- The platform’s permissionless design and lightning-fast execution are increasingly drawing capital from centralized venues to DeFi , and this trade could set a precedent for whale activity.

- HYPE jumped 15% in the past 24 hours on renewed attention and usage-driven speculation.

Derivatives Positioning

- Analyzing the liquidations heatmap of the BTC-USDT pair on Binance, the largest liquidations cluster around $108.5K and $106.9K with liquidations worth $143 million and $112.5 million, respectively.

- Meanwhile, BTC the options market swells post-breakout, with open interest on Deribit climbing above $34 billion, just shy of the all-time high of $35.9 billion set in December. The bulk of this positioning is centered on the 30 May expiry, which now holds over $9 billion in notional value to become a key date for potential volatility.

- Bullish sentiment is clearly in control, with traders aggressively targeting upside via calls. Strikes at $100K, $120K and $150K have attracted particularly large open interest, reflecting growing conviction in a continued rally.

- Put/call ratios underscore this shift in sentiment — the 24-hour volume ratio has dropped to 0.49, while the open interest ratio sits at 0.60, indicating a meaningful tilt toward bullish exposure following BTC’s move above $110K.

- Near-term options activity is also picking up, with weekly and monthly contracts seeing notable inflows. Traders appear to be positioning for further momentum or short-term price swings in the wake of the breakout.

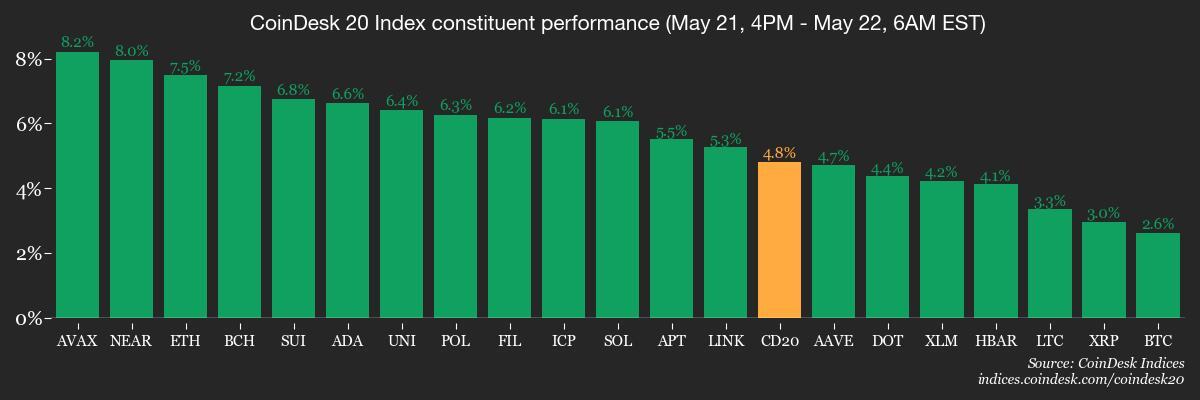

Market Movements

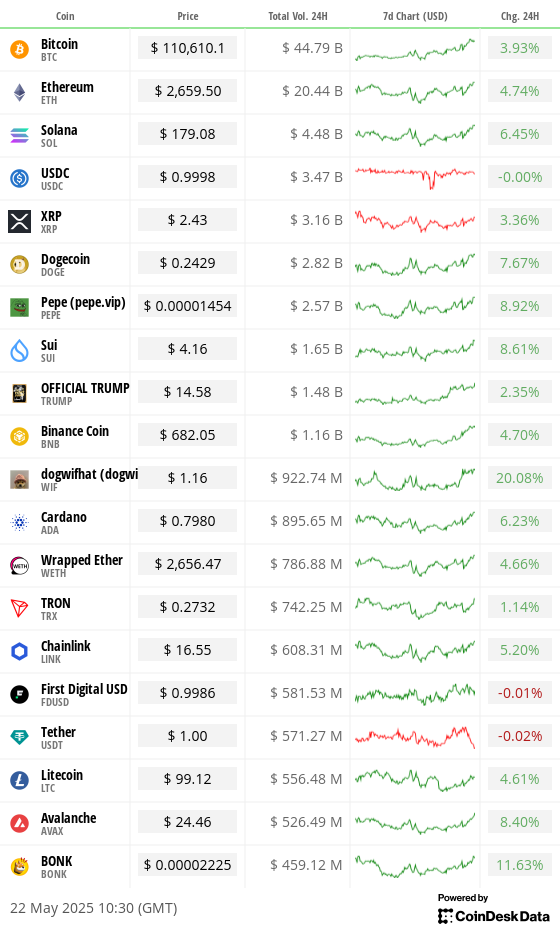

- BTC is up 1.19% from 4 p.m. ET Wednesday at $110,690.36 (24hrs: +4.05%)

- ETH is up 6.19% at $2,662.72 (24hrs: +5.23%)

- CoinDesk 20 is up 3.64% at 3,348.63 (24hrs: +4.88%)

- Ether CESR Composite Staking Rate is unchanged at 3.03%

- BTC funding rate is at 0.03% (10.95% annualized) on Binance

- DXY is up 0.25% at 99.81

- Gold is down 0.26% at $3,305.6/oz

- Silver is down 0.83% at $33.17/oz

- Nikkei 225 closed -0.84% at 36,985.87

- Hang Seng closed -1.19% at 23,544.31

- FTSE is down 0.68% at 8,726.62

- Euro Stoxx 50 is down 0.96% at 5,402.31

- DJIA closed on Wednesday -0.91% at 41,860.44

- S&P 500 closed -1.61% at 5,844.61

- Nasdaq closed -1.41% at 18,872.64

- S&P/TSX Composite Index closed -0.83% at 25,839.17

- S&P 40 Latin America closed -1.31% at 2,597.38

- U.S. 10-year Treasury rate is down 2 bps at 4.58%

- E-mini S&P 500 futures are unchanged at 5,865.50

- E-mini Nasdaq-100 futures are up 0.15% at 21,188.50

- E-mini Dow Jones Industrial Average Index futures are down 0.17% at 41,875.00

Bitcoin Stats:

- BTC Dominance: 63.90 (-0.62%)

- Ethereum to bitcoin ratio: 0.02409 (3.52%)

- Hashrate (seven-day moving average): 875 EH/s

- Hashprice (spot): $58.24

- Total Fees: 7.89 BTC / $847,124

- CME Futures Open Interest: 160,740 BTC

- BTC priced in gold: 33.4 oz

- BTC vs gold market cap: 9.47%

Technical Analysis

- Bitcoin reached a new all-time high of $111,875 this morning, breaking decisively above the previous peak just above $109,000 set in January.

- With a confirmed close above that level and no sign of a swing failure pattern, the bias remains firmly tilted toward continued upside. In the near term, BTC may encounter resistance around the $112,000–$113,000 range, aligning with a trendline drawn from the prior highs in December and January.

- However, last week’s consolidation above $100,000 — and the successful reclaim of the previous all-time high — suggest this area is now acting as short-term support.

- A pullback below $100,000, especially into the weekly order block, would likely represent a healthy correction within the broader uptrend and could offer a compelling reentry opportunity if further downside is seen.

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $402.69 (-3.41%), up 1.73% at $409.67 in pre-market

- Coinbase Global (COIN): closed at $258.99 (-0.91%), up 2.78% at $266.20

- Galaxy Digital Holdings (GLXY): closed at C$31 (+1.57%)

- MARA Holdings (MARA): closed at $15.84 (-2.16%), up 4.42% at $16.54

- Riot Platforms (RIOT): closed at $8.84 (-1.01%), up 3.39% at $9.14

- Core Scientific (CORZ): closed at $10.78 (-1.28%), up 1.48% at $10.94

- CleanSpark (CLSK): closed at $10.11 (+4.23%), up 4.65% at $10.58

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.75 (-1.33%)

- Semler Scientific (SMLR): closed at $44.89 (+7.19%), up 6.01% at $47.59

- Exodus Movement (EXOD): closed at $32.76 (-5.07%), unchanged in pre-market

ETF Flows

- Daily net flow: $607.1 million

- Cumulative net flows: $43.35 billion

- Total BTC holdings ~ 1.19 million

- Daily net flow: $0.6 million

- Cumulative net flows: $2.61 billion

- Total ETH holdings ~ 3.49 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows bitcoin open interest has hit a new all-time high.

- Most OI is concentrated on major centralized exchanges, with Hyperliquid showing solid growth.

While You Were Sleeping

- Bitcoin Smashes Past $111K, Setting New Record Highs, on Institutional Fervor (CoinDesk): Bitcoin hit an all-time high above $111,800 Thursday, surpassing Wednesday’s record.

- Bitcoin’s Rally to Record Highs Puts Focus on $115K Where an ’Invisible Hand’ May Slow Bull Run (CoinDesk): The rally may face resistance near $115,000 as options dealers with positive gamma exposure hedge by selling into price strength, creating contrarian flows that could limit further upside.

- King Dollar Falls, Bitcoin Marches Toward Sound Money Highs (CoinDesk): Despite soaring 50% from April lows and outperforming tech stocks and Treasuries, bitcoin has yet to reclaim its all-time highs against traditional safe havens such as gold and silver.

- GOP Leaders Make Last-Minute Changes to Trump Tax Bill (The Wall Street Journal): Republicans aim to extend and expand Trump’s 2017 tax cuts while covering only part of the cost, raising concerns over delayed spending curbs and worsening budget deficits.

- Japan’s Possible Response to Rise in Super-Long Bond Yields (Reuters): Yields on these bonds are spiking amid concerns about large tax cuts and increased government spending. The central bank is likely to consider technical tweaks while avoiding broader intervention.

- Russia’s Struggling War Economy Might Be What Finally Drives Moscow to the Negotiating Table (CNBC): Mounting pressure from inflation, falling oil revenues and depleted military reserves may eventually force Moscow into real peace talks.

In the Ether