Bitcoin Charges Toward All-Time High as MetaPlanet Frenzy Goes Mainstream

BTC bulls push price toward record territory while Japan’s MetaPlanet mania starts looking suspiciously like 2021’s NFT hype cycle.

Wall Street’s latest ’blockchain pivot’ smells like desperation—another hedge fund repackages old tech with crypto buzzwords and calls it innovation.

What to Watch

- Crypto

- May 22: Bitcoin Pizza Day.

- May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by President Trump at the Trump National Golf Club in Washington.

- May 30: The second round of FTX repayments starts.

- Macro

- Day 2 of 3: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem will co-host the three-day meeting of G7 finance ministers and central bank governors in Banff, Alberta.

- May 21, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases retail sales data.

- Retail Sales MoM Est. 0.1% vs. Prev. 0.2%

- Retail Sales YoY Est. 2.2% vs. Prev. -1.1%

- May 22, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases (final) Q1 GDP growth data.

- GDP Growth Rate QoQ Est. 0.2% vs. Prev. -0.6%

- GDP Growth Rate YoY Est. 0.8% vs. Prev. 0.5%

- May 22, 8:30 a.m.: Statistics Canada releases April producer price inflation data.

- PPI MoM Est. -0.5% vs. Prev. 0.5%.

- PPI YoY Prev. 4.7%.

- May 22, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended May 17.

- Initial Jobless Claims Est. 230K vs. Prev. 229K

- Earnings (Estimates based on FactSet data)

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program to reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

- Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40, “Callisto.” bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17, and voting ends May 29.

- May 21, 11 a.m: Maple to host an X spaces session to “unveil the next chapter of Maple.”

- May 22: Official Trump to announce its “next Era” at the day of the dinner for the largest token holders.

- June 10: Ether.fi to host an analyst call followed by a Q&A session.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $22.58 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $169.38 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.33 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $15.36 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $57.91 million.

- Token Launches

- May 21: Mantra (OM) to be listed on Upbeat and the Crypto.com app.

- June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

Conferences

- Day 3 of 7: Dutch Blockchain Week (Amsterdam)

- Day 2 of 3: Avalanche Summit London

- Day 2 of 3: Seamless Middle East Fintech 2025 (Dubai)

- Day 1 of 2: Crypto Expo Dubai

- Day 1 of 2: Cryptoverse Conference (Warsaw)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

Token Talk

By Shaurya Malwa and Oliver Knight

- Hailey Welch, aka “Hawk Tuah Girl,” is distancing herself from the failed HAWK memecoin she promoted in December 2024, despite initially calling it a compliant, fan-focused project.

- On her Talk Tuah podcast, Welch said she was questioned by the FBI, gave her phone to the SEC, and was “cleared” of wrongdoing, claiming she was an unwitting participant.

- Welch now says she didn’t understand crypto and felt “sick” that fans trusted her, contrasting her November 2024 enthusiasm, when she claimed to have “learned so much” about the token.

- HAWK, launched on Solana, reached a $491 million market cap before crashing below $100 million within hours. It’s now at $104,000, down 99% from its peak.

- Welch claimed user losses were $180,000, much lower than the estimated $1.2 million. Her figure excludes 10,149 token holders who never sold, per Solscan.

- Commentators criticized Welch for endorsing a project she didn’t understand, with YouTube comments highlighting her lack of accountability.

- Welch’s team previously stated the project was legally compliant with a Cayman foundation and that her tokens would vest over three years.

Derivatives Positioning

- BTC CME futures open interest continues to rise, topping $17 billion for the first time since February. Meanwhile, growth in ETH open interest has stalled above $2 billion. However, the premium in ETH futures is slightly higher than BTC’s.

- On offshore exchanges, perpetual funding rates continue to flash bullish with sub-10% readings.

- BCH, TON perpetual funding rates remain negative, suggesting a bias for shorts and potential for a short squeeze should the market move higher.

- In options, flows on OTC network Paradigm featured demand for calls, especially the $180K call expiring in September.

Market Movements

- BTC is down 0.64% from 4 p.m. ET Tuesday at $106,257.16 (24hrs: +1.23%)

- ETH is up 0.42% at $2,525.16 (24hrs: +0.51%)

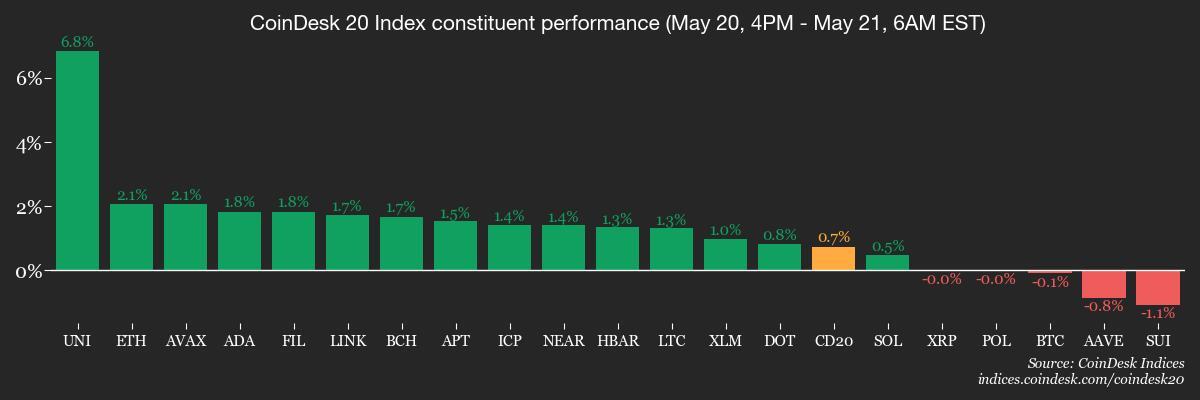

- CoinDesk 20 is down 0.27% at 2,268.01 (24hrs: +0.6%)

- Ether CESR Composite Staking Rate is down 1 bps at 3.03%

- BTC funding rate is at 0.0088% (9.6886% annualized) on Binance

- DXY is down 0.49% at 99.63

- Gold is up 1% at $3,313.10/oz

- Silver is up 1.02% at $33.31/oz

- Nikkei 225 closed -0.61% at 37,298.98

- Hang Seng closed +0.62% at 23,827.78

- FTSE is down 0.15% at 8,768.01

- Euro Stoxx 50 is down 0.45% at 5,430.16

- DJIA closed on Tuesday -0.27% at 42,677.24

- S&P 500 closed -0.39% at 5,940.46

- Nasdaq closed -0.38% at 19,142.71

- S&P/TSX Composite Index closed +0.32% at 26,055.6

- S&P 40 Latin America closed -0.26% at 2,631.81

- U.S. 10-year Treasury rate is up 5 bps at 4.54%

- E-mini S&P 500 futures are down 0.76% at 5,914.75

- E-mini Nasdaq-100 futures are down 0.81% at 21,274.50

- E-mini Dow Jones Industrial Average Index futures are down 0.76% at 42,447.00

Bitcoin Stats

- BTC Dominance: 64.01 (-0.15%)

- Ethereum to bitcoin ratio: 0.02378 (0.63%)

- Hashrate (seven-day moving average): 884 EH/s

- Hashprice (spot): $56.1

- Total Fees: 7.42 BTC / $784,400

- CME Futures Open Interest: 160,155

- BTC priced in gold: 32.3 oz

- BTC vs gold market cap: 9.15%

Technical Analysis

- BTC rose as high as $108,000 early today but struggled to maintain the momentum, with the hourly chart MACD histogram turning negative.

- Prices will likely consolidate for some time, allowing a positive reset of the MACD, following which the next leg higher could resume.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $416.92 (+0.85%), down 0.58% at $414.50 in pre-market

- Coinbase Global (COIN): closed at $261.38 (-0.99%), down 0.67% at $259.64

- Galaxy Digital Holdings (GLXY): closed at C$30.52 (-3.08%)

- MARA Holdings (MARA): closed at $16.19 (-0.8%), down 1.17% at $16

- Riot Platforms (RIOT): closed at $8.93 (-0.45%), down 1.46% at $8.80

- Core Scientific (CORZ): closed at $10.92 (+0.65%), down 2.2% at $10.68

- CleanSpark (CLSK): closed at $9.7 (-1.42%), down 1.65% at $9.54

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $17.99 (-0.77%)

- Semler Scientific (SMLR): closed at $41.88 (-3.21%), up 2.63% at $42.98

- Exodus Movement (EXOD): closed at $34.51 (+1.77%), down 1.45% at $34.01

ETF Flows

- Daily net flow: $329.2 million

- Cumulative net flows: $42.75 billion

- Total BTC holdings ~ 1.19 million

- Daily net flow: $64.8 million

- Cumulative net flows: $2.61 billion

- Total ETH holdings ~ 3.47 million

Source: Farside Investors

Overnight Flows

Chart of the Day

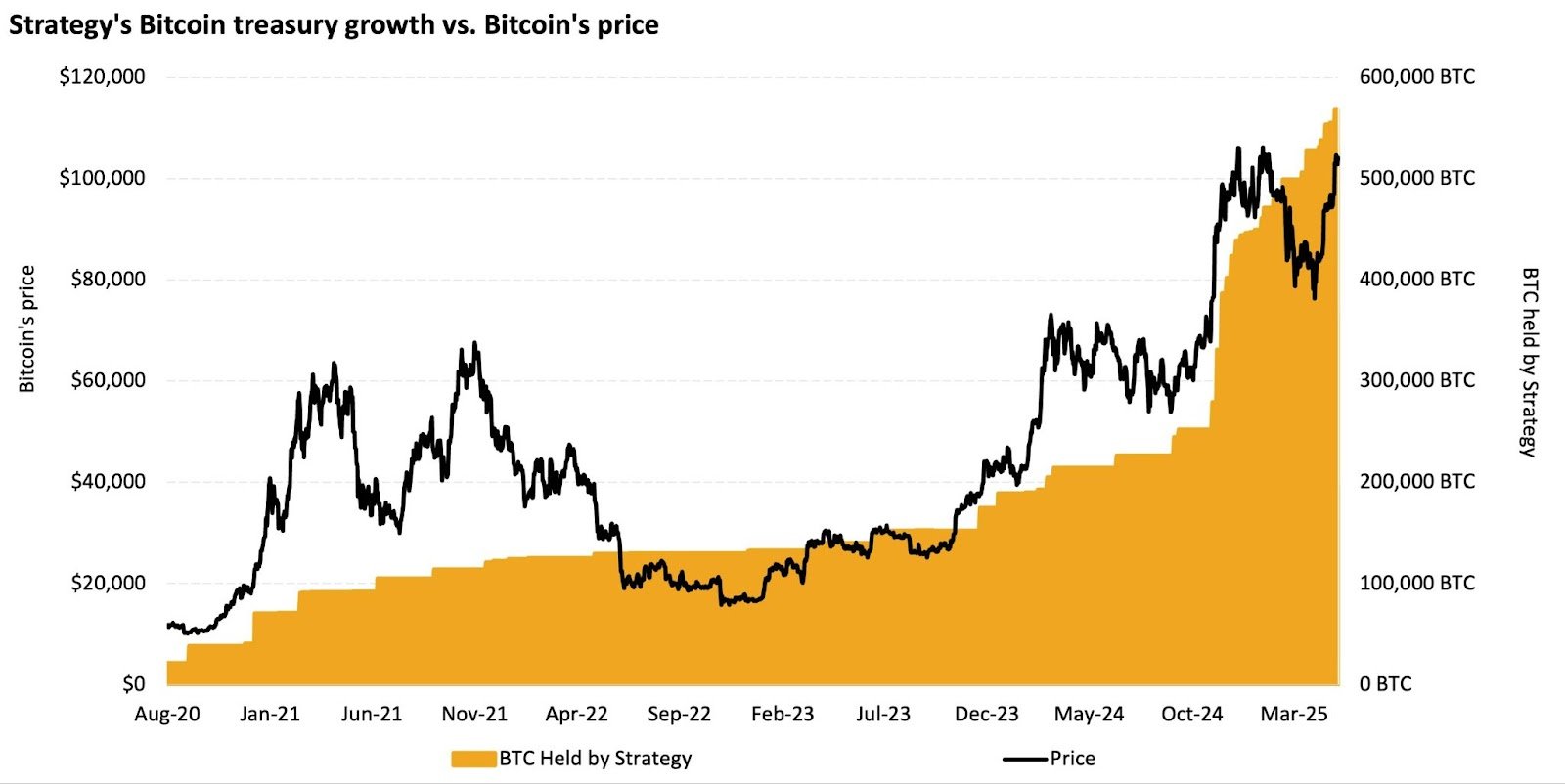

- Strategy (MSTR) has been accumulating bitcoin at a breakneck speed, maintaining the pace even during the March-April price swoon.

- "From GameStop to MetaPlanet to Strategy’s $60B stash, BTC is reshaping corporate finance. Discover how the ’42/42 Plan’ could become a blueprint for others," 21Shares said on X.

While You Were Sleeping

- Bitcoin Sets Record Daily Close With $110K as the Next Level to Watch for BTC (CoinDesk): Bitcoin set a record high close on Tuesday at $106,830 as spot ETF inflows rose and bond-market turmoil fueled concerns over fiscal stability, which analysts say could benefit BTC and gold.

- SEC Charges Unicoin, Top Executives With $100M ‘Massive Securities Fraud’ (CoinDesk): The SEC alleged Unicoin misled investors by inflating property values, overstating sales claims — touting $3 billion when only $110 million was raised — and promoting rights certificates with exaggerated return promises.

- U.K. Inflation Jumps, Reinforcing Bank of England’s Caution (The Wall Street Journal): Annual inflation rose more than forecast to 3.5% in April on rising labor and energy costs. Projections suggest a gradual return to target by 2027.

- ’Days to Cover mNAV’: The New Standard for Evaluating Bitcoin Equities (CoinDesk): This metric estimates how long a company would need to accumulate enough bitcoin to justify its market cap based on daily yield and net asset value multiple.

- Morgan Stanley Strategists Say Buy America Except the Dollar (Bloomberg): Morgan Stanley strategists expect 2026 Fed rate cuts to benefit U.S. stocks and Treasuries, while forecasting dollar weakness as growth and yield advantages over other economies shrink.

- IMF Urges U.S. to Curb Deficit as Trump Tax Cut Plan Stirs Debt Fears (Financial Times): The IMF’s first deputy managing director said U.S. fiscal policy should aim to lower the debt-to-GDP ratio and warned that trade uncertainty remains high despite recent tariff relief.

In the Ether