Bitcoin Shatters $100K Ceiling—Now the Floor? Traders Bet This Sticky Price Level Is the New Normal

Bitcoin’s stubborn refusal to dip below six figures has Wall Street’s technical analysts scrambling to update their charts—and traditional finance veterans muttering about ’irrational exuberance.’

Market psychology flips: What was once a distant moon-shot target now acts as a gravitational pull for BTC’s price action. Every failed dip below $100K fuels the self-fulfilling prophecy.

Meanwhile, goldbugs and bank CEOs cope by insisting this is just ’greater fool theory’ in action—never mind that institutional custody wallets now hold more BTC than all but three national reserves.

What to Watch

- Crypto

- May 22: Bitcoin Pizza Day.

- May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by President Trump at the Trump National Golf Club in Washington.

- May 30: The second round of FTX repayments starts.

- Macro

- Day 1 of 3: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem will co-host the three-day meeting of G7 finance ministers and central bank governors in Banff, Alberta.

- May 20, 8:30 a.m.: Statistics Canada releases April consumer price inflation data.

- Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.1%

- Core Inflation Rate YoY Prev. 2.2%

- Inflation Rate MoM Est. -0.2% vs. Prev. 0.3%

- Inflation Rate YoY Est. 1.6% vs. Prev. 2.3%

- May 21, 2 a.m.: The U.K.’s Office for National Statistics releases April consumer price inflation data.

- Core Inflation Rate MoM Est. 1.2% vs. Prev. 0.5%

- Core Inflation Rate YoY Est. 3.6% vs. Prev. 3.4%

- Inflation Rate MoM Est. 1.1% vs. Prev. 0.3%

- Inflation Rate YoY Est. 3.3% vs. Prev. 2.6%

- May 21, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases retail sales data.

- Retail Sales MoM Est. 0.1% vs. Prev. 0.2%

- Retail Sales YoY Est. 2.2% vs. Prev. -1.1%

- Earnings (Estimates based on FactSet data)

- May 20: Canaan (CAN), pre-market

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program that would reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

- Arbitrum DAO is voting on a constitutional AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto”, bringing them in line with Ethereum’s May 7 Pectra upgrade. The proposal schedules activation for June 17. Voting ends on May 29.

- May 20, 12 p.m.: Lido to hist its 28th node operator community call.

- May 21: Maple Finance has teased at an upcoming announcement on the future of asset management.

- May 21, 6 p.m.: Theta Network to host an Ask Me Anything session in a livestream

- May 22: Official Trump to announce its “next Era” at the day of the dinner for its largest holders.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating supply worth $22.28 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating supply worth $169.82 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating supply worth $11.24 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating supply worth $15.16 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating supply worth $58.02 million.

- Token Launches

- May 20: Deadline for users to claim their Xterio (XTER) airdrop on Binance Alpha.

- June 1: Staking rewards for staking ERC-20 OM on MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC as part of Lido on Polygon’s sunsetting process ends.

Conferences

- Day 2 of 7: Dutch Blockchain Week (Amsterdam)

- Day 1 of 3: Avalanche Summit London

- Day 1 of 3: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

Token Talk

By Shaurya Malwa

- TokenFi is facilitating what it calls the first-ever tokenization of a consumer AI robot, the Floki Minibot M1, giving the platform a unique real-world use and a strong narrative in the increasingly crowded market for RWA applications.

- The Floki Minibot M1 presale and tokenization go live May 23, the same day TokenFi debuts its RWA tokenization module, aligning a high-profile product drop with core platform functionality — a powerful driver for platform visibility and utility for TokenFi’s TOKEN.

- TokenFi’s association with Rice Robotics, which works with companies like Nvidia, Softbank and 7-Eleven Japan, lends legitimacy to the project’s RWA ambitions and strengthens long-term investor confidence in TOKEN, which sits at a $60 million market capitalization as of Tuesday.

- TokenFi will benefit from an upcoming RICE token airdrop to Floki and TokenFi holders, offering direct value accrual and potentially incentivizing new buyers and stakers of TOKEN in anticipation of eligibility.

- The TokenFi team said Monday it would be the title sponsor of the West Indies cricket team’s tour of Ireland 2025, bringing its brand to viewers globally through broadcast partners like TNT Sports, Supersport and Fancode, giving the token a visibility boost among retail audiences.

Derivatives Positioning

- Bitcoin CME futures open interest has risen to the highest in three months in a sign of renewed uptick in institutional activity. ETH’s open interest has jumped to its highest since March.

- Still, positioning in both markets remains light compared with December.

- On offshore exchanges, perpetual funding rates for major coins remain below an annualized 10%. It’s a sign that while traders are using leverage to take bullish bets, the market is far from being frothy.

- On Deribit, BTC and ETH calls continue to trade pricier than puts across timeframes, indicating a bullish bias.

- Block flows on Paradigm have been mixed, with calendar spreads both bought and sold.

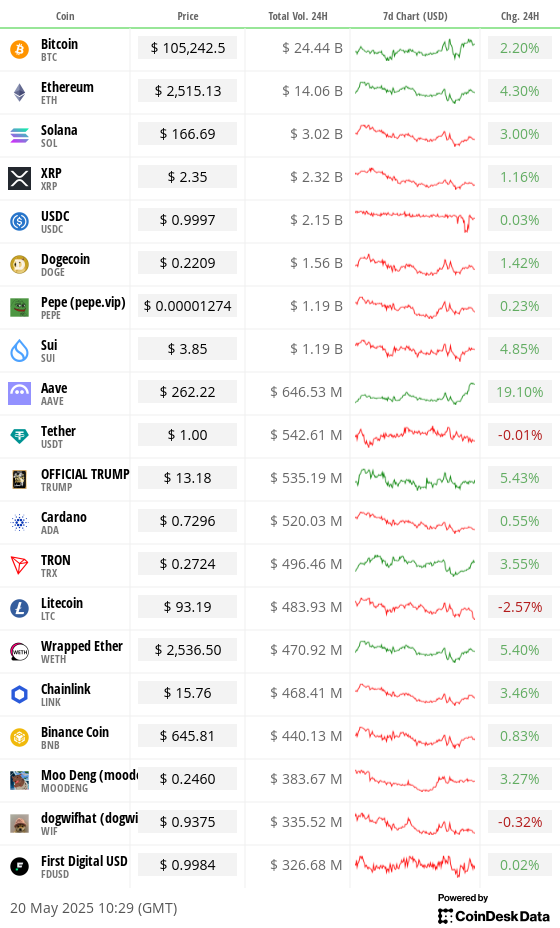

Market Movements

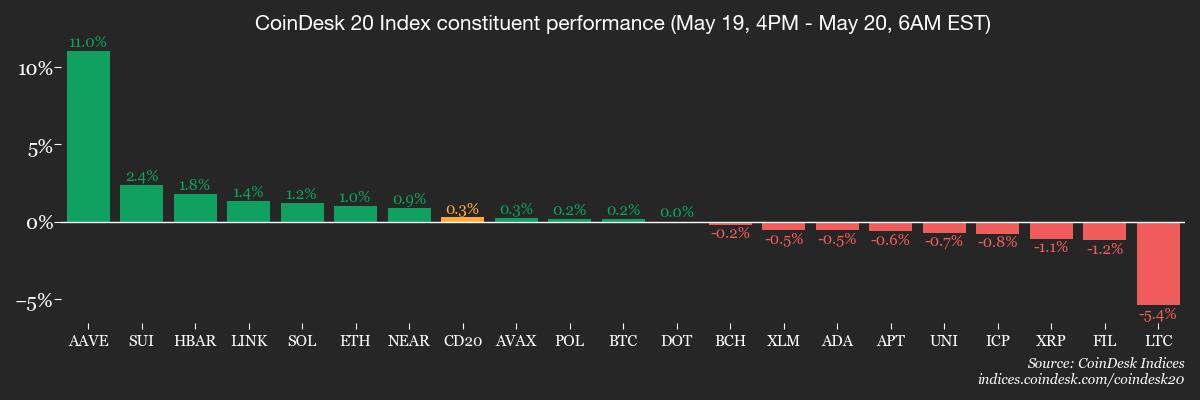

- BTC is down 0.51% from 4 p.m. ET Monday at $105,181.50 (24hrs: +2.12%)

- ETH is unchanged at $2,519.42 (24hrs: +4.46%)

- CoinDesk 20 is down 0.42% at 3,171.22 (24hrs: +2.84%)

- Ether CESR Composite Staking Rate is up 13 bps at 3.04%

- BTC funding rate is at 0.0074% (8.1227% annualized) on Binance

- DXY is down 0.2% at 100.22

- Gold is up 0.13% at $3,233.79/oz

- Silver is up 0.31% at $32.45/oz

- Nikkei 225 closed unchanged at 37,529.49

- Hang Seng closed +1.49% at 23,681.48

- FTSE is up 0.5% at 8,742.80

- Euro Stoxx 50 is up 0.25% at 5,440.56

- DJIA closed on Monday +0.32% at 42,792.07

- S&P 500 closed unchanged at 5,963.60

- Nasdaq closed unchanged at 19,215.46

- S&P/TSX Composite Index closed +0.29% at 25,971.93

- S&P 40 Latin America closed +0.56% at 2,638.56

- U.S. 10-year Treasury rate is up 1 bp at 4.46%

- E-mini S&P 500 futures are down 0.29% at 5,965.25

- E-mini Nasdaq-100 futures are down 0.4% at 21,440.25

- E-mini Dow Jones Industrial Average Index futures are unchanged at 42,870.00

Bitcoin Stats

- BTC Dominance: 63.86 (-0.04%)

- Ethereum to bitcoin ratio: 0.02401 (0.29%)

- Hashrate (seven-day moving average): 853 EH/s

- Hashprice (spot): $54.3

- Total Fees: 6.87 BTC / $717,919

- CME Futures Open Interest: 157,875 BTC

- BTC priced in gold: 32.4 oz

- BTC vs gold market cap: 9.17%

Technical Analysis

- The chart shows the XMR/BTC ratio has broken above the swing high resistance from September 2024, confirming a bullish trend reversal higher.

- The pattern points to continued monero (XMR) outperformance relative to bitcoin.

Crypto Equities

- Strategy (MSTR): closed on Monday at $413.42 (+3.41%), up 0.4% at $415.06 in pre-market

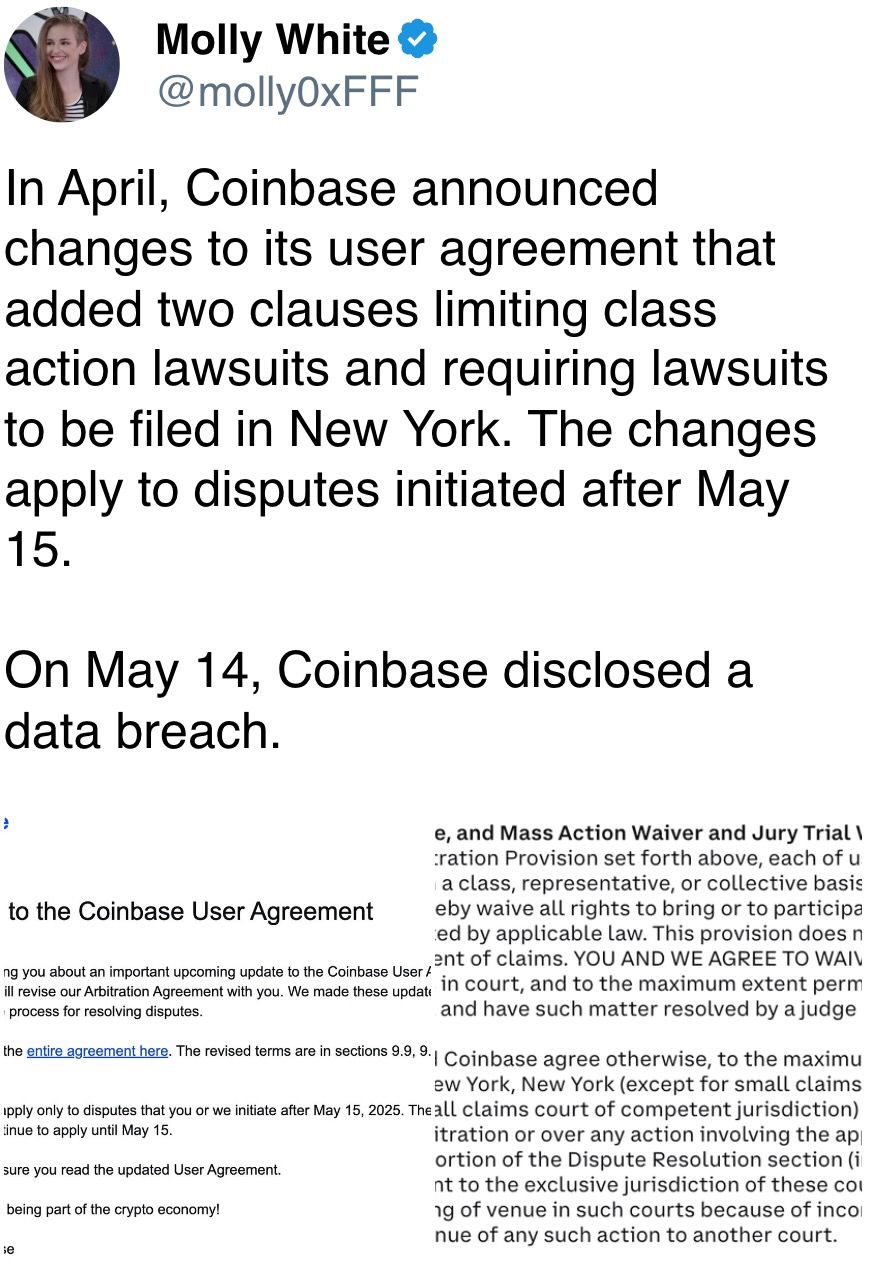

- Coinbase Global (COIN): closed at $263.99 (-0.93%), up 1.11% at $266.93

- Galaxy Digital Holdings (GLXY): closed at C$31.49 (+3.01%)

- MARA Holdings (MARA): closed at $16.32 (+0.68%), up 0.49% at $16.40

- Riot Platforms (RIOT): closed at $8.97 (-1.97%), up 0.88% at $9.04

- Core Scientific (CORZ): closed at $10.85 (+0.65%), up 0.55% at $10.91

- CleanSpark (CLSK): closed at $9.84 (+0.61%), up 0.51% at $9.89

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $18.13 (+0.72%)

- Semler Scientific (SMLR): closed at $43.27 (+5.85%), up 4% at $45

- Exodus Movement (EXOD): closed at $33.91 (-4.21%), up 3.21% at $35

ETF Flows

- Daily net flow: $667.4 million

- Cumulative net flows: $42.41 billion

- Total BTC holdings ~ 1.19 million

- Daily net flow: $13.7 million

- Cumulative net flows: $2.54 billion

- Total ETH holdings ~ 3.47 million

Source: Farside Investors

Overnight Flows

Chart of the Day

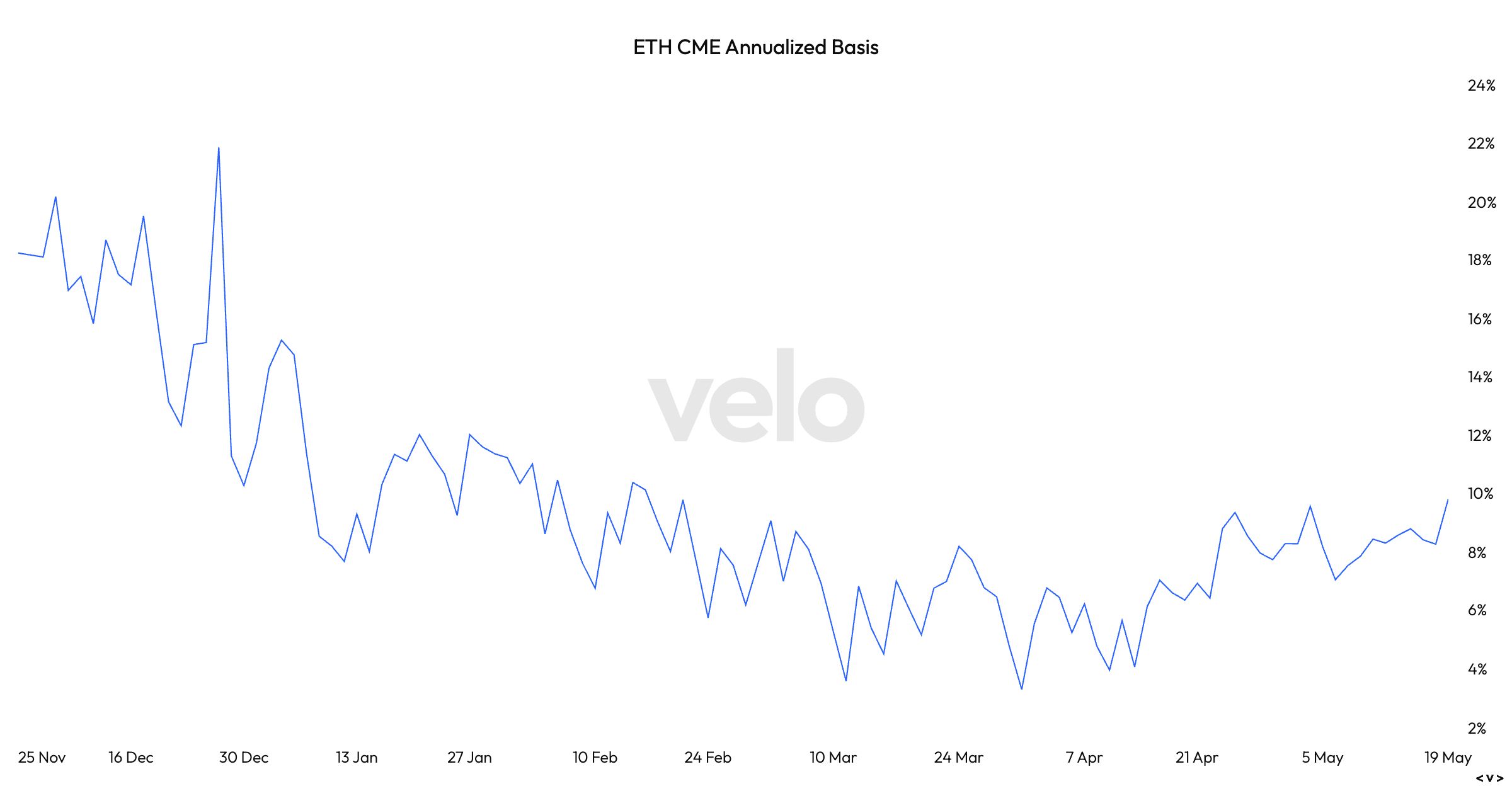

- The annualized premium or basis in ETH futures trading on the CME is close to topping the 10% mark for the first time since early February.

- It shows traders are taking leveraged bullish bets on ETH.

- The widening basis could entice cash and carry arbitrage traders, leading to accelerated inflows into the U.S.-listed spot ether ETFs.

While You Were Sleeping

- Bitcoin ETF Inflows Surge as Basis Trade Nears 9%, Signaling Renewed Demand (CoinDesk): U.S. spot bitcoin ETFs drew $667.4 million in net inflows on May 19, the most since May 2, as rising basis trade yield and bitcoin’s strength above $100,000 revived institutional interest.

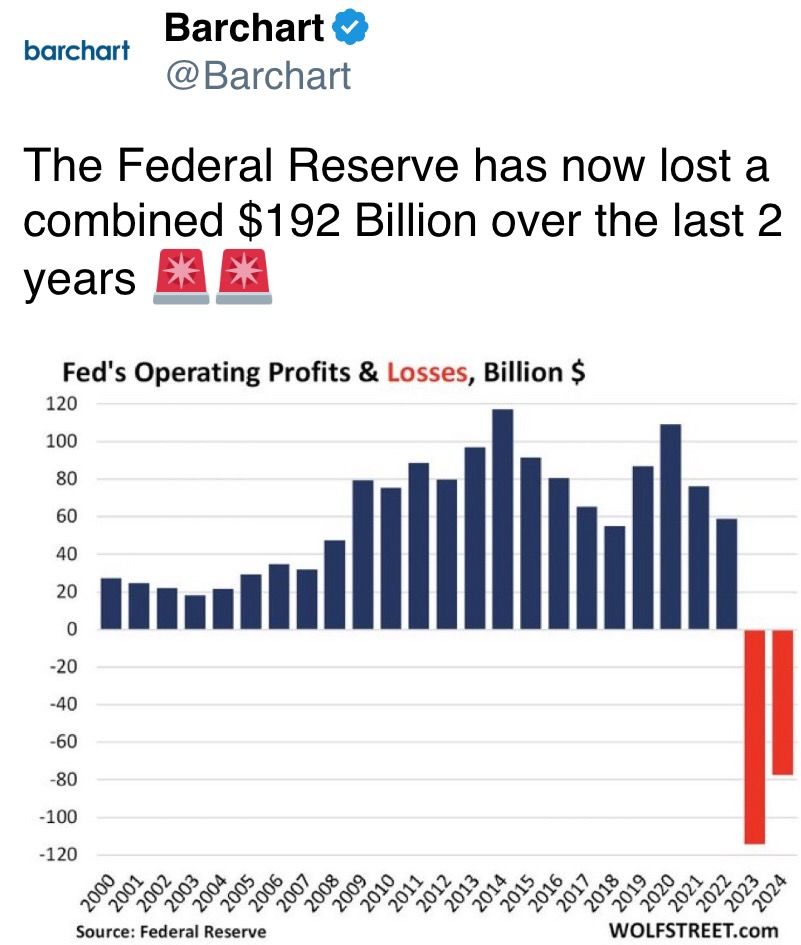

- Bitcoin and Gold in Sweet Spot as Bond Market ’Smackdown’ Exposes the U.S. Fiscal Kayfabe: Godbole (CoinDesk): Bond markets are challenging the illusion of U.S. fiscal stability and safe haven status. BTC and gold stand to gain.

- KuCoin Enhances Point-of-Sale Mobile Payments With AEON (CoinDesk): KuCoin introduced a crypto payment service in select Asian markets through a tie-up with AEON.

- Will Trump’s Tariff Climbdown Save the US From Recession? (Financial Times): Trump’s tariff rollback eased recession fears, but lingering uncertainty, elevated trade barriers and rising prices continue to weigh on confidence, spending and business investment across the U.S. economy.

- U.S. Treasury Yields Slip as Fed Signals Just One Rate Cut in 2025 (CNBC): Yields edged down early Tuesday after a Monday spike, as Atlanta Fed President Raphael Bostic flagged tariff-driven inflation risks and analysts said the U.S. downgrade won’t shake Treasury markets.

- Divided GOP Closes In on Tense House Vote (The Wall Street Journal): GOP infighting over Medicaid rules, tax breaks and climate subsidies is stalling Trump’s push to extend 2017 cuts, which would add nearly $3 trillion to projected deficits over the next decade.

In the Ether